Homeowners Insurance Deductibles_ Choosing the Right Amount

Understanding Homeowners Insurance Basics What You Need to Know

Homeowners insurance isn't just a piece of paper; it's your financial safety net when the unexpected happens to your most valuable asset: your home. Think of it as a shield against life's curveballs, protecting you from financial ruin when disaster strikes. But what exactly does it cover, and why is it so crucial?

At its core, homeowners insurance provides financial protection against a wide range of potential perils. These perils typically include:

- Fire and Smoke: This is a big one. If a fire ravages your home, your insurance will help cover the costs of rebuilding or repairing the damage, as well as replacing your belongings.

- Windstorm and Hail: Depending on your location, wind and hail can cause significant damage to your roof, siding, and windows. Your policy can help cover these repairs.

- Water Damage: This usually refers to sudden and accidental water damage, like a burst pipe. However, it's important to note that flood damage is typically *not* covered by standard homeowners insurance and requires a separate flood insurance policy.

- Theft and Vandalism: If someone breaks into your home and steals your belongings, or vandalizes your property, your insurance can help cover the losses.

- Liability: This is where things get interesting. Liability coverage protects you if someone is injured on your property and sues you. It can help cover medical bills, legal fees, and even settlements.

Beyond these common perils, most homeowners insurance policies also cover:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and foundation.

- Personal Property Coverage: This covers your belongings, such as furniture, clothing, electronics, and appliances.

- Loss of Use Coverage: If your home is damaged to the point where you can't live in it, this coverage helps pay for temporary housing, such as a hotel or rental apartment.

- Other Structures Coverage: This covers structures on your property that aren't attached to your home, such as a detached garage, shed, or fence.

Why is homeowners insurance so important? Because without it, you're financially vulnerable to potentially devastating losses. Imagine a fire destroying your home. Without insurance, you'd be responsible for paying for all the repairs and replacements out of pocket. This could easily bankrupt most people. Homeowners insurance provides peace of mind knowing that you're protected against these financial risks.

Choosing the Right Homeowners Insurance Policy Coverage Levels and Options

Now that you understand the basics of homeowners insurance, the next step is choosing the right policy for your needs. This involves considering factors like coverage levels, deductibles, and optional coverages. Let's break it down:

Understanding Coverage Levels Adequate Protection for Your Home

Coverage levels refer to the amount of money your insurance company will pay out in the event of a covered loss. The most important coverage level is your dwelling coverage, which should be enough to rebuild your home to its original condition. Here's how to determine the right amount:

- Replacement Cost vs. Actual Cash Value: Replacement cost coverage pays to rebuild or repair your home with new materials, while actual cash value coverage pays the current value of your home, taking depreciation into account. Replacement cost is generally the better option, as it ensures you can fully rebuild your home.

- Consider Construction Costs: Research the current cost of construction in your area. Factors like labor costs, material prices, and building codes can all impact the cost of rebuilding your home.

- Get a Professional Appraisal: A professional appraisal can help you determine the replacement cost of your home.

For personal property coverage, you'll need to estimate the value of your belongings. This can be a time-consuming process, but it's important to be accurate. Consider creating a home inventory, which includes photos or videos of your belongings, along with their estimated value. You can also use online tools to help you estimate the value of your personal property.

Selecting the Right Deductible Balancing Cost and Risk

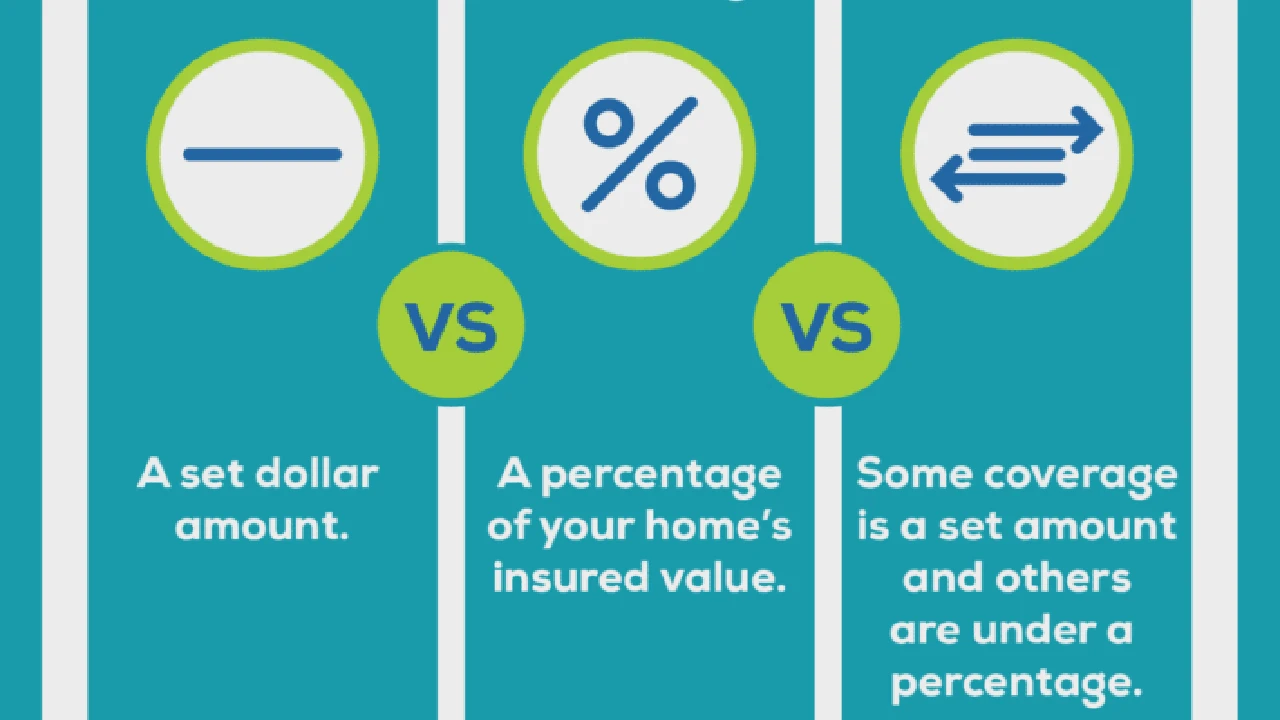

Your deductible is the amount you'll pay out of pocket before your insurance coverage kicks in. A higher deductible typically means a lower premium, but it also means you'll have to pay more out of pocket in the event of a claim. A lower deductible means a higher premium, but you'll pay less out of pocket when you file a claim.

Choosing the right deductible depends on your risk tolerance and financial situation. If you're comfortable paying a higher deductible and you're less likely to file small claims, a higher deductible might be a good option. If you prefer to pay a lower deductible and you're more likely to file small claims, a lower deductible might be a better choice.

Exploring Optional Coverages Enhancing Your Protection

In addition to the standard coverages included in most homeowners insurance policies, there are also several optional coverages you can add to enhance your protection. These optional coverages can provide additional financial protection in specific situations.

- Flood Insurance: As mentioned earlier, standard homeowners insurance policies typically don't cover flood damage. If you live in a flood-prone area, you'll need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer.

- Earthquake Insurance: If you live in an earthquake-prone area, you may want to consider purchasing earthquake insurance. This coverage can help cover the costs of repairing or rebuilding your home after an earthquake.

- Sewer Backup Coverage: This coverage protects you if your sewer backs up and causes damage to your home. Sewer backups can be messy and expensive to clean up, so this coverage can be a valuable addition to your policy.

- Personal Umbrella Policy: A personal umbrella policy provides additional liability coverage beyond the limits of your homeowners insurance policy. This can be especially important if you have significant assets to protect.

Comparing Homeowners Insurance Companies Finding the Best Fit for You

Once you understand the different types of coverage and coverage levels, it's time to start shopping around for the best homeowners insurance policy. There are many different insurance companies to choose from, each with its own strengths and weaknesses. Here's how to compare homeowners insurance companies and find the best fit for you:

Researching Insurance Companies Reputation and Financial Stability

Before you start comparing quotes, it's important to research the reputation and financial stability of the insurance companies you're considering. You want to make sure you're working with a company that has a good track record of paying claims and that is financially stable enough to weather any potential disasters.

- Check Ratings: Look for ratings from independent rating agencies like A.M. Best, Standard & Poor's, and Moody's. These ratings assess the financial strength of insurance companies and can give you an idea of their ability to pay claims.

- Read Reviews: Read online reviews from other customers to get an idea of their experiences with the insurance company. Pay attention to reviews that mention claims handling, customer service, and overall satisfaction.

- Check with the Better Business Bureau: The Better Business Bureau (BBB) provides ratings and reviews of businesses, including insurance companies. Check the BBB rating of the insurance companies you're considering.

Comparing Quotes Price and Coverage

Once you've narrowed down your list of potential insurance companies, it's time to start comparing quotes. Get quotes from multiple companies and compare the price and coverage offered by each policy. Don't just focus on the price; make sure you're also getting adequate coverage for your needs.

- Compare Coverage Levels: Make sure you're comparing policies with similar coverage levels. Pay attention to the dwelling coverage, personal property coverage, and liability coverage.

- Compare Deductibles: Compare the deductibles offered by each policy. Remember that a higher deductible will typically mean a lower premium, but it also means you'll have to pay more out of pocket in the event of a claim.

- Look for Discounts: Ask about any discounts that may be available, such as discounts for having a security system, being a non-smoker, or bundling your homeowners insurance with your auto insurance.

Considering Customer Service Claims Handling and Support

Customer service is an important factor to consider when choosing a homeowners insurance company. You want to work with a company that is responsive, helpful, and easy to deal with. Claims handling is also crucial. You want to make sure the company has a smooth and efficient claims process.

- Contact Customer Service: Call the customer service department of each insurance company and ask some questions. Pay attention to how long it takes to get through to a representative and how helpful the representative is.

- Ask About the Claims Process: Ask about the claims process. Find out how to file a claim, how long it typically takes to process a claim, and what documentation is required.

- Read Reviews About Claims Handling: Read online reviews about the claims handling process of each insurance company. Pay attention to reviews that mention the ease of filing a claim, the speed of the claims process, and the fairness of the settlement.

Homeowners Insurance Policy Discounts Saving Money on Your Premium

Everyone wants to save money on their homeowners insurance premium. Fortunately, there are many discounts available that can help you lower your costs. Here are some common homeowners insurance policy discounts:

Home Security System Discounts Protecting Your Home from Burglary

Installing a home security system can not only protect your home from burglary, but it can also qualify you for a discount on your homeowners insurance premium. Insurance companies view homes with security systems as being less risky, so they're often willing to offer a discount.

- Monitored vs. Unmonitored Systems: Monitored security systems, which are monitored by a professional security company, typically qualify for a larger discount than unmonitored systems.

- Fire and Smoke Detectors: Installing fire and smoke detectors can also qualify you for a discount.

- Smart Home Devices: Some insurance companies offer discounts for installing smart home devices, such as smart locks, smart thermostats, and water leak detectors.

Bundling Insurance Policies Combining Home and Auto Insurance

Bundling your homeowners insurance with your auto insurance is another common way to save money. Many insurance companies offer discounts for bundling policies, as it's more efficient for them to manage multiple policies for the same customer.

- Potential Savings: Bundling discounts can range from 5% to 15% or more, depending on the insurance company.

- Compare Quotes: Even with a bundling discount, it's still important to compare quotes from multiple insurance companies to make sure you're getting the best overall price.

- Consider Your Needs: Make sure the bundled policies meet your needs in terms of coverage and deductibles.

Home Improvement Discounts Upgrading Your Home for Safety

Making certain home improvements can also qualify you for a discount on your homeowners insurance premium. These improvements typically involve upgrading your home for safety and reducing the risk of damage.

- Roof Upgrades: Upgrading your roof to a more durable material, such as metal or tile, can qualify you for a discount.

- Wind Mitigation: Installing wind-resistant features, such as hurricane shutters or reinforced garage doors, can also qualify you for a discount, especially in hurricane-prone areas.

- Plumbing and Electrical Upgrades: Upgrading your plumbing and electrical systems can reduce the risk of water damage and fire, and may qualify you for a discount.

Other Potential Discounts Loyalty and Payment Options

In addition to the discounts mentioned above, there are also several other potential discounts you may be eligible for:

- Loyalty Discounts: Some insurance companies offer discounts to long-term customers.

- Payment Options: Paying your premium in full upfront may qualify you for a discount. Setting up automatic payments may also qualify you for a discount.

- Age-Based Discounts: Some insurance companies offer discounts to senior citizens.

Understanding Homeowners Insurance Claims Filing Process and What to Expect

Filing a homeowners insurance claim can be a stressful experience, especially if you've never done it before. Understanding the claims filing process and what to expect can help make the process smoother and less overwhelming. Here's a step-by-step guide to filing a homeowners insurance claim:

Documenting the Damage Taking Photos and Videos

The first step in filing a homeowners insurance claim is to document the damage. Take photos and videos of the damage as soon as possible after the incident occurs. This documentation will be crucial when you file your claim.

- Take Clear Photos and Videos: Make sure your photos and videos are clear and well-lit. Capture the extent of the damage from multiple angles.

- Document Everything: Document all the damage, no matter how small it may seem. Even small amounts of damage can add up over time.

- Keep a Record: Keep a record of all the photos and videos you take. This will help you stay organized and ensure you don't miss anything.

Contacting Your Insurance Company Reporting the Loss

The next step is to contact your insurance company and report the loss. You can typically do this online, by phone, or through your insurance agent. Be prepared to provide details about the incident, including the date, time, and location of the damage.

- Be Prepared to Answer Questions: The insurance company will likely ask you a series of questions about the incident. Be prepared to answer these questions accurately and honestly.

- Get a Claim Number: The insurance company will assign you a claim number. Keep this number handy, as you'll need it for all future communications with the insurance company.

- Ask About the Claims Process: Ask the insurance company about the claims process. Find out what documentation you'll need to provide and what to expect in terms of timelines.

Working with an Insurance Adjuster Assessing the Damage

After you file your claim, the insurance company will send an insurance adjuster to assess the damage. The adjuster will inspect your property and estimate the cost of repairs. It's important to be present during the adjuster's inspection and to point out all the damage.

- Be Prepared to Answer Questions: The adjuster will likely ask you questions about the incident and the damage. Be prepared to answer these questions accurately and honestly.

- Provide Documentation: Provide the adjuster with any documentation you have, such as photos, videos, and receipts.

- Get a Copy of the Adjuster's Report: Ask the adjuster for a copy of their report. This will give you an idea of how much the insurance company is willing to pay for repairs.

Receiving Payment and Completing Repairs Getting Your Home Back to Normal

Once the insurance company approves your claim, you'll receive payment for the repairs. You can then use this money to hire contractors and complete the repairs. It's important to choose reputable contractors who are licensed and insured.

- Get Multiple Bids: Get multiple bids from contractors before hiring someone. This will help you ensure you're getting a fair price.

- Check References: Check the references of any contractors you're considering hiring.

- Get a Written Contract: Get a written contract from the contractor before work begins. The contract should outline the scope of work, the price, and the payment schedule.

Homeowners Insurance and Natural Disasters Preparing for the Unexpected

Natural disasters can cause significant damage to homes. It's important to understand how your homeowners insurance policy covers natural disasters and to take steps to prepare for the unexpected.

Understanding Coverage for Different Natural Disasters Specific Policy Details

The coverage for different natural disasters can vary depending on your homeowners insurance policy. It's important to carefully review your policy to understand what's covered and what's not.

- Hurricanes: Homeowners insurance policies typically cover damage caused by hurricanes, such as wind damage and rain damage. However, flood damage is typically not covered and requires a separate flood insurance policy.

- Tornadoes: Homeowners insurance policies typically cover damage caused by tornadoes, such as wind damage and hail damage.

- Earthquakes: Earthquake damage is typically not covered by standard homeowners insurance policies and requires a separate earthquake insurance policy.

- Wildfires: Homeowners insurance policies typically cover damage caused by wildfires, such as fire damage and smoke damage.

- Floods: As mentioned earlier, flood damage is typically not covered by standard homeowners insurance policies and requires a separate flood insurance policy.

Preparing Your Home for Natural Disasters Minimizing Potential Damage

Taking steps to prepare your home for natural disasters can help minimize potential damage and reduce the risk of loss.

- Hurricane Preparedness: In hurricane-prone areas, install hurricane shutters, reinforce garage doors, and trim trees and shrubs.

- Tornado Preparedness: In tornado-prone areas, identify a safe room or shelter in your home.

- Earthquake Preparedness: In earthquake-prone areas, secure heavy furniture and appliances to the walls.

- Wildfire Preparedness: In wildfire-prone areas, clear brush and debris from around your home and maintain a defensible space.

- Flood Preparedness: In flood-prone areas, elevate appliances and utilities above the flood level and consider purchasing flood insurance.

Creating an Emergency Plan Protecting Your Family and Belongings

Creating an emergency plan is essential for protecting your family and belongings in the event of a natural disaster.

- Develop a Communication Plan: Establish a communication plan with your family so you can stay in touch during an emergency.

- Identify Evacuation Routes: Identify evacuation routes in case you need to leave your home quickly.

- Assemble an Emergency Kit: Assemble an emergency kit with essential supplies, such as food, water, medication, and a first-aid kit.

- Store Important Documents: Store important documents, such as insurance policies, identification, and medical records, in a waterproof container.

Homeowners Insurance for Specific Situations Renters Landlords and More

Homeowners insurance isn't just for homeowners. There are also specialized insurance policies for renters, landlords, and other specific situations.

Renters Insurance Protecting Your Belongings in a Rental Property

Renters insurance protects your belongings in a rental property. It covers damage caused by perils such as fire, theft, and vandalism. It also provides liability coverage if someone is injured in your rental unit.

- Personal Property Coverage: Renters insurance covers your personal belongings, such as furniture, clothing, electronics, and appliances.

- Liability Coverage: Renters insurance provides liability coverage if someone is injured in your rental unit and sues you.

- Loss of Use Coverage: Renters insurance provides loss of use coverage if your rental unit is damaged and you need to find temporary housing.

Landlord Insurance Protecting Your Investment Property

Landlord insurance protects your investment property. It covers damage to the property caused by perils such as fire, wind, and vandalism. It also provides liability coverage if someone is injured on your property.

- Property Coverage: Landlord insurance covers the physical structure of your rental property.

- Liability Coverage: Landlord insurance provides liability coverage if someone is injured on your property and sues you.

- Loss of Rental Income Coverage: Landlord insurance provides loss of rental income coverage if your rental property is damaged and you lose rental income.

Vacant Home Insurance Protecting Unoccupied Properties

Vacant home insurance protects unoccupied properties. Standard homeowners insurance policies typically don't cover vacant homes, as they are considered to be at higher risk of damage due to vandalism, theft, and neglect.

- Coverage for Vandalism and Theft: Vacant home insurance covers damage caused by vandalism and theft.

- Coverage for Fire and Water Damage: Vacant home insurance covers damage caused by fire and water.

- Liability Coverage: Vacant home insurance provides liability coverage if someone is injured on your property.

Homeowners Insurance and Technology Smart Home Devices and Insurance Discounts

Technology is playing an increasingly important role in homeowners insurance. Smart home devices can help protect your home from damage and may even qualify you for insurance discounts.

Smart Home Devices Reducing Risks and Lowering Premiums

Smart home devices can help reduce the risk of damage to your home, which can lead to lower insurance premiums.

- Smart Water Leak Detectors: Smart water leak detectors can detect leaks early and alert you before they cause significant damage.

- Smart Smoke Detectors: Smart smoke detectors can detect smoke and fire early and alert you even when you're not home.

- Smart Security Systems: Smart security systems can deter burglars and alert you to any suspicious activity.

Insurance Company Partnerships Integrating Technology for Better Protection

Some insurance companies are partnering with technology companies to integrate smart home devices into their policies. This can provide homeowners with better protection and potentially lower premiums.

- Discounted Smart Home Devices: Some insurance companies offer discounted smart home devices to their customers.

- Real-Time Monitoring: Some insurance companies provide real-time monitoring of smart home devices.

- Data-Driven Pricing: Some insurance companies are using data from smart home devices to personalize insurance premiums.

Recommended Homeowners Insurance Products and Services

Choosing the right homeowners insurance product can be daunting. Here are a few recommendations based on different needs and situations:

Lemonade Home Insurance A Tech-Driven Approach

Lemonade is a relatively new insurance company that uses technology to streamline the insurance process. They offer a user-friendly online platform and fast claims processing. Their prices are often competitive, especially for renters and first-time homeowners.

- Pros: User-friendly online platform, fast claims processing, competitive prices.

- Cons: Limited coverage options, not available in all states.

- Use Case: Ideal for renters and first-time homeowners looking for a simple and affordable insurance option.

- Pricing: Varies depending on location and coverage levels.

State Farm Home Insurance A Trusted and Reliable Provider

State Farm is one of the largest and most well-established insurance companies in the United States. They offer a wide range of coverage options and have a strong reputation for customer service and claims handling.

- Pros: Wide range of coverage options, strong reputation for customer service, available nationwide.

- Cons: Prices may be higher than some competitors.

- Use Case: Ideal for homeowners looking for comprehensive coverage and reliable customer service.

- Pricing: Varies depending on location and coverage levels.

Allstate Home Insurance Customization and Discount Options

Allstate offers a wide range of customization options and discounts, allowing you to tailor your policy to your specific needs and budget. They also have a strong online presence and a network of local agents.

- Pros: Wide range of customization options, numerous discount opportunities, strong online presence.

- Cons: Prices may be higher than some competitors.

- Use Case: Ideal for homeowners looking for a customized policy and numerous opportunities to save money.

- Pricing: Varies depending on location and coverage levels.

Frequently Asked Questions About Homeowners Insurance

Here are some frequently asked questions about homeowners insurance:

What is the difference between homeowners insurance and mortgage insurance?

Homeowners insurance protects your home and belongings from damage and loss. Mortgage insurance protects the lender if you default on your mortgage.

How much homeowners insurance do I need?

You need enough homeowners insurance to rebuild your home to its original condition and to replace your belongings. You should also consider liability coverage to protect you if someone is injured on your property.

How can I lower my homeowners insurance premium?

You can lower your homeowners insurance premium by increasing your deductible, bundling your policies, installing a home security system, and making certain home improvements.

What happens if I file a homeowners insurance claim?

If you file a homeowners insurance claim, the insurance company will send an adjuster to assess the damage. The adjuster will estimate the cost of repairs, and the insurance company will pay you for the covered losses.

Is flood damage covered by homeowners insurance?

Flood damage is typically not covered by standard homeowners insurance policies and requires a separate flood insurance policy.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)