Health Insurance Scams_ How to Protect Yourself

Understanding Health Insurance The Basics

Let's dive into the world of health insurance. It can seem complicated, but breaking it down into its core components makes it much easier to understand. At its heart, health insurance is a contract between you and an insurance company. You pay a premium, and in return, the insurance company agrees to pay for a portion of your healthcare costs. This shared risk helps protect you from potentially crippling medical bills.

There are several key terms you'll encounter frequently:

- Premium: This is the monthly fee you pay to maintain your health insurance coverage. Think of it like a subscription fee for access to healthcare benefits.

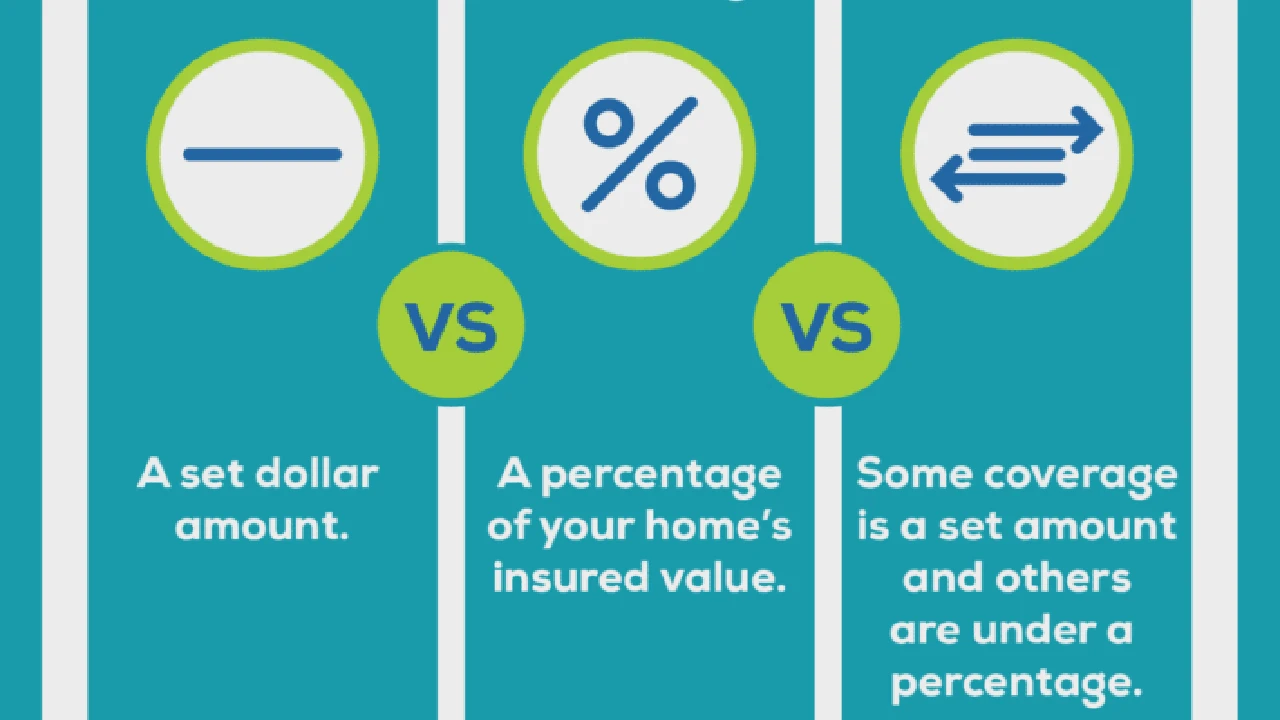

- Deductible: This is the amount you pay out-of-pocket for covered healthcare services before your insurance company starts paying. For example, if your deductible is $2,000, you'll pay the first $2,000 of your healthcare costs, and then your insurance will start covering its share.

- Copay: This is a fixed amount you pay for certain healthcare services, such as a doctor's visit or prescription. It's typically a smaller amount than the overall cost of the service.

- Coinsurance: This is the percentage of healthcare costs you pay after you've met your deductible. For example, if your coinsurance is 20%, you'll pay 20% of the remaining costs, and your insurance company will pay the other 80%.

- Out-of-pocket maximum: This is the maximum amount you'll pay out-of-pocket for covered healthcare services during a policy year. Once you reach this limit, your insurance company will pay 100% of your covered costs for the rest of the year.

Understanding these terms is crucial for choosing the right health insurance plan and managing your healthcare costs effectively.

Exploring Different Types of Health Insurance Plans Comprehensive Overview

The health insurance landscape is diverse, with various types of plans catering to different needs and budgets. Let's explore some of the most common types:

- Health Maintenance Organization (HMO): HMO plans typically require you to choose a primary care physician (PCP) who will coordinate your care. You usually need a referral from your PCP to see a specialist. HMOs often have lower premiums and deductibles but offer less flexibility in choosing providers.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility than HMOs. You can see any doctor or specialist you want without a referral, but you'll pay less if you stay within the plan's network of preferred providers. PPOs generally have higher premiums and deductibles than HMOs.

- Exclusive Provider Organization (EPO): EPO plans are similar to HMOs in that you typically need to stay within the plan's network to receive coverage. However, EPOs usually don't require you to choose a PCP or get referrals to see specialists.

- Point of Service (POS): POS plans combine features of HMOs and PPOs. You'll typically need to choose a PCP and get referrals to see specialists, but you can also go out-of-network for care, although you'll pay more.

- High-Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles. They are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money for healthcare expenses. HDHPs can be a good option for people who are generally healthy and don't anticipate needing a lot of healthcare services.

- Medicare: This is a federal health insurance program for people age 65 or older, as well as some younger people with disabilities or certain medical conditions.

- Medicaid: This is a joint federal and state program that provides health insurance coverage to low-income individuals and families.

Choosing the right type of plan depends on your individual needs, budget, and preferences. Consider factors such as your healthcare needs, the cost of premiums and deductibles, and the availability of providers in your area.

Health Insurance Marketplaces Navigating Enrollment and Options

The Affordable Care Act (ACA) created health insurance marketplaces, also known as exchanges, where individuals and families can shop for and enroll in health insurance plans. These marketplaces offer a variety of plans from different insurance companies, allowing you to compare options and find the best fit for your needs.

Key features of health insurance marketplaces include:

- Open enrollment period: This is the annual period when you can enroll in or change your health insurance plan through the marketplace. The open enrollment period typically runs from November 1 to January 15.

- Special enrollment period: You may be eligible for a special enrollment period if you experience a qualifying life event, such as losing your job-based health insurance, getting married, or having a baby.

- Premium tax credits: These are subsidies that can help lower your monthly premium costs. Premium tax credits are available to individuals and families with incomes between 100% and 400% of the federal poverty level.

- Cost-sharing reductions: These are subsidies that can help lower your out-of-pocket costs, such as deductibles and copays. Cost-sharing reductions are available to individuals and families with incomes below 250% of the federal poverty level who enroll in a Silver plan.

Navigating the health insurance marketplace can be overwhelming, but there are resources available to help. You can get assistance from navigators, who are trained professionals who can help you understand your options and enroll in a plan. You can also contact the marketplace directly or visit its website for more information.

Supplemental Health Insurance Enhancing Your Coverage

While comprehensive health insurance plans cover a wide range of medical expenses, supplemental health insurance can provide additional coverage for specific needs or situations. These plans can help fill gaps in your primary insurance and provide financial protection against unexpected costs.

Common types of supplemental health insurance include:

- Accident insurance: This type of insurance provides benefits if you're injured in an accident. It can help cover medical expenses, lost wages, and other costs associated with your injury.

- Critical illness insurance: This type of insurance provides a lump-sum payment if you're diagnosed with a covered critical illness, such as cancer, heart attack, or stroke. The money can be used to pay for medical expenses, living expenses, or anything else you need.

- Hospital indemnity insurance: This type of insurance pays a daily benefit if you're hospitalized. The money can be used to help cover expenses such as deductibles, copays, and other out-of-pocket costs.

- Dental insurance: This type of insurance covers dental care, such as cleanings, exams, and fillings.

- Vision insurance: This type of insurance covers vision care, such as eye exams and eyeglasses.

Consider whether supplemental health insurance is right for you based on your individual needs and risk factors. Evaluate the costs and benefits of each type of plan and choose the coverage that best fits your circumstances.

Telehealth and Virtual Care The Future of Healthcare Delivery

Telehealth, also known as virtual care, is the use of technology to deliver healthcare remotely. It allows you to consult with doctors, therapists, and other healthcare providers from the comfort of your own home. Telehealth has become increasingly popular in recent years, offering convenience, accessibility, and cost-effectiveness.

Benefits of telehealth include:

- Convenience: You can access healthcare services from anywhere with an internet connection, eliminating the need to travel to a doctor's office.

- Accessibility: Telehealth can improve access to care for people in rural areas or those with mobility issues.

- Cost-effectiveness: Telehealth can often be less expensive than in-person visits, as it eliminates the costs associated with travel and facility overhead.

- Improved health outcomes: Telehealth can help people manage chronic conditions more effectively and improve adherence to treatment plans.

Telehealth is used for a variety of healthcare services, including:

- Primary care: Routine checkups, diagnosis and treatment of common illnesses, and prescription refills.

- Mental health: Therapy, counseling, and medication management.

- Specialty care: Consultations with specialists, such as dermatologists, cardiologists, and endocrinologists.

- Chronic disease management: Monitoring and management of conditions such as diabetes, heart disease, and asthma.

Talk to your healthcare provider or insurance company to see if telehealth services are available and covered under your plan.

Health Savings Accounts HSAs Maximizing Your Healthcare Dollars

A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for qualified medical expenses. HSAs are available to people who are enrolled in a high-deductible health plan (HDHP). They offer a triple tax benefit: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Key features of HSAs include:

- Tax-deductible contributions: You can deduct your HSA contributions from your taxable income, reducing your tax liability.

- Tax-free earnings: The money in your HSA grows tax-free, allowing you to accumulate more savings over time.

- Tax-free withdrawals: You can withdraw money from your HSA tax-free to pay for qualified medical expenses, such as doctor's visits, prescriptions, and medical equipment.

- Portability: Your HSA is yours to keep, even if you change jobs or health insurance plans.

HSAs can be a valuable tool for managing your healthcare costs and saving for the future. They can help you pay for unexpected medical expenses, cover your deductible, and save for healthcare expenses in retirement.

Navigating Pre-Existing Conditions and Health Insurance Coverage

A pre-existing condition is a health condition that you had before enrolling in a health insurance plan. Prior to the Affordable Care Act (ACA), insurance companies could deny coverage or charge higher premiums to people with pre-existing conditions. However, the ACA prohibits insurance companies from discriminating against people with pre-existing conditions.

Under the ACA, insurance companies cannot:

- Deny coverage: They cannot refuse to sell you a health insurance plan because of a pre-existing condition.

- Charge higher premiums: They cannot charge you a higher premium because of a pre-existing condition.

- Impose waiting periods: They cannot impose a waiting period before covering treatment for a pre-existing condition.

This means that you can get health insurance coverage regardless of your health history. If you have a pre-existing condition, you should shop for health insurance plans on the health insurance marketplace or through a private insurance company. You can also contact a navigator for assistance.

Understanding Mental Health Coverage and Access to Care

Mental health is an essential part of overall health and well-being. Health insurance plans are required to cover mental health services, including therapy, counseling, and medication management. The Mental Health Parity and Addiction Equity Act (MHPAEA) requires insurance companies to provide mental health benefits that are comparable to physical health benefits.

This means that insurance companies cannot:

- Impose stricter limits on mental health benefits: They cannot limit the number of visits or the amount of coverage for mental health services more than they limit physical health services.

- Charge higher copays or deductibles for mental health services: They cannot charge you more for mental health services than they charge for physical health services.

- Deny coverage for mental health conditions: They cannot refuse to cover treatment for mental health conditions that are covered for physical health conditions.

If you need mental health care, talk to your healthcare provider or insurance company to find a mental health professional who is in your network. You can also contact the Substance Abuse and Mental Health Services Administration (SAMHSA) for resources and information.

Prescription Drug Coverage Managing Medication Costs

Prescription drug coverage is a key component of most health insurance plans. It helps you pay for the medications you need to manage your health conditions. Prescription drug coverage typically includes a formulary, which is a list of covered medications. The formulary may be tiered, with different cost-sharing amounts for different tiers of drugs.

Tips for managing prescription drug costs:

- Choose generic drugs: Generic drugs are typically less expensive than brand-name drugs.

- Compare prices: Prices for prescription drugs can vary significantly from pharmacy to pharmacy.

- Use mail-order pharmacies: Mail-order pharmacies often offer lower prices and convenient delivery.

- Ask your doctor about alternatives: Your doctor may be able to prescribe a less expensive alternative to your current medication.

Understanding your prescription drug coverage and taking steps to manage your medication costs can help you save money and stay healthy.

Preventive Care Services Staying Healthy and Avoiding Costly Treatments

Preventive care services are healthcare services that are designed to prevent illness and disease. They include screenings, vaccinations, and counseling. Many health insurance plans cover preventive care services at no cost to you, thanks to the Affordable Care Act (ACA).

Examples of preventive care services include:

- Annual checkups: These checkups allow your doctor to assess your overall health and identify any potential health problems early on.

- Vaccinations: Vaccines protect you from infectious diseases, such as the flu, measles, and chickenpox.

- Screenings: Screenings can detect early signs of cancer, heart disease, and other conditions.

- Counseling: Counseling can help you manage stress, quit smoking, and make other healthy lifestyle changes.

Taking advantage of preventive care services can help you stay healthy, avoid costly treatments, and improve your overall quality of life.

Understanding Out-of-Network Coverage and Emergency Care

Your health insurance plan has a network of doctors, hospitals, and other healthcare providers that have agreed to provide services at a negotiated rate. If you see a provider who is in your network, you'll typically pay less than if you see a provider who is out-of-network.

Out-of-network coverage varies depending on your health insurance plan. Some plans may not cover out-of-network care at all, while others may cover it at a higher cost. It's important to understand your plan's out-of-network coverage rules before seeking care from a provider who is not in your network.

In emergency situations, you should seek care at the nearest hospital or emergency room, regardless of whether it's in your network. Your health insurance plan is required to cover emergency care, even if you go to an out-of-network facility.

COBRA and Health Insurance Options After Job Loss

If you lose your job, you may be eligible for COBRA, which allows you to continue your health insurance coverage through your former employer. However, COBRA coverage can be expensive, as you'll typically have to pay the full premium, plus an administrative fee.

Other health insurance options after job loss include:

- Health insurance marketplace: You can enroll in a health insurance plan through the health insurance marketplace. You may be eligible for premium tax credits or cost-sharing reductions to help lower your costs.

- Medicaid: If you have a low income, you may be eligible for Medicaid.

- Spouse's or parent's plan: You may be able to enroll in your spouse's or parent's health insurance plan.

Losing your job can be a stressful time, but it's important to explore your health insurance options to ensure that you have continued coverage.

Health Insurance for Self-Employed Individuals and Small Business Owners

If you're self-employed or own a small business, you have several options for health insurance coverage:

- Health insurance marketplace: You can enroll in a health insurance plan through the health insurance marketplace. You may be eligible for premium tax credits to help lower your costs.

- Small Business Health Options Program (SHOP): The SHOP marketplace offers health insurance plans specifically for small businesses.

- Private insurance company: You can purchase a health insurance plan directly from a private insurance company.

- Association health plan: Association health plans are offered by professional or trade associations to their members.

Choosing the right health insurance plan for your business depends on your budget, the size of your business, and the needs of your employees.

Health Insurance for Students and Young Adults

If you're a student or young adult, you have several options for health insurance coverage:

- Parent's plan: You may be able to stay on your parent's health insurance plan until you turn 26.

- Student health plan: Many colleges and universities offer student health plans.

- Health insurance marketplace: You can enroll in a health insurance plan through the health insurance marketplace. You may be eligible for premium tax credits to help lower your costs.

- Medicaid: If you have a low income, you may be eligible for Medicaid.

It's important to have health insurance coverage, even if you're young and healthy. Unexpected medical expenses can be costly, and health insurance can protect you from financial hardship.

Health Insurance Product Recommendations and Comparisons

Choosing the right health insurance plan can be a daunting task. There are many different plans available, each with its own set of benefits and costs. Here are a few product recommendations and comparisons to help you make an informed decision:

UnitedHealthcare

UnitedHealthcare is one of the largest health insurance companies in the United States. They offer a wide variety of plans, including HMOs, PPOs, and EPOs. UnitedHealthcare plans are generally well-regarded for their comprehensive coverage and large network of providers.

Use Cases:

- Individuals and families looking for comprehensive coverage.

- People who want a large network of providers to choose from.

- Those who prefer the structure of an HMO, PPO, or EPO plan.

Pricing:

Premiums for UnitedHealthcare plans vary depending on the type of plan, your location, and your age. You can get a quote on their website or through a health insurance broker.

Kaiser Permanente

Kaiser Permanente is a unique health insurance provider that combines insurance coverage with healthcare delivery. They own and operate their own hospitals and clinics, and their doctors and nurses are employees of Kaiser Permanente. This integrated model allows Kaiser Permanente to provide coordinated care and often lower costs.

Use Cases:

- People who prefer a coordinated care model.

- Those who live in areas where Kaiser Permanente has a strong presence.

- Individuals and families looking for potentially lower costs.

Pricing:

Premiums for Kaiser Permanente plans vary depending on your location and the type of plan you choose. You can get a quote on their website.

Blue Cross Blue Shield

Blue Cross Blue Shield is a federation of 36 independent health insurance companies across the United States. They offer a wide variety of plans, including HMOs, PPOs, and EPOs. Blue Cross Blue Shield plans are known for their broad network of providers and their commitment to quality care.

Use Cases:

- Individuals and families looking for a reputable and established health insurance provider.

- People who want a broad network of providers to choose from.

- Those who prefer the flexibility of a PPO plan.

Pricing:

Premiums for Blue Cross Blue Shield plans vary depending on the specific plan, your location, and your age. You can get a quote on their website or through a health insurance broker.

Cigna

Cigna is a global health service company that offers a wide range of health insurance plans and related services. They are known for their innovative approach to healthcare and their focus on wellness and prevention.

Use Cases:

- Individuals and families looking for a health insurance provider with a focus on wellness.

- People who want access to a variety of health and wellness programs.

- Those who travel frequently and need international coverage options.

Pricing:

Premiums for Cigna plans vary depending on the type of plan, your location, and your age. You can get a quote on their website or through a health insurance broker.

Oscar Health

Oscar Health is a technology-driven health insurance company that offers a user-friendly experience and innovative features. They are known for their easy-to-use website and mobile app, as well as their virtual care services.

Use Cases:

- Tech-savvy individuals and families.

- People who value convenience and accessibility.

- Those who are comfortable using technology to manage their healthcare.

Pricing:

Premiums for Oscar Health plans vary depending on your location and the type of plan you choose. You can get a quote on their website.

Evaluating Health Insurance Plans Key Considerations

When choosing a health insurance plan, it's important to consider several factors, including:

- Premium: How much will you pay each month for coverage?

- Deductible: How much will you pay out-of-pocket before your insurance starts paying?

- Copay: How much will you pay for each doctor's visit or prescription?

- Coinsurance: What percentage of your healthcare costs will you pay after you meet your deductible?

- Out-of-pocket maximum: What is the maximum amount you'll pay out-of-pocket in a year?

- Network: Does the plan include your preferred doctors and hospitals?

- Coverage: Does the plan cover the services you need, such as prescription drugs, mental health care, and preventive care?

By carefully considering these factors, you can choose a health insurance plan that meets your needs and budget.

Affordable Care Act ACA and Its Impact on Health Insurance

The Affordable Care Act (ACA) has had a significant impact on health insurance in the United States. It has expanded access to coverage, improved the quality of care, and helped to control costs.

Key provisions of the ACA include:

- Individual mandate: Requires most people to have health insurance coverage (this provision has since been repealed).

- Employer mandate: Requires large employers to offer health insurance to their employees.

- Expansion of Medicaid: Expands Medicaid eligibility to more low-income individuals and families.

- Health insurance marketplaces: Creates health insurance marketplaces where individuals and families can shop for and enroll in health insurance plans.

- Pre-existing condition protections: Prohibits insurance companies from denying coverage or charging higher premiums to people with pre-existing conditions.

- Preventive care coverage: Requires health insurance plans to cover preventive care services at no cost to you.

The ACA has helped millions of Americans gain access to health insurance coverage and has improved the overall health of the population.

Future Trends in Health Insurance Innovation and Technology

The health insurance industry is constantly evolving, with new innovations and technologies emerging all the time. Some of the key trends to watch include:

- Personalized medicine: Using genetic information and other data to tailor treatments to individual patients.

- Artificial intelligence (AI): Using AI to improve diagnosis, treatment, and administrative processes.

- Wearable technology: Using wearable devices to track health data and provide personalized insights.

- Blockchain technology: Using blockchain to improve data security and transparency.

- Value-based care: Shifting from a fee-for-service model to a value-based care model that rewards providers for delivering high-quality, cost-effective care.

These trends have the potential to transform the health insurance industry and improve the health and well-being of people around the world.

Final Thoughts on Navigating Health Insurance

Navigating the world of health insurance can be complex, but understanding the basics, exploring your options, and staying informed about industry trends can empower you to make the best decisions for your health and financial well-being. Remember to carefully evaluate your needs, compare plans, and seek assistance when needed. Your health is an investment, and choosing the right health insurance is a crucial step in protecting that investment.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)