Auto Insurance Scams_ How to Protect Yourself

Understanding Auto Insurance Basics A Comprehensive Guide

Let's dive into the world of auto insurance, shall we? It's not exactly the most thrilling topic, but trust me, understanding the basics can save you a lot of headaches (and money) down the road. Think of auto insurance as a safety net – a financial shield that protects you from the potentially devastating costs associated with car accidents, theft, or damage.

So, what exactly does auto insurance cover? Well, that depends on the type of coverage you choose. Here's a breakdown of some common types:

- Liability Coverage: This is the most basic type of coverage and is often legally required. It covers damages you cause to others if you're at fault in an accident. This includes bodily injury and property damage.

- Collision Coverage: This covers damage to your own vehicle, regardless of who's at fault in an accident. So, even if you're the one who caused the fender bender, collision coverage will help pay for the repairs.

- Comprehensive Coverage: This covers damage to your vehicle that's not caused by a collision. Think things like theft, vandalism, fire, hail, or even hitting a deer.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of who's at fault in an accident. It can also cover lost wages and other related expenses.

Choosing the right coverage can feel overwhelming, but it's important to understand what you're paying for. Consider your individual needs and risk tolerance. Are you a safe driver? Do you live in an area with high rates of theft or vandalism? These factors can help you determine the right level of coverage for you.

Exploring Different Auto Insurance Providers and Their Offerings

Now that you understand the basics of auto insurance, let's explore some of the major players in the industry. There are tons of auto insurance providers out there, each with its own unique offerings and pricing structures. Here's a look at a few of the most popular:

- Progressive: Known for its online quote tool and quirky advertising, Progressive offers a wide range of coverage options and discounts. They're a solid choice for drivers who want a convenient online experience.

- State Farm: A long-standing and reputable insurer, State Farm is known for its strong customer service and local agent network. They're a good option for drivers who prefer personalized service and advice.

- GEICO: Another popular choice, GEICO is known for its competitive rates and easy-to-use mobile app. They're a good option for drivers who are looking for affordability and convenience.

- Allstate: Allstate offers a comprehensive suite of insurance products, including auto, home, and life insurance. They're a good option for drivers who want to bundle their insurance policies for potential discounts.

- USAA: Exclusively for military members and their families, USAA consistently ranks high in customer satisfaction surveys. They offer excellent coverage and competitive rates for their target audience.

When choosing an auto insurance provider, it's important to compare quotes from multiple companies. Don't just focus on the price – consider the coverage options, customer service reputation, and claims process. Read reviews and talk to friends and family to get their recommendations.

Comparing Auto Insurance Quotes and Finding the Best Rates

Okay, let's talk about the dreaded task of comparing auto insurance quotes. It can be time-consuming, but it's essential to ensure you're getting the best possible rate. Here are some tips to help you navigate the process:

- Shop Around: Get quotes from multiple insurance companies. Don't settle for the first quote you receive.

- Be Honest: Provide accurate information about your driving history, vehicle, and other factors. Inaccurate information can lead to higher rates or even denial of coverage.

- Understand Your Coverage Needs: Determine the right level of coverage for you based on your individual needs and risk tolerance.

- Ask About Discounts: Many insurance companies offer discounts for things like good driving records, safe vehicles, bundling policies, and being a student.

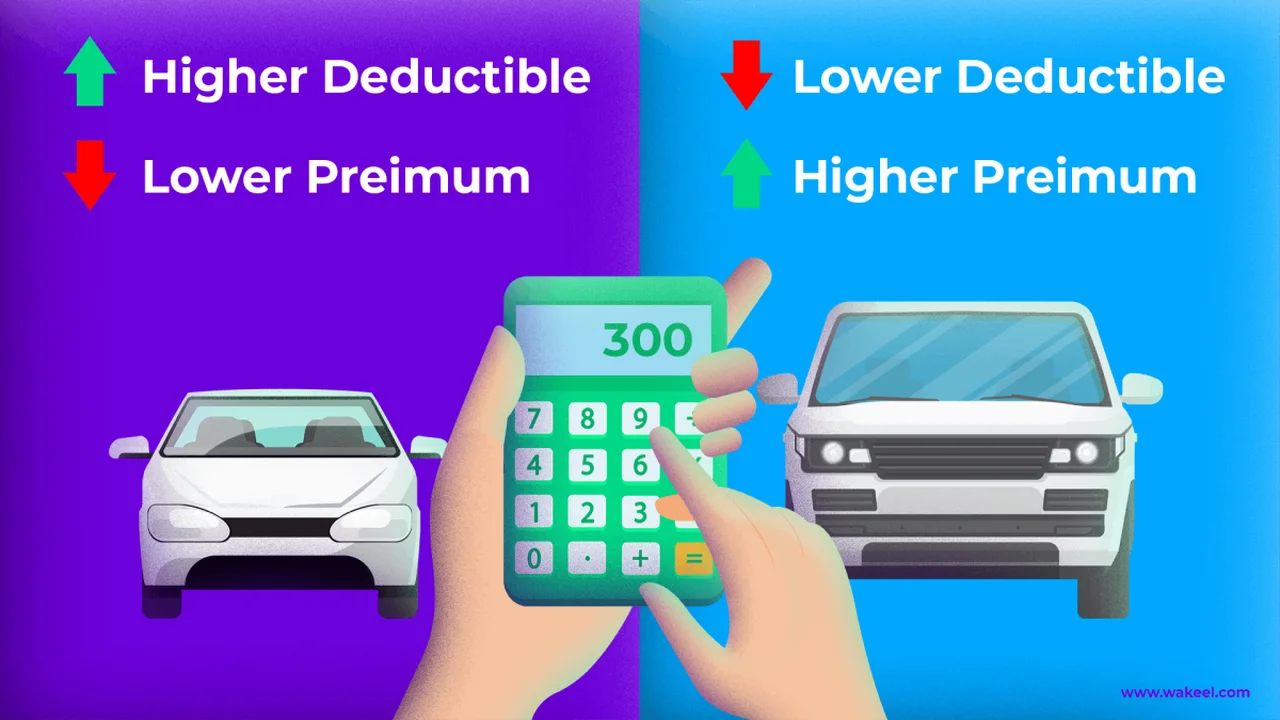

- Consider a Higher Deductible: Increasing your deductible can lower your premium, but make sure you can afford to pay the deductible if you need to file a claim.

- Read the Fine Print: Before you sign up for a policy, carefully review the terms and conditions to understand what's covered and what's not.

There are also online tools that can help you compare auto insurance quotes from multiple companies at once. These tools can save you time and effort, but be sure to use reputable websites and be wary of providing your personal information to unknown sources.

Decoding Auto Insurance Jargon Understanding Common Terms

Auto insurance policies are often filled with confusing jargon. Let's break down some of the most common terms:

- Premium: The amount you pay for your insurance policy.

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in.

- Liability Limits: The maximum amount your insurance company will pay for damages you cause to others.

- Coverage: The types of losses your insurance policy covers.

- Policy Period: The length of time your insurance policy is in effect.

- Claim: A request for payment from your insurance company for a covered loss.

- Endorsement: An amendment to your insurance policy that adds or changes coverage.

- Exclusion: A specific loss or event that is not covered by your insurance policy.

Understanding these terms will help you make informed decisions about your auto insurance coverage and avoid any surprises down the road. Don't hesitate to ask your insurance agent to explain any terms you don't understand.

Auto Insurance Discounts Unlocking Savings and Lowering Premiums

Who doesn't love a good discount? Auto insurance companies offer a variety of discounts that can help you lower your premiums. Here are some of the most common:

- Good Driver Discount: Drivers with a clean driving record are often eligible for significant discounts.

- Safe Vehicle Discount: Vehicles with safety features like anti-lock brakes and airbags may qualify for discounts.

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or life insurance, can often result in discounts.

- Student Discount: Students with good grades may be eligible for discounts.

- Low Mileage Discount: Drivers who drive fewer miles per year may qualify for discounts.

- Defensive Driving Course Discount: Completing a defensive driving course can often earn you a discount.

- Affiliation Discounts: Some insurance companies offer discounts to members of certain organizations, such as alumni associations or professional groups.

Be sure to ask your insurance agent about all the discounts you may be eligible for. You might be surprised at how much you can save.

The Impact of Driving History on Auto Insurance Rates

Your driving history plays a significant role in determining your auto insurance rates. A clean driving record will generally result in lower rates, while accidents and traffic violations can lead to higher rates. Here's a look at how different events can impact your premiums:

- Accidents: Accidents, especially those where you're at fault, can significantly increase your rates.

- Traffic Violations: Speeding tickets, red light violations, and other traffic violations can also lead to higher rates.

- DUI/DWI: Driving under the influence is a serious offense that can result in a significant increase in your insurance rates, as well as potential legal consequences.

- Suspended License: Having your driver's license suspended can also lead to higher rates or even denial of coverage.

Maintaining a clean driving record is the best way to keep your auto insurance rates low. Drive safely, obey traffic laws, and avoid accidents and violations.

Understanding Auto Insurance Coverage Options Liability vs Full Coverage

Choosing between liability coverage and full coverage can be a tough decision. Let's break down the differences:

- Liability Coverage: This is the most basic type of coverage and only covers damages you cause to others. It doesn't cover damage to your own vehicle.

- Full Coverage: This includes liability coverage, as well as collision and comprehensive coverage. It covers damage to your own vehicle, regardless of who's at fault.

Liability coverage is typically cheaper than full coverage, but it also offers less protection. If you're on a tight budget, liability coverage may be your only option. However, if you can afford it, full coverage is generally recommended, especially if you have a newer vehicle or can't afford to repair or replace your car out of pocket.

Auto Insurance for New Drivers Tips and Strategies for Young Adults

Getting auto insurance as a new driver can be challenging and expensive. Here are some tips and strategies to help young adults find affordable coverage:

- Shop Around: Get quotes from multiple insurance companies. Rates can vary significantly for young drivers.

- Stay on Your Parents' Policy: If possible, stay on your parents' policy. This is often the cheapest option.

- Take a Defensive Driving Course: Completing a defensive driving course can often earn you a discount.

- Maintain Good Grades: Students with good grades may be eligible for discounts.

- Drive a Safe Vehicle: Vehicles with safety features like anti-lock brakes and airbags may qualify for discounts.

- Avoid Accidents and Violations: Maintaining a clean driving record is the best way to keep your rates low.

Remember, patience and persistence are key when shopping for auto insurance as a new driver. Don't get discouraged if you don't find the perfect rate right away. Keep searching and comparing quotes until you find a policy that fits your needs and budget.

The Role of Credit Score in Determining Auto Insurance Premiums

In many states, insurance companies use credit scores to help determine auto insurance premiums. Drivers with good credit scores typically pay lower rates than drivers with poor credit scores. This is because insurance companies believe that drivers with good credit are more responsible and less likely to file claims.

If you have a poor credit score, you can improve it by paying your bills on time, reducing your debt, and avoiding opening new credit accounts. Improving your credit score can help you lower your auto insurance premiums over time.

Auto Insurance Claims Process A Step-by-Step Guide

Filing an auto insurance claim can be stressful, but understanding the process can help you navigate it more smoothly. Here's a step-by-step guide:

- Report the Accident: Immediately report the accident to your insurance company.

- Gather Information: Collect information from the other driver, including their name, address, insurance information, and license plate number. Also, gather information from any witnesses.

- Document the Damage: Take photos or videos of the damage to your vehicle and the other vehicle.

- File a Police Report: If the accident is serious or involves injuries, file a police report.

- Cooperate with the Insurance Company: Provide the insurance company with all the information they need to process your claim.

- Get Estimates for Repairs: Get estimates from multiple repair shops before having your vehicle repaired.

- Review the Settlement Offer: Carefully review the settlement offer from the insurance company before accepting it.

Remember to keep detailed records of all communication with the insurance company and any expenses you incur as a result of the accident. If you're not satisfied with the insurance company's handling of your claim, you may have the option to file a complaint with your state's insurance regulator.

Auto Insurance and Technology Telematics and Usage-Based Insurance

Technology is changing the way auto insurance is priced and delivered. Telematics and usage-based insurance (UBI) are becoming increasingly popular. These programs use devices or apps to track your driving behavior, such as speeding, hard braking, and mileage. The data collected is then used to determine your insurance premiums.

UBI programs can offer significant discounts to safe drivers. However, they can also lead to higher rates for drivers who exhibit risky driving behavior. If you're a safe driver, UBI programs can be a great way to save money on your auto insurance. However, if you're not a safe driver, you may want to avoid these programs.

Auto Insurance for Rideshare Drivers Uber Lyft and More

Driving for rideshare companies like Uber and Lyft requires a special type of auto insurance. Your personal auto insurance policy may not cover you while you're driving for these companies. Rideshare companies typically provide some insurance coverage, but it may not be enough to fully protect you.

There are several options for rideshare insurance. You can purchase a separate rideshare insurance policy, or you can add a rideshare endorsement to your existing policy. Talk to your insurance agent to determine the best option for you.

Future of Auto Insurance Autonomous Vehicles and Changing Coverage Needs

Autonomous vehicles are poised to revolutionize the auto industry, and they will also have a significant impact on auto insurance. As vehicles become more autonomous, the responsibility for accidents will shift from the driver to the vehicle manufacturer or technology provider.

The future of auto insurance is uncertain, but it's likely that coverage needs will change as autonomous vehicles become more prevalent. We may see a shift towards product liability insurance for manufacturers and technology providers, as well as new types of coverage for cyber security and data breaches.

Recommended Products and Use Cases

Let's look at some specific product recommendations, focusing on different use cases:

For the Budget-Conscious Driver: Progressive Snapshot

Use Case: If you're a safe driver looking for the absolute lowest rates and are comfortable with your driving being monitored, Progressive's Snapshot program is worth considering. It tracks your driving habits through a device plugged into your car or a mobile app, and rewards safe driving with discounts. However, be aware that aggressive driving can lead to higher premiums.

Details: Snapshot monitors things like hard braking, rapid acceleration, and nighttime driving. The more you drive safely, the bigger the discount you can earn. It's a great option for people who primarily drive during off-peak hours and avoid risky driving behaviors.

Pricing: The discount varies based on your driving habits. Some drivers have reported saving hundreds of dollars per year, while others have seen their rates increase slightly.

For the Family with Multiple Drivers: State Farm

Use Case: Families with multiple drivers and vehicles often benefit from the comprehensive coverage and discounts offered by State Farm. Their strong local agent network provides personalized service and support, which can be particularly valuable when dealing with complex situations.

Details: State Farm offers multi-car discounts, safe driver discounts, and good student discounts. They also have a reputation for excellent customer service and a smooth claims process.

Pricing: State Farm's rates are generally competitive, especially when you factor in the discounts available for families.

For the Tech-Savvy Driver: GEICO

Use Case: If you prefer managing your insurance policy online and through a mobile app, GEICO is a great choice. Their user-friendly app allows you to get quotes, file claims, and access your policy information from anywhere.

Details: GEICO offers a variety of coverage options and discounts, and their mobile app makes it easy to manage your policy on the go. They also have a virtual assistant that can answer your questions and provide support.

Pricing: GEICO is known for its competitive rates, particularly for drivers with good driving records.

For the Military Community: USAA

Use Case: USAA provides exceptional service and competitive rates exclusively to military members and their families. Their understanding of the unique needs of the military community makes them a top choice for this demographic.

Details: USAA offers a wide range of insurance products and financial services, and they consistently rank high in customer satisfaction surveys. They also provide special benefits for military members, such as deployment coverage and vehicle storage discounts.

Pricing: USAA's rates are consistently among the lowest in the industry, especially for military members.

Product Comparison: Progressive vs State Farm vs GEICO

Here's a quick comparison of three popular auto insurance providers:

| Feature | Progressive | State Farm | GEICO | |-------------------|-------------------------------------------|---------------------------------------------|--------------------------------------------| | **Online Experience** | Excellent online quote tool and website | Decent website, strong local agent network | User-friendly mobile app and website | | **Customer Service** | Good, but can vary | Excellent, known for personalized service | Good, but can be less personal | | **Discounts** | Snapshot program, multi-policy discounts| Multi-car discounts, safe driver discounts | Competitive rates, good student discounts | | **Pricing** | Generally competitive | Competitive, especially with discounts | Known for low rates |Ultimately, the best auto insurance provider for you will depend on your individual needs and preferences. Consider your budget, driving habits, and desired level of customer service when making your decision.

Detailed Information: Auto Insurance Pricing Factors

Understanding the factors that influence auto insurance pricing is crucial for making informed decisions. Here's a more in-depth look:

* **Age:** Younger drivers, particularly those under 25, typically pay higher rates due to their lack of experience. * **Driving History:** As mentioned earlier, a clean driving record is essential for lower rates. Accidents and traffic violations will significantly increase your premiums. * **Location:** Urban areas with higher traffic density and crime rates generally have higher insurance costs than rural areas. * **Vehicle Type:** The make and model of your vehicle can impact your rates. Expensive cars, sports cars, and vehicles with a high theft rate tend to be more expensive to insure. * **Coverage Levels:** The amount of coverage you choose will directly affect your premiums. Higher liability limits and comprehensive coverage will result in higher costs. * **Deductible:** Choosing a higher deductible will lower your premium, but you'll need to pay more out of pocket if you file a claim. * **Credit Score:** In many states, your credit score can influence your rates. * **Annual Mileage:** The more you drive, the higher your risk of an accident, and the higher your premiums will be. * **Marital Status:** Married drivers often pay lower rates than single drivers. * **Gender:** Statistically, men tend to pay slightly higher rates than women, particularly younger men.Auto Insurance Scenarios and Examples

Let's consider some real-life scenarios to illustrate how auto insurance works:

* **Scenario 1: Fender Bender:** You accidentally rear-end another car at a stoplight. Your liability coverage will pay for the damage to the other driver's vehicle and any injuries they sustain. Your collision coverage will pay for the damage to your own car, minus your deductible. * **Scenario 2: Hail Damage:** A severe hailstorm damages your car. Your comprehensive coverage will pay for the repairs, minus your deductible. * **Scenario 3: Hit-and-Run:** You're parked on the street, and someone hits your car and drives off. Your uninsured motorist property damage coverage (if you have it) will pay for the repairs, or your collision coverage will, subject to the deductible. * **Scenario 4: Theft:** Your car is stolen. Your comprehensive coverage will pay for the value of your car, minus your deductible. * **Scenario 5: Medical Expenses:** You're injured in an accident, regardless of who's at fault. Your personal injury protection (PIP) coverage will pay for your medical expenses and lost wages.These scenarios highlight the importance of having adequate auto insurance coverage to protect yourself financially from unexpected events.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)