Auto Insurance Deductibles_ Choosing the Right Amount

Understanding Auto Insurance Basics What Is Auto Insurance

Auto insurance is a contract between you and an insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your paying a premium the insurance company agrees to pay your losses as outlined in your policy.

Think of it as a financial safety net for your car. It’s there to help cover costs associated with accidents whether it’s damage to your vehicle injuries to yourself or others or even legal fees if you’re found responsible for an accident.

Why Is Auto Insurance Important The Necessity of Coverage

Auto insurance isn’t just a good idea; in most states it’s the law. But even if it weren’t legally required having auto insurance is crucial for several reasons:

- Financial Protection: Accidents can be incredibly expensive. Medical bills car repairs and legal fees can quickly add up to tens of thousands of dollars. Auto insurance helps protect you from these potentially devastating costs.

- Legal Compliance: Driving without insurance can result in hefty fines license suspension or even jail time depending on the state.

- Peace of Mind: Knowing you’re covered in case of an accident allows you to drive with greater peace of mind.

- Protection for Others: Auto insurance doesn’t just protect you; it also protects other drivers and pedestrians in case you’re at fault in an accident.

Different Types of Auto Insurance Coverage Exploring Your Options

Auto insurance policies typically include several different types of coverage each designed to protect you in different situations. Here’s a breakdown of some of the most common types:

Liability Coverage Protecting Against Lawsuits and Damages

Liability coverage is arguably the most important part of your auto insurance policy. It protects you if you’re at fault in an accident that causes injury or property damage to someone else. It covers their medical bills car repairs and other related expenses up to the limits of your policy.

There are two types of liability coverage:

- Bodily Injury Liability: Covers medical expenses lost wages and pain and suffering for people injured in an accident you caused.

- Property Damage Liability: Covers damage to another person’s vehicle or property (like a fence or building) caused by an accident you caused.

It’s crucial to choose liability coverage limits that are high enough to adequately protect your assets. If you don’t have enough coverage you could be personally liable for any damages that exceed your policy limits.

Collision Coverage Repairing Your Vehicle After an Accident

Collision coverage pays for damage to your vehicle if you collide with another vehicle or object regardless of who is at fault. This coverage is especially important if you have a newer car or if you rely on your car for transportation.

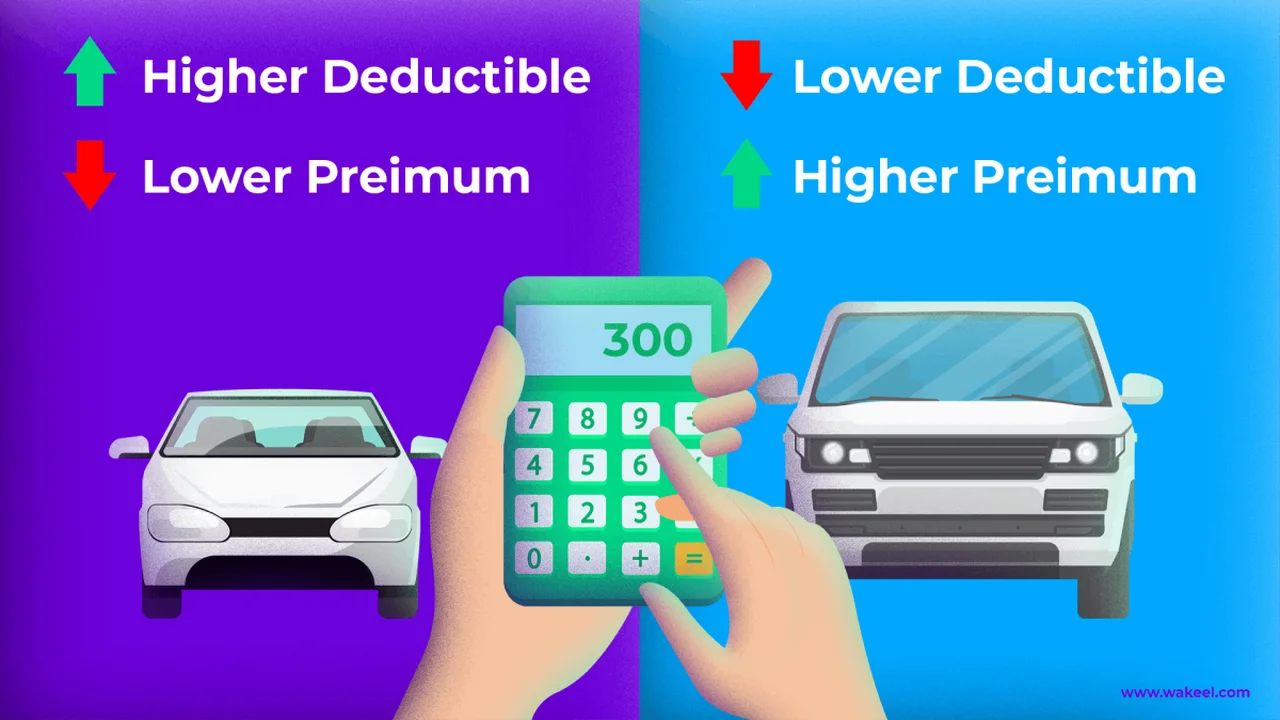

With collision coverage you’ll typically have a deductible which is the amount you pay out of pocket before your insurance company pays the rest. Choosing a higher deductible can lower your premium but it also means you’ll have to pay more out of pocket if you have an accident.

Comprehensive Coverage Protecting Against Non-Collision Damage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions such as:

- Theft

- Vandalism

- Fire

- Hail

- Flood

- Animal strikes

Like collision coverage comprehensive coverage typically has a deductible. This coverage is particularly useful if you live in an area prone to certain types of weather or crime.

Uninsured and Underinsured Motorist Coverage Protection Against Negligent Drivers

Uninsured and underinsured motorist coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

This coverage can help pay for your medical bills lost wages and other expenses if you’re hit by an uninsured or underinsured driver. It’s especially important to have this coverage in states with high rates of uninsured drivers.

Personal Injury Protection PIP Coverage Medical Expenses and Lost Wages

Personal Injury Protection (PIP) coverage is available in some states and pays for your medical expenses and lost wages regardless of who is at fault in an accident. It can also cover expenses for your passengers.

PIP coverage can be particularly helpful if you live in a no-fault state where drivers are required to file claims with their own insurance companies regardless of who caused the accident.

Medical Payments Coverage Immediate Medical Expense Coverage

Medical Payments coverage is similar to PIP coverage but it typically has lower limits and doesn’t cover lost wages. It pays for your medical expenses and those of your passengers regardless of who is at fault in an accident.

This coverage can be a good option if you want to ensure that you have some immediate coverage for medical expenses after an accident.

Factors Affecting Auto Insurance Rates Understanding Pricing

Auto insurance rates are determined by a variety of factors including:

Driving History Safe Driving Habits and Insurance Premiums

Your driving history is one of the biggest factors affecting your auto insurance rates. If you have a clean driving record with no accidents or tickets you’ll typically pay lower premiums. Conversely if you have a history of accidents or traffic violations you’ll likely pay higher premiums.

Insurance companies view drivers with a history of accidents or tickets as being higher risk and therefore charge them more for coverage.

Age and Gender How Demographics Influence Insurance Costs

Age and gender can also play a role in determining your auto insurance rates. Younger drivers particularly males are often considered to be higher risk and therefore pay higher premiums. This is because younger drivers tend to have less driving experience and are more likely to be involved in accidents.

As drivers get older and gain more experience their rates typically decrease. However rates may start to increase again for older drivers as they age and their driving skills may decline.

Vehicle Type The Impact of Car Model on Insurance Rates

The type of vehicle you drive can also affect your auto insurance rates. More expensive cars typically cost more to insure because they’re more expensive to repair or replace. Cars that are known to be frequently stolen or involved in accidents also tend to have higher insurance rates.

Conversely cars that are considered to be safer or less likely to be stolen may have lower insurance rates.

Location Where You Live and Its Effect on Insurance Costs

Your location can also impact your auto insurance rates. If you live in an area with high rates of crime traffic congestion or accidents you’ll likely pay higher premiums. This is because insurance companies view these areas as being higher risk.

Conversely if you live in a rural area with low rates of crime and accidents you may pay lower premiums.

Coverage Limits and Deductibles Balancing Cost and Protection

The amount of coverage you choose and the deductible you select can also affect your auto insurance rates. Higher coverage limits typically result in higher premiums while higher deductibles typically result in lower premiums.

It’s important to strike a balance between cost and protection when choosing your coverage limits and deductible. You want to make sure you have enough coverage to adequately protect your assets but you also want to choose a deductible that you can afford to pay out of pocket if you have an accident.

Finding the Best Auto Insurance Rates Tips and Strategies

Finding the best auto insurance rates requires some research and comparison shopping. Here are some tips to help you find the best deal:

Shop Around Comparing Quotes from Multiple Insurers

The best way to find the best auto insurance rates is to shop around and compare quotes from multiple insurers. Get quotes from at least three or four different companies and compare their coverage options and prices.

You can get quotes online by phone or through an independent insurance agent.

Bundling Policies Combining Home and Auto Insurance for Savings

Many insurance companies offer discounts if you bundle your auto insurance with other policies such as homeowners insurance or renters insurance. Bundling your policies can save you a significant amount of money on your insurance premiums.

Ask your insurance company about bundling discounts when you get a quote.

Increasing Your Deductible Lowering Premiums with Higher Out-of-Pocket Costs

Increasing your deductible can lower your auto insurance premiums. However it also means you’ll have to pay more out of pocket if you have an accident.

Consider increasing your deductible if you can afford to pay a higher amount out of pocket in case of an accident.

Taking Advantage of Discounts Exploring Potential Savings Opportunities

Insurance companies offer a variety of discounts that can help you save money on your auto insurance premiums. Some common discounts include:

- Safe driver discount: For drivers with a clean driving record.

- Good student discount: For students with good grades.

- Multi-car discount: For households with multiple vehicles insured with the same company.

- Low mileage discount: For drivers who drive fewer miles per year.

- Anti-theft device discount: For vehicles equipped with anti-theft devices.

- Defensive driving course discount: For drivers who complete a defensive driving course.

Ask your insurance company about any discounts you may be eligible for.

Improving Your Credit Score How Credit Impacts Insurance Rates

In some states your credit score can affect your auto insurance rates. Drivers with good credit scores typically pay lower premiums than drivers with poor credit scores.

If you have poor credit improving your credit score can help you save money on your auto insurance.

Specific Product Recommendations and Use Cases

Now let's delve into some specific auto insurance products and how they might benefit you.

Progressive Snapshot Usage-Based Insurance for Safe Drivers

Product: Progressive Snapshot

Description: Progressive Snapshot is a usage-based insurance program that tracks your driving habits and rewards safe drivers with lower rates. It uses a small device that plugs into your car to monitor things like hard braking speeding and nighttime driving.

Use Case: If you're a consistently safe driver who avoids risky behaviors like speeding or hard braking Snapshot could help you save a significant amount of money on your auto insurance. It's particularly beneficial for drivers who drive fewer miles or at less risky times of day.

Details: The device tracks your driving for a set period typically six months. After that period Progressive analyzes your data and adjusts your rate accordingly. You can also monitor your driving data online or through the Progressive app.

Pricing: The discount you receive from Snapshot varies depending on your driving habits. Some drivers may save up to 30% or more while others may not see any savings at all. It’s important to note that Snapshot can also increase your rates if you exhibit risky driving behaviors.

State Farm Drive Safe & Save Another Option for Usage-Based Savings

Product: State Farm Drive Safe & Save

Description: Similar to Progressive Snapshot State Farm Drive Safe & Save is a usage-based insurance program that rewards safe driving habits with lower rates. It uses a smartphone app to track your driving behavior.

Use Case: If you’re comfortable with your driving being monitored via an app Drive Safe & Save can be a great way to potentially lower your insurance premiums. It's especially suitable for drivers who are confident in their safe driving habits.

Details: The app tracks things like speeding hard braking acceleration and cornering. It also monitors your phone usage while driving. You can view your driving data in the app and see how your driving habits are affecting your potential discount.

Pricing: State Farm claims that drivers can save up to 50% on their auto insurance premiums with Drive Safe & Save. However the actual savings will vary depending on your driving habits.

GEICO DriveEasy Rewards for Safe Driving with an App

Product: GEICO DriveEasy

Description: GEICO DriveEasy is another app-based usage-based insurance program designed to reward safe drivers. It monitors your driving habits and provides feedback to help you improve your driving skills.

Use Case: DriveEasy is a good option for drivers who want to actively improve their driving habits and potentially save money on their insurance. The app provides personalized feedback and tips to help you become a safer driver.

Details: The app tracks your speed acceleration braking cornering and phone usage while driving. It also provides a driving score based on your performance. You can use the app to track your progress and see how your driving score is improving.

Pricing: GEICO doesn’t specify a maximum savings amount for DriveEasy. The discount you receive will depend on your driving habits and your driving score.

Liberty Mutual RightTrack Personalized Insurance Based on Your Driving

Product: Liberty Mutual RightTrack

Description: Liberty Mutual RightTrack is a personalized insurance program that uses either a plug-in device or a mobile app to monitor your driving habits. It adjusts your rate based on your actual driving performance.

Use Case: RightTrack is suitable for drivers who believe their driving habits are safer than average and who are comfortable sharing their driving data with Liberty Mutual. It can be a good way to potentially lower your premiums if you're a safe driver.

Details: The program monitors your mileage hard braking hard acceleration and nighttime driving. You typically use the device or app for a set period such as 90 days.

Pricing: Liberty Mutual states that participants can save between 5% and 30% on their auto insurance premiums with RightTrack. They also guarantee that your rate won’t increase based on your driving data.

Product Comparison Choosing the Right Option for You

Choosing the right usage-based insurance program depends on your individual needs and preferences. Here's a comparison of the products mentioned above:

| Product | Tracking Method | Potential Savings | Key Features | Considerations |

|---|---|---|---|---|

| Progressive Snapshot | Plug-in Device | Up to 30% or more | Tracks hard braking speeding and nighttime driving. Can increase rates based on risky driving. | Requires a plug-in device. Not available in all states. |

| State Farm Drive Safe & Save | Mobile App | Up to 50% | Tracks speeding hard braking acceleration cornering and phone usage. | Requires a smartphone and app usage. Potential privacy concerns. |

| GEICO DriveEasy | Mobile App | Unspecified | Tracks speed acceleration braking cornering and phone usage. Provides personalized feedback. | Requires a smartphone and app usage. Discount amount not guaranteed. |

| Liberty Mutual RightTrack | Plug-in Device or Mobile App | 5% to 30% | Tracks mileage hard braking hard acceleration and nighttime driving. Rate won't increase based on driving data. | Requires a plug-in device or app usage. Savings range is limited. |

When choosing a usage-based insurance program consider the following:

- Tracking method: Are you comfortable with a plug-in device or do you prefer a mobile app?

- Potential savings: How much can you potentially save?

- Key features: Does the program offer features that are important to you such as personalized feedback or the ability to track your progress?

- Considerations: Are there any potential drawbacks to the program such as the possibility of increased rates or privacy concerns?

Detailed Information and Pricing Considerations

It's crucial to remember that pricing and availability of these programs can vary by state and individual circumstances. Always check with the insurance provider directly for the most up-to-date information.

Pricing Models Understanding the Costs

The pricing for usage-based insurance programs is complex and depends on several factors including:

- Base rate: Your base insurance rate is determined by factors such as your driving history age vehicle type and location.

- Driving habits: Your driving habits are tracked by the device or app and used to adjust your rate.

- Discount/surcharge: Based on your driving habits you may receive a discount or a surcharge on your base rate.

It's important to understand how your driving habits will affect your rate before enrolling in a usage-based insurance program.

Hidden Fees and Potential Rate Increases Awareness Is Key

While usage-based insurance programs can offer potential savings it's important to be aware of any potential hidden fees or rate increases.

- Device fees: Some programs may charge a fee for the plug-in device.

- Data usage: Using a mobile app to track your driving may consume data on your smartphone plan.

- Rate increases: Some programs may increase your rates if you exhibit risky driving behaviors.

Read the terms and conditions carefully before enrolling in a usage-based insurance program to understand any potential fees or rate increases.

Availability by State Checking for Coverage in Your Area

Not all usage-based insurance programs are available in all states. Check with the insurance provider to see if the program is available in your area.

You can typically find this information on the insurance provider's website or by contacting their customer service department.

The Future of Auto Insurance Technology and Trends

The auto insurance industry is constantly evolving with new technologies and trends emerging all the time. Here are some of the key trends shaping the future of auto insurance:

Autonomous Vehicles The Impact of Self-Driving Cars on Insurance

The development of autonomous vehicles is poised to revolutionize the auto insurance industry. As cars become more self-driving the risk of accidents is expected to decrease which could lead to lower insurance rates.

However the rise of autonomous vehicles also raises new questions about liability. Who is responsible if a self-driving car causes an accident? The car manufacturer the software developer or the owner?

Telematics and Data Analytics Personalized Insurance Through Data

Telematics and data analytics are playing an increasingly important role in the auto insurance industry. Insurance companies are using data from telematics devices and mobile apps to better understand drivers' behavior and to personalize insurance rates.

This trend is likely to continue as insurance companies seek to more accurately assess risk and offer more competitive rates.

Cybersecurity and Data Privacy Protecting Your Information

As auto insurance companies collect more and more data about drivers cybersecurity and data privacy are becoming increasingly important. Insurance companies need to protect this data from hackers and ensure that it is used responsibly.

Consumers also need to be aware of the potential privacy risks associated with sharing their driving data with insurance companies.

Making Informed Decisions About Auto Insurance

Choosing the right auto insurance policy can be a complex process but it's important to take the time to understand your options and make an informed decision. By understanding the different types of coverage the factors that affect your rates and the available discounts you can find a policy that provides the protection you need at a price you can afford.

Remember to shop around compare quotes and read the fine print before making a decision. And don't hesitate to ask questions if you're unsure about anything.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)