Travel Insurance Scams_ How to Protect Yourself

Understanding the Importance of Travel Insurance Coverage

Traveling the world is an exciting prospect, filled with new experiences, cultures, and memories waiting to be made. However, unexpected events can occur, turning your dream vacation into a stressful ordeal. This is where travel insurance steps in, acting as a safety net that protects you financially and provides assistance when you need it most.

Travel insurance isn't just an optional add-on; it's a crucial component of responsible travel planning. It can cover a wide range of potential issues, from medical emergencies and trip cancellations to lost luggage and travel delays. Without it, you could be facing substantial out-of-pocket expenses that can quickly drain your savings.

Comprehensive Travel Insurance Plans Explained

The world of travel insurance can seem complex, with a variety of plans offering different levels of coverage. Understanding the key components of a comprehensive travel insurance plan is essential to choosing the right policy for your needs.

Here's a breakdown of common coverages:

* **Trip Cancellation Coverage:** Reimburses you for non-refundable trip costs if you have to cancel your trip due to a covered reason, such as illness, injury, or a family emergency. * **Trip Interruption Coverage:** Covers expenses if your trip is interrupted after it has begun, such as if you need to return home early due to a covered reason. * **Medical Expense Coverage:** Pays for medical expenses incurred while traveling, including doctor visits, hospital stays, and emergency medical transportation. * **Emergency Medical Evacuation Coverage:** Covers the cost of transporting you to a suitable medical facility if you experience a medical emergency in a remote or underserved area. * **Baggage Loss and Delay Coverage:** Reimburses you for lost, stolen, or damaged luggage, and provides coverage for essential items if your luggage is delayed. * **Travel Delay Coverage:** Covers expenses incurred due to travel delays, such as meals, accommodation, and transportation. * **Accidental Death and Dismemberment Coverage:** Provides a lump-sum payment in the event of accidental death or dismemberment during your trip.Choosing the Right Travel Insurance Policy For Your Trip

Selecting the right travel insurance policy involves careful consideration of your individual needs and travel plans. Here are some factors to consider:

* **Destination:** The cost of medical care and the risk of certain events can vary significantly depending on your destination. * **Trip Duration:** Longer trips typically require more comprehensive coverage. * **Activities:** If you plan to participate in adventurous activities, such as skiing, scuba diving, or rock climbing, you may need to add extra coverage. * **Pre-existing Medical Conditions:** Some policies may exclude coverage for pre-existing medical conditions, so it's important to disclose any relevant information. * **Budget:** Travel insurance premiums can vary depending on the level of coverage and the provider.Travel Insurance For Pre Existing Medical Conditions Coverage

Traveling with pre-existing medical conditions requires careful planning, and travel insurance is an essential part of that process. Many standard travel insurance policies exclude or limit coverage for pre-existing conditions, which can leave you vulnerable to significant financial risks if you experience a medical issue while traveling.

However, there are specialized travel insurance policies designed to cover pre-existing conditions. These policies may require you to provide information about your medical history and may have higher premiums, but they can provide peace of mind knowing that you're protected.

When looking for travel insurance for pre-existing conditions, be sure to:

* **Disclose all relevant medical information:** Failure to disclose pre-existing conditions can void your policy. * **Compare policies carefully:** Look for policies that specifically cover your pre-existing conditions. * **Read the fine print:** Understand the exclusions and limitations of the policy.Best Travel Insurance Companies Product Recommendations

Choosing the right travel insurance company can be overwhelming, given the numerous options available. Here are a few reputable companies known for their comprehensive coverage and excellent customer service:

* **Allianz Global Assistance:** Offers a wide range of travel insurance plans, including single-trip, multi-trip, and annual policies. They are known for their 24/7 customer support and their comprehensive coverage options. * **World Nomads:** Caters to adventurous travelers and offers policies that cover a wide range of activities, including extreme sports. They also offer flexible policies that can be extended or modified while you're traveling. * **Travel Guard:** A well-established travel insurance provider with a variety of plans to suit different needs and budgets. They offer comprehensive coverage and 24/7 assistance. * **Seven Corners:** Specializes in travel insurance for international travelers, including students, missionaries, and business travelers. They offer a range of plans with customizable coverage options.Travel Insurance Product Comparisons Detailed Information

To help you make an informed decision, let's compare some of the key features and benefits of different travel insurance policies:

| Feature | Allianz Global Assistance | World Nomads | Travel Guard | Seven Corners | | ----------------------- | ------------------------- | ------------- | ------------ | ------------- | | Trip Cancellation | Yes | Yes | Yes | Yes | | Trip Interruption | Yes | Yes | Yes | Yes | | Medical Expenses | Yes | Yes | Yes | Yes | | Medical Evacuation | Yes | Yes | Yes | Yes | | Baggage Loss | Yes | Yes | Yes | Yes | | Travel Delay | Yes | Yes | Yes | Yes | | Pre-existing Conditions | May require rider | Limited | May require rider | May require rider | | Adventure Activities | Limited | Yes | Limited | Limited | | 24/7 Assistance | Yes | Yes | Yes | Yes |**Allianz Global Assistance:** Offers a variety of plans with customizable coverage options. Their plans are generally more comprehensive than World Nomads, but they may be more expensive. Allianz offers different tiers of coverage, ranging from basic to comprehensive, allowing you to choose the level of protection that best suits your needs. Their customer service is highly rated, and they have a user-friendly online platform for managing your policy.

**World Nomads:** Is a great option for adventurous travelers who need coverage for a wide range of activities. Their policies are more flexible than Allianz, and they can be extended or modified while you're traveling. World Nomads focuses on providing coverage for activities like hiking, scuba diving, and skiing, which may be excluded from standard travel insurance policies. Their online platform is easy to use, and they offer 24/7 assistance.

**Travel Guard:** Is a well-established provider with a variety of plans to suit different needs and budgets. They offer comprehensive coverage and 24/7 assistance. Travel Guard offers a range of plans, from basic to comprehensive, and they have options for single-trip, multi-trip, and annual coverage. They are known for their reliable customer service and their extensive network of medical providers.

**Seven Corners:** Specializes in travel insurance for international travelers, including students, missionaries, and business travelers. They offer a range of plans with customizable coverage options. Seven Corners focuses on providing affordable and comprehensive coverage for travelers who are spending extended periods of time abroad. They offer plans that are specifically designed for students, missionaries, and business travelers, and they have a strong focus on customer service.

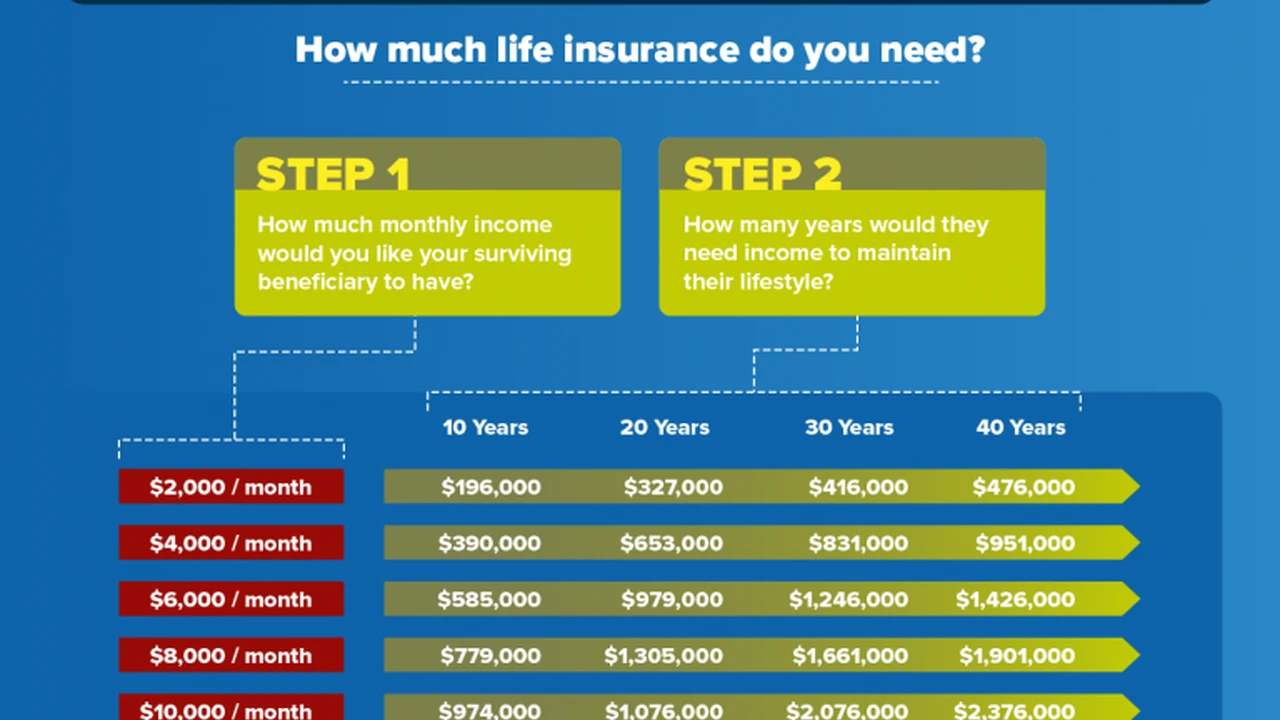

Travel Insurance Pricing Factors and Cost Considerations

The cost of travel insurance can vary depending on several factors, including:

* **Age:** Older travelers typically pay higher premiums due to the increased risk of medical issues. * **Destination:** The cost of medical care and the risk of certain events can vary significantly depending on your destination. Traveling to a remote or high-risk area will likely increase your premium. * **Trip Duration:** Longer trips typically require more comprehensive coverage, which can increase the cost. * **Coverage Level:** More comprehensive policies with higher coverage limits will generally cost more. * **Deductible:** A higher deductible will typically result in a lower premium, but you'll have to pay more out-of-pocket if you file a claim. * **Pre-existing Medical Conditions:** Policies that cover pre-existing medical conditions may have higher premiums.When comparing travel insurance quotes, be sure to consider the following:

* **Coverage Limits:** Make sure the policy provides adequate coverage for medical expenses, trip cancellation, and other potential losses. * **Exclusions:** Understand what is not covered by the policy. * **Deductibles:** Know how much you'll have to pay out-of-pocket if you file a claim. * **Policy Terms and Conditions:** Read the fine print carefully to understand the policy's terms and conditions.Travel Insurance For Specific Travel Types Usage Cases

Travel insurance needs can vary depending on the type of travel you're planning. Here are some specific usage cases:

* **Family Travel:** When traveling with children, it's important to have coverage for medical expenses, trip cancellation, and lost luggage. Look for policies that offer family plans or discounts for children. * **Adventure Travel:** If you're planning to participate in adventurous activities, such as skiing, scuba diving, or rock climbing, you'll need a policy that covers these activities. * **Business Travel:** Business travelers may need coverage for trip cancellation, lost luggage, and medical expenses. Some policies also offer coverage for business equipment and lost documents. * **Cruise Travel:** Cruise travel requires specialized insurance that covers medical emergencies at sea, trip interruption due to weather, and missed port calls. * **Senior Travel:** Seniors may need travel insurance to cover pre-existing medical conditions and medical emergencies. Look for policies that offer coverage for seniors and that have high coverage limits.Travel Insurance Claims Process and Documentation Requirements

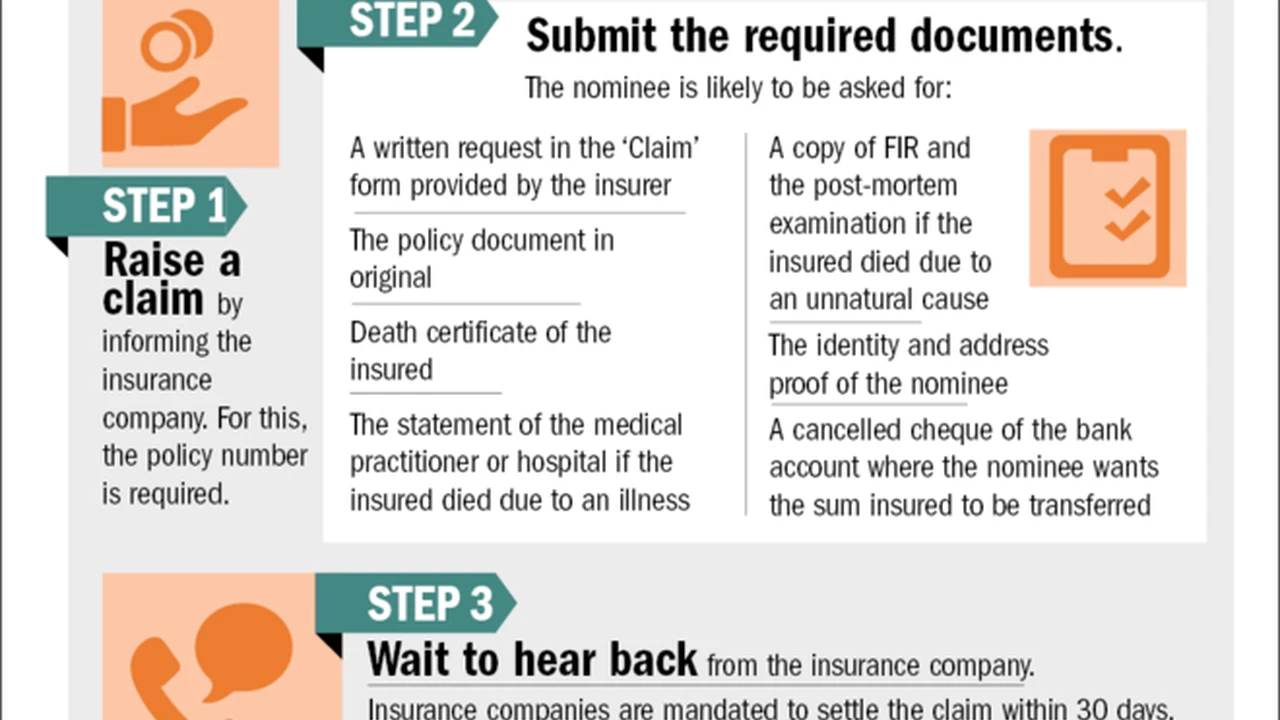

Filing a travel insurance claim can be a straightforward process if you're prepared. Here are the general steps involved:

1. **Notify the insurance company:** Contact the insurance company as soon as possible after the event that caused the loss. 2. **Gather documentation:** Collect all relevant documentation, such as medical bills, receipts, police reports, and travel itineraries. 3. **Complete the claim form:** Fill out the claim form accurately and completely. 4. **Submit the claim:** Submit the claim form and all supporting documentation to the insurance company. 5. **Follow up:** Follow up with the insurance company to check on the status of your claim.Common documentation requirements include:

* **Policy Number:** Your travel insurance policy number. * **Proof of Travel:** Copies of your airline tickets, cruise tickets, or other travel documents. * **Medical Bills:** Original medical bills and receipts. * **Police Report:** If you were a victim of theft or crime, a copy of the police report. * **Receipts:** Receipts for any expenses you incurred as a result of the covered event. * **Travel Itinerary:** Your travel itinerary, showing the dates and locations of your trip.Travel Insurance Exclusions and Limitations To Be Aware Of

It's important to be aware of the exclusions and limitations of your travel insurance policy. Common exclusions include:

* **Pre-existing Medical Conditions:** Many policies exclude coverage for pre-existing medical conditions, unless you purchase a specific rider. * **Acts of War or Terrorism:** Most policies exclude coverage for events caused by acts of war or terrorism. * **Participation in Illegal Activities:** Coverage is typically excluded if you are injured or experience a loss while participating in illegal activities. * **Intoxication:** Injuries or losses sustained while under the influence of alcohol or drugs may not be covered. * **Cosmetic Surgery:** Elective cosmetic surgery is typically not covered. * **Extreme Sports:** Some policies exclude coverage for extreme sports, such as skydiving, rock climbing, and backcountry skiing.Understanding these exclusions and limitations can help you choose the right policy and avoid unexpected surprises if you need to file a claim.

Travel Insurance and Covid 19 Coverage Important Considerations

The COVID-19 pandemic has significantly impacted travel insurance coverage. Many policies now offer coverage for COVID-19 related issues, such as trip cancellation due to illness, medical expenses incurred due to COVID-19, and trip interruption due to quarantine requirements.

However, it's important to check the specific terms and conditions of your policy to understand the extent of coverage. Some policies may exclude coverage for certain COVID-19 related events, such as travel to areas with high infection rates or cancellation due to government travel advisories.

When looking for travel insurance during the pandemic, be sure to:

* **Check for COVID-19 coverage:** Ensure that the policy covers COVID-19 related issues. * **Understand the exclusions:** Be aware of any exclusions related to COVID-19. * **Review the cancellation policy:** Understand the cancellation policy in case you need to cancel your trip due to COVID-19.Tips for Saving Money on Travel Insurance Premiums

While travel insurance is essential, there are ways to save money on premiums:

* **Compare quotes:** Get quotes from multiple insurance companies to find the best price. * **Choose a higher deductible:** A higher deductible will typically result in a lower premium. * **Consider an annual policy:** If you travel frequently, an annual policy may be more cost-effective than purchasing single-trip policies. * **Bundle your insurance:** Some insurance companies offer discounts if you bundle your travel insurance with other types of insurance, such as home or auto insurance. * **Look for discounts:** Some organizations, such as AAA, offer discounts on travel insurance for their members.Travel Insurance Resources and Helpful Websites

Here are some helpful websites and resources for learning more about travel insurance:

* **The U.S. Department of State:** Provides information on travel safety and insurance. * **The Centers for Disease Control and Prevention (CDC):** Offers health information for travelers. * **The World Health Organization (WHO):** Provides global health information. * **Travel Insurance Review Websites:** Sites like InsureMyTrip and Squaremouth allow you to compare quotes and read reviews of different travel insurance policies.Frequently Asked Questions about Travel Insurance

Here are some frequently asked questions about travel insurance:

* **Do I really need travel insurance?** Yes, travel insurance is essential for protecting yourself against unexpected events that can occur while traveling. * **What does travel insurance cover?** Travel insurance can cover a wide range of potential issues, including medical emergencies, trip cancellation, lost luggage, and travel delays. * **How much does travel insurance cost?** The cost of travel insurance can vary depending on several factors, including your age, destination, trip duration, and coverage level. * **How do I file a travel insurance claim?** To file a travel insurance claim, you'll need to notify the insurance company, gather documentation, complete the claim form, and submit the claim. * **What are the exclusions and limitations of travel insurance?** Common exclusions include pre-existing medical conditions, acts of war or terrorism, and participation in illegal activities.Staying Informed and Making Smart Travel Decisions

Travel insurance is a vital component of responsible travel planning. By understanding the different types of coverage available, comparing policies carefully, and knowing the exclusions and limitations, you can choose the right policy for your needs and travel with peace of mind. Remember to stay informed about travel advisories, health recommendations, and any potential risks at your destination. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)