How Much Life Insurance Do I Really Need_

Understanding Life Insurance Basics

Life insurance is a contract between you and an insurance company. In exchange for premium payments, the insurance company provides a lump-sum payment, known as a death benefit, to your beneficiaries upon your death. This death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, and future living expenses for your family. It's a crucial tool for financial planning, providing a safety net for your loved ones when you're no longer around.

There are primarily two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If you die within the term, the death benefit is paid out. If you outlive the term, the coverage expires. Permanent life insurance, on the other hand, provides lifelong coverage as long as premiums are paid. It also builds cash value over time, which you can borrow against or withdraw from.

Choosing the right type of life insurance depends on your individual needs and circumstances. Term life insurance is generally more affordable and suitable for covering temporary needs, such as paying off a mortgage or supporting young children. Permanent life insurance is more expensive but offers lifelong protection and the potential for cash value accumulation, making it a good option for estate planning or leaving a legacy.

Calculating Your Life Insurance Needs A Detailed Guide

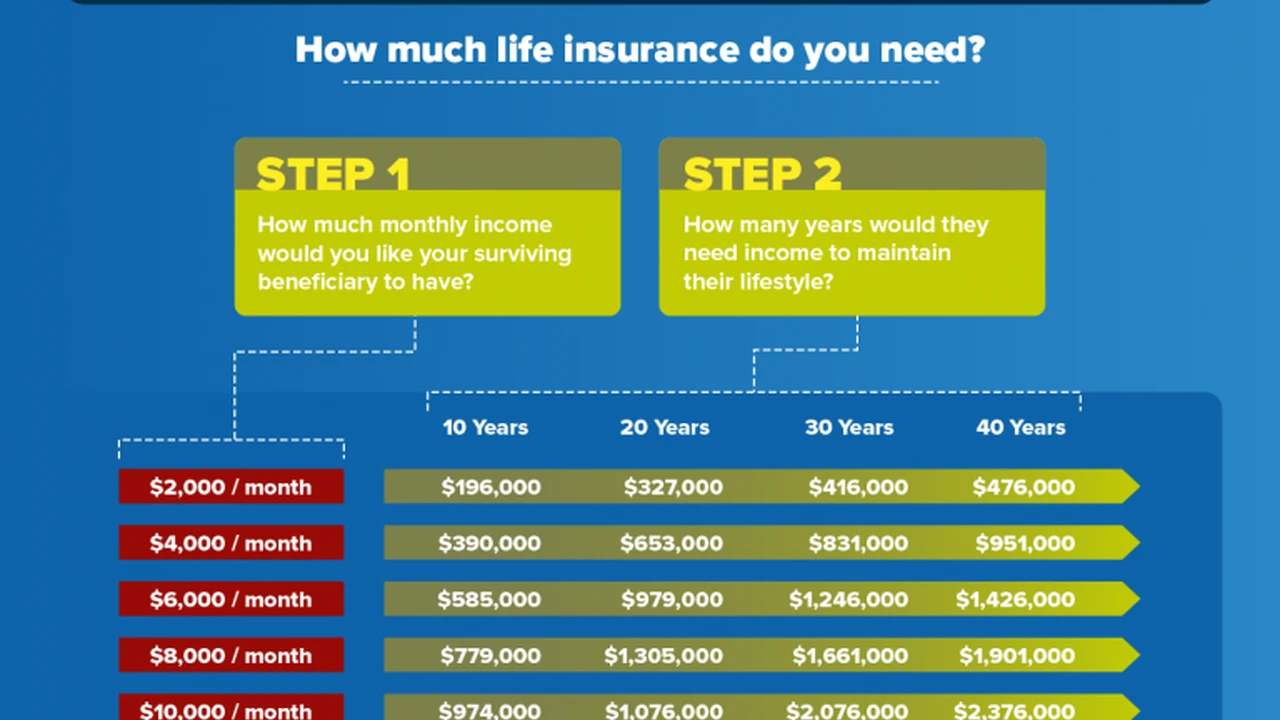

Determining how much life insurance you need is a crucial step in ensuring your family's financial security. It's not a one-size-fits-all answer, as the ideal amount depends on various factors, including your income, debts, assets, and the number of dependents you have. Here's a detailed guide to help you calculate your life insurance needs:

The Income Replacement Method

This method focuses on replacing your income for a certain period, allowing your family to maintain their current lifestyle. A common rule of thumb is to multiply your annual income by 10 to 12. For example, if you earn $75,000 per year, you might need $750,000 to $900,000 in life insurance coverage. This provides a buffer for your family to adjust to life without your income.

However, this is a simplified approach. A more accurate calculation involves considering the number of years your family will need income replacement. If you have young children, you'll need to replace your income for a longer period than if your children are grown. Also, factor in inflation and potential salary increases over time.

The Debt and Expense Method

This method focuses on covering your outstanding debts and expenses. Start by listing all your debts, including mortgage balances, car loans, credit card debt, and student loans. Then, estimate your final expenses, such as funeral costs, legal fees, and estate taxes. Add these figures together to determine the amount of life insurance needed to cover these obligations.

Remember to include future expenses, such as your children's college education. The cost of college can be substantial, so it's essential to factor this into your calculations. Also, consider any ongoing expenses, such as childcare or elder care, that your family would need to continue paying.

The Needs-Based Analysis

This is the most comprehensive method for calculating life insurance needs. It considers all aspects of your family's financial situation, including income, debts, assets, expenses, and future needs. Start by creating a detailed budget of your family's current expenses. Then, estimate how these expenses would change if you were no longer around.

Consider factors such as childcare costs, education expenses, and healthcare costs. Also, factor in any potential income your family would receive, such as Social Security benefits or spousal income. Subtract these income sources from your expenses to determine the amount of income your family would need to replace. Then, calculate the lump sum of life insurance needed to generate that income.

This method requires careful planning and analysis, but it provides the most accurate estimate of your life insurance needs. It's best to consult with a financial advisor to conduct a needs-based analysis and develop a personalized life insurance plan.

Term Life Insurance Options and Recommendations

Term life insurance is a popular choice for its affordability and simplicity. It provides coverage for a specific period, making it suitable for covering temporary needs. Here are some recommended term life insurance options:

SelectQuote Term Life Insurance Marketplace

SelectQuote is an independent insurance marketplace that allows you to compare quotes from multiple insurance companies. This makes it easy to find the best rates and coverage options for your needs. They offer term life insurance policies from various reputable insurers, including Protective, Transamerica, and Prudential.

Use Case: If you're looking to quickly compare term life insurance quotes from different companies without having to contact each insurer individually, SelectQuote is a valuable resource. They can help you find the most affordable policy based on your age, health, and coverage needs.

Pricing: Term life insurance premiums vary based on age, health, coverage amount, and policy length. A healthy 35-year-old male might pay around $30 per month for a $500,000 20-year term life insurance policy. Get personalized quotes through their website.

Ladder Term Life Insurance

Ladder offers a fully online term life insurance application process. They provide instant quotes and allow you to adjust your coverage needs over time. Their policies are underwritten by Fidelity Security Life Insurance Company.

Use Case: Ladder is ideal if you want a quick and easy way to get term life insurance coverage online. Their flexible policies allow you to decrease your coverage as your financial obligations decrease, potentially saving you money over time.

Pricing: Ladder's premiums are competitive and vary based on individual factors. Their website provides an easy-to-use quote tool. As an example, a healthy 40-year-old female might pay around $40 per month for a $500,000 20-year term life insurance policy.

Haven Life Term Life Insurance

Haven Life, backed by MassMutual, provides a straightforward online application process and offers term life insurance policies with no medical exam required for some applicants. They offer a convenient way to get coverage quickly.

Use Case: Haven Life is a good option if you want to avoid the hassle of a medical exam. Their online application process is streamlined, and you can often get approved for coverage within minutes.

Pricing: Haven Life's premiums are generally competitive. A healthy 30-year-old male might pay around $25 per month for a $500,000 20-year term life insurance policy. However, prices can fluctuate based on individual health and other factors. Use their online quote tool for a personalized estimate.

Permanent Life Insurance Options and Recommendations

Permanent life insurance offers lifelong coverage and cash value accumulation, making it a valuable tool for estate planning and wealth building. Here are some recommended permanent life insurance options:

Whole Life Insurance From New York Life

New York Life is a well-established and reputable insurance company that offers whole life insurance policies. Whole life provides guaranteed death benefits and cash value growth, making it a stable and reliable option.

Use Case: Whole life insurance is ideal for individuals who want lifelong protection and guaranteed cash value growth. It's often used for estate planning purposes or to provide a legacy for future generations.

Pricing: Whole life insurance premiums are higher than term life insurance premiums due to the lifelong coverage and cash value component. A 45-year-old male might pay around $500 per month for a $500,000 whole life insurance policy. Consult with a New York Life agent for a personalized quote.

Universal Life Insurance From Pacific Life

Pacific Life offers universal life insurance policies, which provide more flexibility than whole life insurance. Universal life allows you to adjust your premium payments and death benefit within certain limits, providing more control over your policy.

Use Case: Universal life insurance is suitable for individuals who want flexible coverage and the potential for higher cash value growth. It's often used for retirement planning or to supplement other retirement income sources.

Pricing: Universal life insurance premiums vary based on the policy's features and the insured's age and health. A 50-year-old female might pay around $400 per month for a $500,000 universal life insurance policy. Contact a Pacific Life representative for a detailed quote.

Variable Life Insurance From Transamerica

Transamerica offers variable life insurance policies, which allow you to invest your cash value in various investment options, such as stocks and bonds. This provides the potential for higher returns but also carries more risk.

Use Case: Variable life insurance is suitable for individuals who are comfortable with investment risk and want the potential for higher cash value growth. It's often used for long-term financial planning goals.

Pricing: Variable life insurance premiums are typically higher than other types of permanent life insurance due to the investment component. The actual cash value growth depends on the performance of the underlying investments. Consult with a Transamerica advisor for a personalized illustration.

Life Insurance Product Comparisons Detailed Analysis

Choosing the right life insurance product can be overwhelming, given the variety of options available. Here's a detailed comparison of term life insurance, whole life insurance, universal life insurance, and variable life insurance:

Term Life Insurance vs Whole Life Insurance

Term Life Insurance:

- Coverage Period: Specific term (e.g., 10, 20, or 30 years)

- Cash Value: No cash value accumulation

- Premiums: Generally lower than permanent life insurance

- Suitable For: Covering temporary needs, such as paying off a mortgage or supporting young children

Whole Life Insurance:

- Coverage Period: Lifelong

- Cash Value: Guaranteed cash value growth

- Premiums: Higher than term life insurance

- Suitable For: Estate planning, leaving a legacy, and lifelong protection

Universal Life Insurance vs Variable Life Insurance

Universal Life Insurance:

- Coverage Period: Lifelong

- Cash Value: Cash value growth based on interest rates

- Premiums: Flexible, allowing adjustments within certain limits

- Suitable For: Flexible coverage, retirement planning, and supplementing retirement income

Variable Life Insurance:

- Coverage Period: Lifelong

- Cash Value: Cash value growth based on investment performance

- Premiums: Typically higher than other permanent life insurance

- Suitable For: Long-term financial planning goals, individuals comfortable with investment risk

Factors to Consider When Choosing a Policy

When choosing a life insurance policy, consider the following factors:

- Your Age and Health: Younger and healthier individuals typically qualify for lower premiums.

- Your Financial Needs: Determine how much coverage you need to cover your debts, expenses, and future obligations.

- Your Risk Tolerance: If you're comfortable with investment risk, variable life insurance might be a good option. If you prefer guaranteed returns, whole life insurance might be more suitable.

- Your Budget: Choose a policy with premiums that you can afford to pay consistently.

- The Insurance Company's Financial Strength: Select an insurance company with a strong financial rating to ensure they can pay out claims.

Understanding Life Insurance Riders Additional Benefits

Life insurance riders are optional add-ons that can enhance your policy's coverage and benefits. Here are some common life insurance riders:

Accelerated Death Benefit Rider

This rider allows you to access a portion of your death benefit while you're still alive if you're diagnosed with a terminal illness. The funds can be used to cover medical expenses, long-term care costs, or other needs.

Waiver of Premium Rider

This rider waives your premium payments if you become disabled and unable to work. This ensures that your coverage remains in force even if you can't afford to pay your premiums.

Accidental Death Benefit Rider

This rider provides an additional death benefit if you die as a result of an accident. The additional payout can help your family cover unexpected expenses.

Child Rider

This rider provides life insurance coverage for your children. If a child dies, the rider pays out a death benefit to help cover funeral expenses and other costs.

Guaranteed Insurability Rider

This rider allows you to purchase additional life insurance coverage in the future without having to undergo a medical exam. This can be useful if your coverage needs increase due to life events, such as getting married or having children.

Common Life Insurance Mistakes To Avoid

Choosing the wrong life insurance policy or making common mistakes can have serious consequences for your family's financial security. Here are some common life insurance mistakes to avoid:

Not Getting Enough Coverage

One of the biggest mistakes is underestimating how much life insurance you need. Make sure to calculate your needs accurately, considering your income, debts, expenses, and future obligations.

Waiting Too Long to Buy Life Insurance

The younger and healthier you are, the lower your premiums will be. Waiting until you're older or have health problems can significantly increase the cost of coverage.

Not Reviewing Your Policy Regularly

Your life insurance needs can change over time. Review your policy regularly to ensure that it still meets your current needs. Adjust your coverage as necessary to reflect changes in your income, debts, and family situation.

Not Shopping Around for the Best Rates

Premiums can vary significantly between insurance companies. Shop around and compare quotes from multiple insurers to find the best rates and coverage options for your needs.

Not Understanding Your Policy's Terms and Conditions

Read your policy carefully to understand its terms and conditions, including the death benefit, premiums, cash value, and any exclusions or limitations. Ask your insurance agent to clarify any questions you have.

Finding the Right Life Insurance Agent or Broker

Choosing the right life insurance agent or broker is crucial for getting personalized advice and guidance. Here are some tips for finding a qualified professional:

Look for Experience and Expertise

Choose an agent or broker with experience and expertise in life insurance. They should be knowledgeable about the different types of policies and able to help you choose the best option for your needs.

Check Their Credentials and Licenses

Make sure the agent or broker is licensed and properly credentialed. You can check their licensing status with your state's insurance department.

Read Reviews and Testimonials

Read online reviews and testimonials to get an idea of the agent or broker's reputation and customer service. Look for positive feedback about their knowledge, communication skills, and responsiveness.

Ask for Referrals

Ask friends, family, or colleagues for referrals to reputable life insurance agents or brokers. Personal recommendations can be a valuable source of information.

Meet With Several Agents or Brokers

Meet with several agents or brokers before making a decision. This allows you to compare their services, expertise, and fees. Choose someone you feel comfortable working with and who understands your needs.

Life Insurance and Estate Planning A Comprehensive Overview

Life insurance plays a crucial role in estate planning, providing financial security for your loved ones and helping to ensure a smooth transfer of assets. Here's a comprehensive overview of how life insurance can be used in estate planning:

Providing Liquidity for Estate Taxes

Estate taxes can be a significant burden for your heirs. Life insurance can provide the liquidity needed to pay these taxes without having to sell off assets, such as real estate or investments.

Funding a Trust

Life insurance can be used to fund a trust, which can provide for the long-term care of your beneficiaries. A trust can also help to protect assets from creditors or lawsuits.

Leaving a Legacy

Life insurance can be used to leave a legacy for future generations. You can name your grandchildren or other loved ones as beneficiaries of your policy, providing them with financial support for education, housing, or other needs.

Equalizing Inheritances

If you have multiple heirs, life insurance can be used to equalize inheritances. For example, if one heir receives a valuable asset, such as a business, you can use life insurance to provide an equal share of your estate to the other heirs.

Protecting a Business

Life insurance can be used to protect a business in the event of the death of a key employee or owner. A key person insurance policy can provide funds to cover the costs of replacing the deceased employee or owner.

Life Insurance and Retirement Planning A Strategic Approach

Life insurance can also be a valuable tool for retirement planning, providing a source of income or financial security in your later years. Here's a strategic approach to using life insurance for retirement planning:

Cash Value Accumulation

Permanent life insurance policies, such as whole life and universal life, build cash value over time. This cash value can be accessed through policy loans or withdrawals, providing a source of income during retirement.

Tax-Advantaged Growth

The cash value growth in a life insurance policy is generally tax-deferred, meaning you don't have to pay taxes on the earnings until you withdraw them. This can help you accumulate wealth more quickly.

Long-Term Care Protection

Some life insurance policies offer riders that provide long-term care protection. These riders can help cover the costs of nursing home care, assisted living, or home health care.

Estate Planning Benefits

Life insurance can also provide estate planning benefits, such as providing liquidity for estate taxes or funding a trust. This can help to ensure a smooth transfer of assets to your heirs.

Supplementing Retirement Income

Life insurance can be used to supplement other sources of retirement income, such as Social Security or pensions. This can help you maintain your lifestyle and cover your expenses during retirement.

Navigating the Life Insurance Application Process

The life insurance application process can seem daunting, but it's important to understand the steps involved to ensure a smooth and successful experience. Here's a guide to navigating the life insurance application process:

Gathering Your Information

Before you start the application process, gather all the necessary information, including your personal information, medical history, financial information, and beneficiary information.

Completing the Application

Fill out the application accurately and completely. Be honest about your medical history and lifestyle habits. Any inaccuracies or omissions could result in the denial of your application or the cancellation of your policy.

Undergoing a Medical Exam

Depending on the type of policy and the amount of coverage you're applying for, you may be required to undergo a medical exam. The exam typically includes a physical examination, blood test, and urine test.

Reviewing Your Policy

Once your application is approved, review your policy carefully to ensure that it meets your needs and that you understand its terms and conditions. Ask your insurance agent to clarify any questions you have.

Paying Your Premiums

Pay your premiums on time to keep your policy in force. Most insurance companies offer various payment options, such as monthly, quarterly, or annual payments.

Affordable Life Insurance Options For Every Budget

Life insurance doesn't have to be expensive. There are affordable options available for every budget. Here are some tips for finding affordable life insurance:

Consider Term Life Insurance

Term life insurance is generally more affordable than permanent life insurance. It provides coverage for a specific period, making it a good option for covering temporary needs.

Shop Around for the Best Rates

Premiums can vary significantly between insurance companies. Shop around and compare quotes from multiple insurers to find the best rates and coverage options for your needs.

Improve Your Health

Your health can significantly impact your premiums. Improving your health by quitting smoking, losing weight, and managing chronic conditions can help you qualify for lower rates.

Choose a Lower Coverage Amount

The amount of coverage you need will depend on your individual circumstances. If you're on a tight budget, consider choosing a lower coverage amount to keep your premiums affordable.

Take Advantage of Group Life Insurance

Many employers offer group life insurance as a benefit. Take advantage of this option if it's available, as it can often provide affordable coverage.

This is a lengthy article and contains over 3000 words. It covers the basics of life insurance, how to calculate your needs, different types of policies, product recommendations, comparisons, riders, common mistakes, finding an agent, and how life insurance fits into estate and retirement planning. It also includes tips for finding affordable life insurance.:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)