Homeowners Insurance Scams_ How to Protect Yourself

Homeowners insurance its not exactly the most thrilling topic is it But trust me understanding it is absolutely crucial for protecting your biggest asset your home Think of it as your financial safety net against the unexpected the things you hope will never happen but need to be prepared for

Understanding the Basics of Homeowners Insurance

So what exactly does homeowners insurance cover At its core it protects your home and its contents from a wide range of perils Think of things like fire theft vandalism and even certain natural disasters like windstorms and hail

There are typically four main types of coverage included in a standard homeowners insurance policy:

- Dwelling Coverage: This covers the physical structure of your home including the walls roof floors and attached structures like a garage. It's designed to help you rebuild or repair your home if it's damaged by a covered peril.

- Personal Property Coverage: This covers your belongings inside the home such as furniture clothing electronics and appliances. It can even cover items stored in a detached garage or shed.

- Liability Coverage: This protects you if someone is injured on your property or if you accidentally damage someone else's property. It can help cover medical expenses legal fees and even settlements if you're sued.

- Additional Living Expenses (ALE) Coverage: Also known as loss of use coverage this helps pay for temporary housing and living expenses if you're unable to live in your home due to a covered loss. This can include hotel bills restaurant meals and other necessary expenses.

Its important to understand that homeowners insurance policies typically have exclusions meaning they dont cover everything Common exclusions include damage from floods earthquakes landslides and wear and tear

Choosing the Right Homeowners Insurance Policy Key Considerations

Selecting the right homeowners insurance policy can feel overwhelming but breaking it down into manageable steps makes the process much easier Here are some key considerations to keep in mind:

Determining Your Coverage Needs An In Depth Look

The first step is to determine how much coverage you actually need This involves assessing the value of your home and your personal belongings

- Dwelling Coverage: To determine the amount of dwelling coverage you need its best to get a professional appraisal or estimate the cost to rebuild your home from scratch Consider factors like the size of your home the materials used in construction and local labor costs. Dont just rely on the market value of your home as rebuilding costs can differ significantly

- Personal Property Coverage: Take an inventory of your belongings and estimate their value You can use a home inventory app or simply create a spreadsheet with descriptions photos and estimated values Consider purchasing replacement cost coverage which will pay to replace your belongings with new items rather than their depreciated value

- Liability Coverage: Determine how much liability coverage you need based on your assets and risk tolerance A good rule of thumb is to choose enough coverage to protect your assets in case you're sued.

- Additional Living Expenses (ALE) Coverage: Consider how much it would cost to live elsewhere if your home were uninhabitable for an extended period Estimate the cost of hotel bills restaurant meals and other necessary expenses.

Understanding Different Types of Homeowners Insurance Policies

Homeowners insurance policies come in various forms each offering different levels of coverage Here are some common types:

- HO-1 (Basic Form): This is the most basic type of homeowners insurance policy and covers a limited number of perils. It's typically not recommended as it offers minimal protection.

- HO-2 (Broad Form): This policy covers a wider range of perils than HO-1 including things like falling objects weight of snow ice or sleet and accidental discharge of water or steam.

- HO-3 (Special Form): This is the most common type of homeowners insurance policy and provides the broadest coverage. It covers all perils except those specifically excluded in the policy.

- HO-5 (Comprehensive Form): This is the most comprehensive type of homeowners insurance policy and offers the highest level of protection. It covers all perils except those specifically excluded in the policy and also provides replacement cost coverage for personal property.

- HO-6 (Condo Form): This policy is designed for condo owners and covers the interior of their unit as well as personal property. It typically doesn't cover the building structure which is usually covered by the condo association's master policy.

- HO-8 (Modified Coverage Form): This policy is designed for older homes where the replacement cost exceeds the market value. It typically covers fewer perils than other policies and uses actual cash value to determine payouts.

The Importance of Homeowners Insurance Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in Choosing a higher deductible can lower your premium but it also means you'll have to pay more if you file a claim

Consider your financial situation and risk tolerance when choosing a deductible If you can afford to pay a higher deductible you can save money on your premium However if you're on a tight budget you may prefer a lower deductible even if it means paying a higher premium

Shopping Around for the Best Homeowners Insurance Rates

Dont just settle for the first quote you receive Shop around and compare rates from multiple insurance companies to find the best deal You can use online comparison tools or work with an independent insurance agent who can help you find the right policy at the right price

When comparing quotes be sure to compare the same coverage levels and deductibles Also pay attention to the policy terms and conditions to ensure you understand what's covered and what's not

Homeowners Insurance Companies Product Recommendations and Comparisons

Navigating the world of homeowners insurance companies can be daunting so lets break down some popular options and their offerings

State Farm Homeowners Insurance Detailed Review

State Farm is one of the largest and most well known homeowners insurance companies in the United States They offer a wide range of coverage options and are known for their excellent customer service

State Farm Homeowners Insurance Coverage Options

- Dwelling Coverage: State Farm offers comprehensive dwelling coverage to protect your home from a variety of perils.

- Personal Property Coverage: They offer replacement cost coverage for personal property ensuring you can replace your belongings with new items.

- Liability Coverage: State Farm provides robust liability coverage to protect you from lawsuits and other financial liabilities.

- Additional Living Expenses (ALE) Coverage: Their ALE coverage helps pay for temporary housing and living expenses if your home is uninhabitable.

State Farm Homeowners Insurance Pricing and Discounts

State Farm's pricing is generally competitive although it can vary depending on factors like your location the age of your home and your claims history They offer a variety of discounts including:

- Multi Policy Discount: Save money by bundling your homeowners and auto insurance policies with State Farm.

- Home Alert Protection Discount: Get a discount if you have a home security system fire alarm or other protective devices.

- New Home Discount: Save money if you're insuring a newly built home.

State Farm Homeowners Insurance Pros and Cons

Pros:

- Excellent customer service

- Wide range of coverage options

- Competitive pricing

- Variety of discounts

Cons:

- May not be the cheapest option for everyone

- Online quoting process can be cumbersome

Allstate Homeowners Insurance In Depth Analysis

Allstate is another major player in the homeowners insurance market They offer a wide range of coverage options and are known for their innovative technology and customer service

Allstate Homeowners Insurance Coverage Options

- Dwelling Coverage: Allstate offers comprehensive dwelling coverage with options for extended replacement cost coverage.

- Personal Property Coverage: They offer replacement cost coverage for personal property with options for scheduled personal property coverage for valuable items.

- Liability Coverage: Allstate provides robust liability coverage with options for umbrella policies for additional protection.

- Additional Living Expenses (ALE) Coverage: Their ALE coverage helps pay for temporary housing and living expenses with options for increased limits.

Allstate Homeowners Insurance Pricing and Discounts

Allstate's pricing is generally competitive and they offer a variety of discounts including:

- Multi Policy Discount: Save money by bundling your homeowners and auto insurance policies with Allstate.

- Claim Free Discount: Get a discount if you haven't filed a claim in a certain period of time.

- Early Signing Discount: Save money by signing up for a policy before your current policy expires.

Allstate Homeowners Insurance Pros and Cons

Pros:

- Innovative technology and customer service

- Wide range of coverage options

- Competitive pricing

- Variety of discounts

Cons:

- Claims process can be slow at times

- May not be the best option for those with a history of claims

Progressive Homeowners Insurance Unveiled

Progressive is best known for its auto insurance but they also offer homeowners insurance through a network of partner companies This allows them to offer a wider range of options and competitive pricing

Progressive Homeowners Insurance Coverage Options

Progressive's homeowners insurance coverage options vary depending on the partner company providing the policy However they generally offer:

- Dwelling Coverage: Comprehensive dwelling coverage to protect your home from a variety of perils.

- Personal Property Coverage: Replacement cost coverage for personal property.

- Liability Coverage: Robust liability coverage.

- Additional Living Expenses (ALE) Coverage: ALE coverage to help pay for temporary housing and living expenses.

Progressive Homeowners Insurance Pricing and Discounts

Progressive's pricing is generally competitive due to their network of partner companies They offer a variety of discounts including:

- Multi Policy Discount: Save money by bundling your homeowners and auto insurance policies with Progressive.

- Quote Online Discount: Get a discount for getting a quote online.

- New Purchase Discount: Save money if you're buying a new home.

Progressive Homeowners Insurance Pros and Cons

Pros:

- Competitive pricing

- Wide range of options through partner companies

- Easy online quoting process

- Variety of discounts

Cons:

- Customer service can vary depending on the partner company

- May not be the best option for those who prefer to work directly with a single insurance company

Liberty Mutual Homeowners Insurance Detailed Examination

Liberty Mutual is a global insurance company that offers a wide range of products including homeowners insurance They are known for their financial stability and commitment to customer service

Liberty Mutual Homeowners Insurance Coverage Options

- Dwelling Coverage: Liberty Mutual offers comprehensive dwelling coverage with options for inflation protection.

- Personal Property Coverage: They offer replacement cost coverage for personal property with options for blanket coverage for valuable items.

- Liability Coverage: Liberty Mutual provides robust liability coverage with options for personal umbrella policies.

- Additional Living Expenses (ALE) Coverage: Their ALE coverage helps pay for temporary housing and living expenses with options for unlimited ALE coverage in some cases.

Liberty Mutual Homeowners Insurance Pricing and Discounts

Liberty Mutual's pricing is generally competitive and they offer a variety of discounts including:

- Multi Policy Discount: Save money by bundling your homeowners and auto insurance policies with Liberty Mutual.

- Early Shopper Discount: Get a discount for getting a quote before your current policy expires.

- Preferred Payment Discount: Save money by paying your premium in full.

Liberty Mutual Homeowners Insurance Pros and Cons

Pros:

- Financial stability and commitment to customer service

- Wide range of coverage options

- Competitive pricing

- Variety of discounts

Cons:

- Claims process can be slow at times

- May not be the best option for those with a history of frequent claims

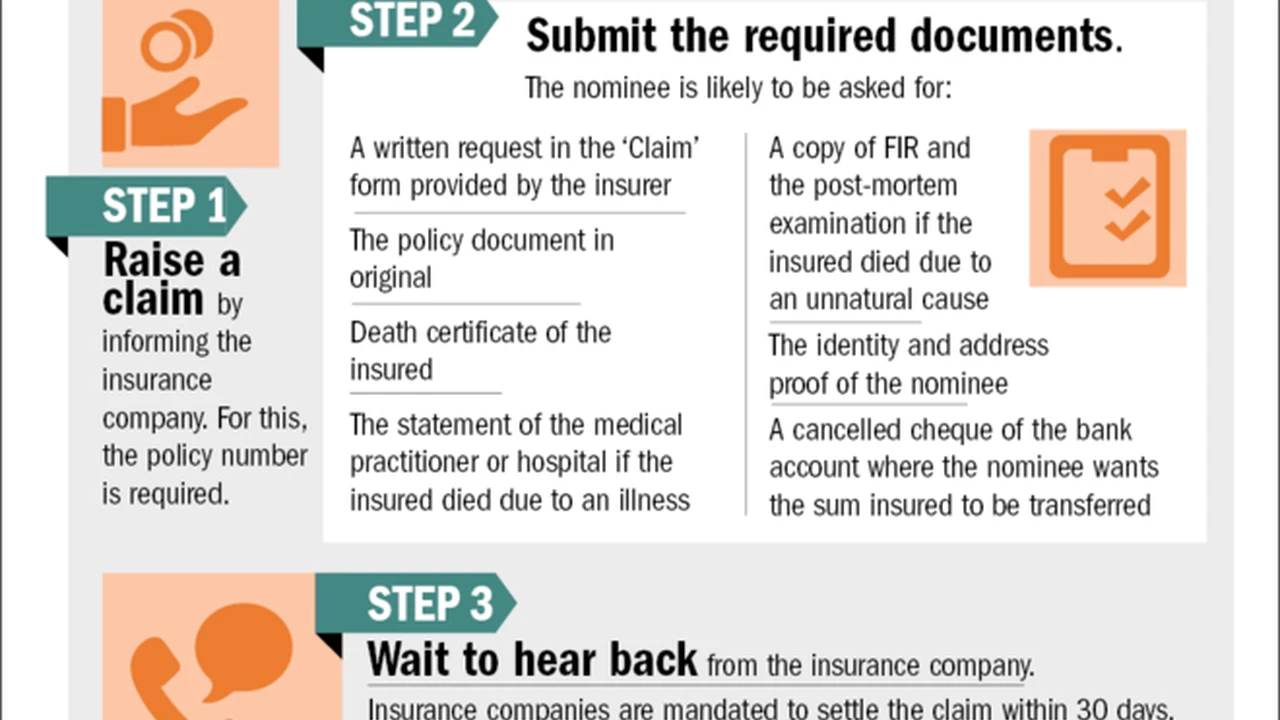

Homeowners Insurance Claims Process A Step by Step Guide

Filing a homeowners insurance claim can be stressful but understanding the process can help make it smoother Here's a step by step guide:

Documenting the Damage Thoroughly

The first step is to document the damage as thoroughly as possible Take photos and videos of the damage before you start cleaning up or making repairs This will help you support your claim and provide evidence to the insurance company

Make a list of all damaged items including their description estimated value and date of purchase If possible gather receipts or other documentation to prove ownership and value

Contacting Your Insurance Company Promptly

Contact your insurance company as soon as possible after the damage occurs Report the incident and provide them with as much information as possible including the date time and cause of the damage

Ask the insurance company about their claims process and what documentation they require Get the name and contact information of your claims adjuster

Working with Your Claims Adjuster Effectively

Your claims adjuster will be your main point of contact throughout the claims process Cooperate with them and provide them with all the information they need to process your claim

Schedule a time for the adjuster to inspect the damage to your home Be present during the inspection and point out all the damage you've identified Ask the adjuster any questions you have about the claims process

Understanding Your Settlement Offer

Once the adjuster has assessed the damage they will provide you with a settlement offer Review the offer carefully and make sure it covers all the damage to your home and belongings

If you disagree with the settlement offer you have the right to negotiate with the insurance company Provide them with additional documentation or estimates to support your claim

Making Repairs and Rebuilding Your Home

Once you've accepted the settlement offer you can start making repairs to your home Get multiple estimates from contractors and choose one who is licensed insured and experienced

Keep detailed records of all expenses related to the repairs including invoices receipts and contracts Submit these records to the insurance company for reimbursement

Homeowners Insurance Cost Factors Influencing Your Premium

Several factors influence the cost of your homeowners insurance premium Understanding these factors can help you make informed decisions and potentially lower your costs

Location and Its Impact on Homeowners Insurance Rates

Your location is one of the biggest factors affecting your homeowners insurance rates Homes in areas prone to natural disasters like hurricanes tornadoes or wildfires will typically have higher premiums

Your location also affects your risk of theft and vandalism Homes in high crime areas will typically have higher premiums

Home Age and Construction Materials

The age and construction materials of your home also affect your homeowners insurance rates Older homes and homes built with less durable materials will typically have higher premiums

Insurance companies consider the risk of damage and the cost to repair or rebuild your home when determining your premium

Coverage Amount and Deductible Selection

The amount of coverage you choose and the deductible you select also affect your homeowners insurance rates Higher coverage amounts and lower deductibles will typically result in higher premiums

Its important to choose a coverage amount that is sufficient to rebuild your home and replace your belongings Choose a deductible that you can afford to pay out of pocket if you file a claim

Claims History and Credit Score Considerations

Your claims history and credit score can also affect your homeowners insurance rates If you have a history of filing claims you may pay higher premiums

Insurance companies use credit scores to assess your risk of filing a claim A lower credit score may result in higher premiums

Homeowners Insurance Discounts Maximize Your Savings

Many insurance companies offer discounts that can help you save money on your homeowners insurance premium Here are some common discounts:

Bundling Home and Auto Insurance Policies

Bundling your home and auto insurance policies with the same company is one of the easiest ways to save money Most insurance companies offer a multi policy discount that can save you a significant amount on your premiums

Installing Home Security Systems and Safety Devices

Installing a home security system fire alarm or other safety devices can also qualify you for a discount Insurance companies view these devices as reducing the risk of theft and damage

Maintaining a Claim Free Record

Maintaining a claim free record can also earn you a discount Insurance companies reward customers who have not filed any claims in a certain period of time

Paying Your Premium in Full

Paying your premium in full rather than in monthly installments can also save you money Some insurance companies offer a discount for paying your premium upfront

Homeowners Insurance and Natural Disasters Understanding Coverage

Homeowners insurance typically covers damage from certain natural disasters but not all Its important to understand what is and isnt covered by your policy

Flood Insurance A Separate Policy Requirement

Standard homeowners insurance policies typically do not cover damage from floods If you live in a flood prone area you will need to purchase a separate flood insurance policy from the National Flood Insurance Program (NFIP) or a private insurer

Earthquake Insurance Protecting Against Seismic Activity

Standard homeowners insurance policies also typically do not cover damage from earthquakes If you live in an earthquake prone area you will need to purchase a separate earthquake insurance policy

Windstorm and Hail Damage Coverage Details

Homeowners insurance typically covers damage from windstorms and hail However some policies may have separate deductibles for wind and hail damage These deductibles can be higher than your standard deductible

Wildfire Insurance Mitigating Fire Risks

Homeowners insurance typically covers damage from wildfires However some insurance companies may be hesitant to insure homes in high risk wildfire areas

Homeowners Insurance for Renters Renters Insurance Explained

If you rent your home you dont need homeowners insurance but you do need renters insurance Renters insurance protects your personal belongings from damage or theft

Coverage for Personal Belongings and Liability

Renters insurance typically covers your personal belongings from a variety of perils including fire theft vandalism and water damage It also provides liability coverage if someone is injured in your apartment

Affordable Protection for Renters

Renters insurance is typically very affordable It's a small price to pay for the peace of mind knowing that your belongings are protected

Homeowners Insurance Scams Protecting Yourself from Fraud

Unfortunately homeowners insurance scams are a reality Its important to be aware of these scams and take steps to protect yourself

Recognizing Common Homeowners Insurance Scams

Some common homeowners insurance scams include:

- Phony Insurance Companies: Scammers may pose as legitimate insurance companies and sell fake policies.

- Storm Chasers: These scammers go door to door after a storm offering to make repairs and file a claim on your behalf.

- Inflated Estimates: Some contractors may inflate their estimates in order to collect more money from your insurance company.

Verifying Insurance Company Credentials

Before purchasing a homeowners insurance policy make sure to verify the company's credentials Check with your state's insurance department to make sure the company is licensed and in good standing

Getting Multiple Repair Estimates

Before hiring a contractor to make repairs get multiple estimates from different companies This will help you ensure you're getting a fair price

Being Wary of Unsolicited Offers

Be wary of unsolicited offers from contractors or insurance companies If someone approaches you out of the blue it's likely a scam

Frequently Asked Questions About Homeowners Insurance

Lets tackle some common questions about homeowners insurance

What Does Homeowners Insurance Actually Cover

Homeowners insurance covers a wide range of perils including fire theft vandalism windstorms and hail It typically does not cover damage from floods earthquakes or wear and tear

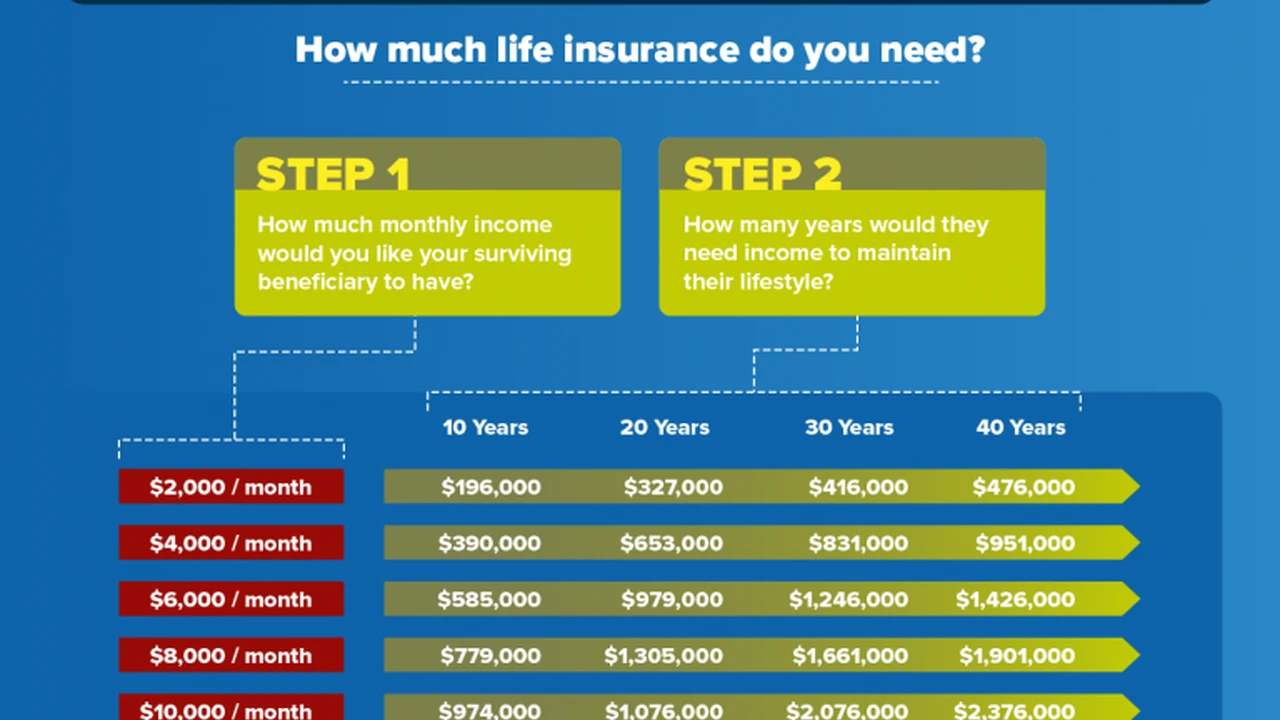

How Much Homeowners Insurance Do I Need

You should choose a coverage amount that is sufficient to rebuild your home and replace your belongings Get a professional appraisal or estimate the cost to rebuild your home from scratch Take an inventory of your belongings and estimate their value

How Can I Lower My Homeowners Insurance Premium

You can lower your homeowners insurance premium by choosing a higher deductible bundling your home and auto insurance policies installing home security systems and maintaining a claim free record

Is Flood Insurance Included in Homeowners Insurance

No flood insurance is not included in standard homeowners insurance policies You will need to purchase a separate flood insurance policy if you live in a flood prone area

What is the Difference Between Replacement Cost and Actual Cash Value

Replacement cost coverage pays to replace your belongings with new items Actual cash value coverage pays the depreciated value of your belongings

The Future of Homeowners Insurance Emerging Trends

The homeowners insurance industry is constantly evolving Here are some emerging trends to watch:

Smart Home Technology and Insurance Discounts

Insurance companies are increasingly offering discounts for homeowners who install smart home technology such as water leak detectors and smart thermostats These devices can help prevent damage and lower the risk of claims

Data Analytics and Personalized Pricing

Insurance companies are using data analytics to personalize pricing and offer more tailored coverage options This allows them to better assess risk and offer more competitive rates

Climate Change and Its Impact on Insurance Coverage

Climate change is having a significant impact on the homeowners insurance industry As natural disasters become more frequent and severe insurance companies are reevaluating their coverage options and pricing

Homeowners Insurance Resources and Tools

Here are some helpful resources and tools for learning more about homeowners insurance:

State Insurance Departments

Your state's insurance department can provide you with information about insurance companies licensed in your state and help you resolve disputes with insurance companies

Consumer Reports

Consumer Reports provides ratings and reviews of insurance companies and products

National Association of Insurance Commissioners (NAIC)

The NAIC is a non profit organization that provides information and resources about insurance

This article provides a comprehensive overview of homeowners insurance covering everything from the basics to advanced topics By understanding the information presented here you can make informed decisions and protect your home and belongings. Remember to always shop around compare rates and choose a policy that meets your specific needs.:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)