Life Insurance Claims_ How to File and What to Expect

This article provides a comprehensive guide to life insurance, covering various coverage options, use cases, product comparisons, and detailed information like pricing, helping you understand and maximize your life insurance benefits.

Understanding Life Insurance Basics What Is It and Why Do You Need It

Life insurance. It's a topic many avoid, but it's crucial for securing your loved ones' financial future. Essentially, life insurance is a contract between you and an insurance company. You pay premiums, and in exchange, the insurer provides a lump-sum payment, known as a death benefit, to your beneficiaries upon your death. But why is this important? Think about your family's current financial situation. Would they be able to maintain their standard of living if you were no longer around? Could they cover mortgage payments, education expenses, and everyday bills? Life insurance acts as a safety net, ensuring they're not burdened with financial hardship during an already difficult time.

Beyond simply replacing your income, life insurance can also cover other important expenses, such as funeral costs, estate taxes, and outstanding debts. It can even be used to create a legacy for your family or support charitable causes you care about. Choosing the right life insurance policy is a significant decision, and understanding the basics is the first step towards protecting your family's future.

Term Life Insurance Explained Affordable and Temporary Coverage

Term life insurance is often the most affordable and straightforward type of life insurance. It provides coverage for a specific "term," typically ranging from 10 to 30 years. If you die within that term, your beneficiaries receive the death benefit. However, if the term expires and you're still alive, the coverage ends, and you typically don't receive any money back.

The primary advantage of term life insurance is its affordability. Because the policy only covers a specific period, the premiums are generally lower than those of permanent life insurance policies. This makes it a great option for young families or individuals on a tight budget who need significant coverage for a defined period, such as while they're paying off a mortgage or raising children.

Another benefit is its simplicity. Term life insurance is relatively easy to understand. You choose the amount of coverage you need and the length of the term, and the insurance company calculates your premiums based on your age, health, and lifestyle. Renewing a term life insurance policy can be more expensive as you age, so consider your long-term needs when selecting the initial term length.

Whole Life Insurance Comprehensive and Permanent Protection

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay the premiums. Unlike term life insurance, whole life policies don't expire. They also include a cash value component that grows over time on a tax-deferred basis.

The cash value is a significant advantage of whole life insurance. A portion of your premiums goes towards building this cash value, which you can borrow against or withdraw from during your lifetime. This can be helpful for covering unexpected expenses, funding retirement, or even paying for college tuition.

Whole life insurance also offers guaranteed death benefits and level premiums, meaning your premiums will remain the same throughout the life of the policy. While the premiums are generally higher than those of term life insurance, the added benefits and long-term security can make it a worthwhile investment for some individuals.

Universal Life Insurance Flexible and Adjustable Coverage Options

Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life insurance. With universal life, you can adjust your premiums and death benefit within certain limits, allowing you to tailor the policy to your changing needs and financial situation.

Like whole life insurance, universal life also includes a cash value component that grows over time. However, the cash value growth in universal life policies is typically tied to market interest rates, which means it can fluctuate. This offers the potential for higher returns but also comes with more risk.

The flexibility of universal life can be particularly appealing to individuals whose income or expenses may vary over time. For example, you might choose to lower your premiums during periods of financial hardship or increase your death benefit as your family grows. However, it's important to carefully monitor your policy and make adjustments as needed to ensure your coverage remains adequate.

Variable Life Insurance Investment Opportunities and Potential Growth

Variable life insurance is a type of permanent life insurance that combines life insurance coverage with investment opportunities. With variable life, a portion of your premiums is allocated to various investment accounts, such as stocks, bonds, and mutual funds. The cash value of your policy then fluctuates based on the performance of these investments.

The potential for higher returns is the main attraction of variable life insurance. If your investments perform well, your cash value can grow significantly, providing you with a valuable source of funds for retirement or other financial goals. However, it's important to understand that variable life also comes with more risk. If your investments perform poorly, your cash value could decline, and you might even need to increase your premiums to maintain your coverage.

Variable life insurance is best suited for individuals who are comfortable with investment risk and have a long-term investment horizon. It's also important to carefully research the investment options available and choose those that align with your risk tolerance and financial goals.

Life Insurance Riders Enhancing Your Policy with Additional Benefits

Life insurance riders are optional additions to your life insurance policy that provide extra benefits and protection. They can be used to customize your policy to meet your specific needs and circumstances. Some common life insurance riders include:

- Accidental Death Benefit Rider: Pays an additional death benefit if you die as a result of an accident.

- Waiver of Premium Rider: Waives your premium payments if you become disabled and are unable to work.

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit if you are diagnosed with a terminal illness.

- Child Term Rider: Provides life insurance coverage for your children.

- Long-Term Care Rider: Helps cover the costs of long-term care services, such as nursing home care or in-home care.

Adding riders to your life insurance policy can provide valuable peace of mind and financial protection. However, it's important to carefully consider the costs and benefits of each rider before adding it to your policy.

Choosing the Right Life Insurance Policy Factors to Consider

Choosing the right life insurance policy can feel overwhelming, but by considering a few key factors, you can make an informed decision that meets your needs and budget.

- Your Financial Needs: How much money would your family need to cover their expenses if you were no longer around? Consider mortgage payments, education expenses, everyday bills, and any outstanding debts.

- Your Budget: How much can you afford to spend on life insurance premiums each month? It's important to find a policy that fits your budget without sacrificing adequate coverage.

- Your Age and Health: Your age and health will significantly impact your life insurance premiums. The younger and healthier you are, the lower your premiums will be.

- Your Lifestyle: Certain lifestyle factors, such as smoking or participating in risky activities, can increase your life insurance premiums.

- Your Long-Term Goals: Are you looking for temporary coverage to protect your family during a specific period, or do you want permanent coverage that will last your entire life?

By carefully considering these factors, you can narrow down your options and choose a life insurance policy that provides the right level of coverage at a price you can afford.

Life Insurance Needs Analysis Determining the Right Coverage Amount

A life insurance needs analysis is a process of evaluating your financial situation to determine the appropriate amount of life insurance coverage you need. This analysis takes into account your income, debts, assets, and financial goals to calculate the amount of money your family would need to maintain their standard of living if you were to die.

There are several methods for conducting a life insurance needs analysis. One common method is the "multiple of income" approach, which involves multiplying your annual income by a certain number, typically 7 to 10. Another method is the "needs-based" approach, which involves calculating your family's specific financial needs and subtracting any existing assets or resources.

Consulting with a financial advisor can be helpful in conducting a thorough life insurance needs analysis. A financial advisor can help you assess your financial situation, identify your needs, and recommend the appropriate amount of life insurance coverage.

Life Insurance Quotes Comparing Policies and Finding the Best Rates

Once you've determined the type and amount of life insurance coverage you need, it's time to start comparing quotes from different insurance companies. Life insurance rates can vary significantly from one company to another, so it's important to shop around and find the best rates.

There are several ways to get life insurance quotes. You can contact insurance companies directly, work with an independent insurance agent, or use online quote comparison websites. When comparing quotes, be sure to consider the following factors:

- Premium: The amount you'll pay for your life insurance policy each month.

- Death Benefit: The amount of money your beneficiaries will receive upon your death.

- Policy Features: Any additional features or benefits included in the policy, such as riders or cash value accumulation.

- Insurance Company Rating: The financial strength rating of the insurance company, which indicates its ability to pay claims.

By comparing quotes from multiple insurance companies, you can find the best life insurance policy at the most affordable price.

Life Insurance Application Process What to Expect

After you've chosen a life insurance policy, the next step is to complete the application process. The application process typically involves providing information about your age, health, lifestyle, and financial situation. You may also be required to undergo a medical exam and provide medical records.

The insurance company will use this information to assess your risk and determine your premium rate. It's important to be honest and accurate when completing your life insurance application. Providing false or misleading information could result in your policy being denied or canceled.

Once your application is approved, you'll need to pay your first premium to activate your coverage. You'll then receive a copy of your life insurance policy, which outlines the terms and conditions of your coverage.

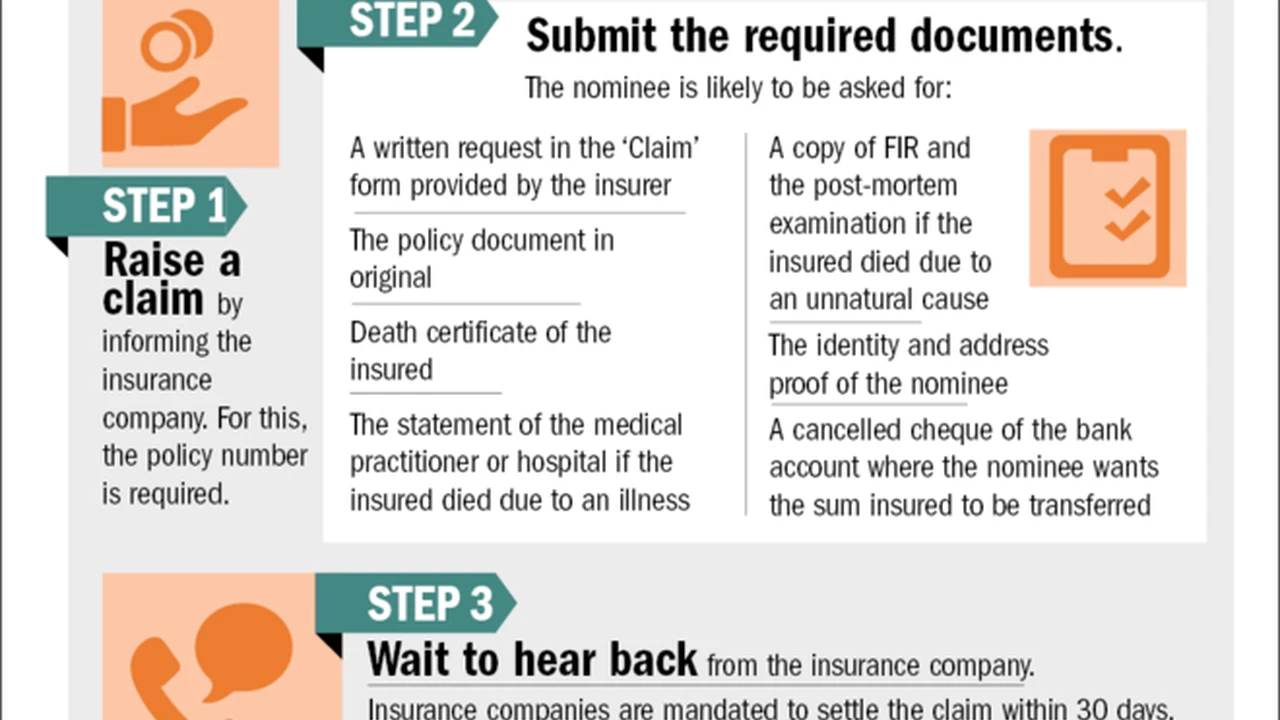

Life Insurance Claims Filing and Beneficiary Information

Filing a life insurance claim can be a difficult process, especially during a time of grief. It's important to understand the steps involved and to have the necessary information readily available.

The first step in filing a life insurance claim is to notify the insurance company of the death of the insured. You'll need to provide a copy of the death certificate and the life insurance policy. The insurance company will then send you a claim form to complete.

The claim form will ask for information about the deceased, the beneficiaries, and the circumstances of the death. It's important to complete the claim form accurately and completely. Once you've submitted the claim form, the insurance company will review it and may request additional information.

If the claim is approved, the insurance company will pay the death benefit to the beneficiaries. The beneficiaries can then use the death benefit to cover expenses such as funeral costs, mortgage payments, and education expenses.

Specific Life Insurance Product Recommendations

While providing specific product recommendations requires understanding your individual circumstances, here are some well-regarded life insurance companies and policy types to consider. Always consult with a licensed financial advisor before making any decisions.

Term Life Insurance Recommendation: Haven Life

Haven Life, backed by MassMutual, is known for its streamlined online application process and competitive rates for term life insurance. They offer coverage up to $3 million and terms ranging from 10 to 30 years. Their simple interface and instant decision-making process make them a popular choice for those seeking quick and affordable term life insurance.

Use Case: A young family with a mortgage and young children seeking affordable coverage for the next 20 years to protect their financial future in case of the death of a primary income earner.

Whole Life Insurance Recommendation: New York Life

New York Life is a mutual insurance company, meaning it's owned by its policyholders, not shareholders. This often translates to a focus on long-term value and stability. They offer a variety of whole life insurance policies with competitive dividend rates and strong financial ratings.

Use Case: Someone looking for lifelong coverage with a guaranteed death benefit and cash value accumulation, potentially for estate planning purposes or to provide a legacy for future generations.

Universal Life Insurance Recommendation: Pacific Life

Pacific Life offers a range of universal life insurance policies with flexible premium and death benefit options. They are known for their strong financial stability and diverse investment options within their universal life policies.

Use Case: Individuals seeking flexibility in their life insurance coverage, allowing them to adjust premiums and death benefits as their financial situation changes. This could be beneficial for entrepreneurs or those with fluctuating income.

Variable Life Insurance Recommendation: Prudential

Prudential offers variable life insurance policies with a wide range of investment options, allowing policyholders to customize their investment strategy. They provide comprehensive resources and support to help policyholders manage their investments within the policy.

Use Case: Sophisticated investors who are comfortable with market risk and seeking the potential for higher returns within their life insurance policy. They understand the fluctuations in cash value and are looking for tax-advantaged growth.

Life Insurance Product Comparison Table

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance | Variable Life Insurance |

|---|---|---|---|---|

| Coverage Duration | Specific Term (e.g., 10, 20, 30 years) | Lifetime | Lifetime | Lifetime |

| Premium | Typically Lower | Typically Higher | Flexible | Flexible |

| Cash Value | No | Yes, Guaranteed Growth | Yes, Market-Based Growth | Yes, Investment-Based Growth |

| Flexibility | Limited | Limited | High | High |

| Risk | Low | Low | Moderate | High |

| Suitability | Young families, short-term needs | Estate planning, lifelong coverage | Flexible needs, variable income | Sophisticated investors, long-term growth |

Life Insurance Pricing Factors and How to Get the Best Rates

Several factors influence the price of your life insurance policy. Understanding these factors can help you get the best possible rates.

- Age: The younger you are, the lower your premiums will be.

- Health: Your health is a major factor. Pre-existing conditions and lifestyle choices (like smoking) can significantly increase premiums.

- Gender: Women typically pay less for life insurance than men because they generally live longer.

- Lifestyle: Risky hobbies or occupations can increase your rates.

- Coverage Amount: The higher the death benefit, the higher the premium.

- Policy Type: Term life is generally cheaper than permanent life insurance.

Tips for Getting the Best Rates:

- Shop Around: Get quotes from multiple insurance companies.

- Improve Your Health: Quitting smoking, maintaining a healthy weight, and controlling pre-existing conditions can lower your rates.

- Buy Sooner Rather Than Later: Premiums increase as you age.

- Consider a Medical Exam: While some policies offer no-exam options, a medical exam can sometimes result in lower rates if you're in good health.

- Work with an Independent Agent: They can help you compare policies from multiple companies and find the best fit for your needs.

Common Life Insurance Mistakes to Avoid

Making informed decisions about life insurance is crucial. Here are some common mistakes to avoid:

- Underestimating Your Coverage Needs: Failing to adequately assess your family's financial needs can leave them vulnerable.

- Waiting Too Long to Buy: Procrastinating can lead to higher premiums as you age and your health potentially declines.

- Not Shopping Around: Settling for the first quote you receive without comparing options can cost you money.

- Misrepresenting Information on Your Application: Honesty is essential. Misleading information can lead to policy denial or cancellation.

- Not Reviewing Your Policy Regularly: Life circumstances change. Regularly review your policy to ensure it still meets your needs.

- Ignoring Riders: Failing to consider riders can mean missing out on valuable benefits that could enhance your coverage.

Life Insurance and Estate Planning Considerations

Life insurance plays a vital role in estate planning, helping to ensure a smooth transfer of assets and protect your loved ones' financial future.

- Estate Taxes: Life insurance proceeds can be used to pay estate taxes, preventing the forced sale of assets to cover these costs.

- Liquidity: Life insurance provides immediate liquidity to your estate, allowing your beneficiaries to cover expenses and debts.

- Wealth Transfer: Life insurance can be used to transfer wealth to future generations, creating a lasting legacy.

- Special Needs Planning: Life insurance can fund a special needs trust, providing for the long-term care and support of a disabled loved one.

Consulting with an estate planning attorney can help you integrate life insurance into your overall estate plan and ensure your wishes are carried out.

Life Insurance for Business Owners Protecting Your Company and Employees

Life insurance is not only important for individuals and families but also for business owners. It can protect your company, your employees, and your business partners.

- Key Person Insurance: Protects the company from the financial loss that could result from the death of a key employee.

- Buy-Sell Agreements: Provides funding for the purchase of a deceased partner's share of the business, ensuring a smooth transition of ownership.

- Employee Benefits: Offering life insurance as an employee benefit can attract and retain talent.

Business owners should carefully consider their life insurance needs and consult with a financial advisor to determine the appropriate coverage for their specific circumstances.

Navigating Life Insurance Policy Reviews and Updates

Life isn't static, and neither should your life insurance policy be. Regular reviews are essential to ensure your coverage continues to align with your evolving needs.

- Life Changes: Significant life events like marriage, divorce, the birth of a child, or a new mortgage warrant a policy review.

- Financial Changes: Changes in your income, debts, or assets can impact your coverage needs.

- Beneficiary Updates: Ensure your beneficiaries are up-to-date and accurately reflect your wishes.

- Policy Performance: If you have a permanent life insurance policy, review its performance and make adjustments as needed.

Schedule regular policy reviews with your insurance agent or financial advisor to ensure your life insurance continues to provide adequate protection.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)