7 Best Life Insurance Companies for Young Adults

Understanding Life Insurance Needs for Young Adults

Life insurance might seem like something for older folks, but for young adults, it's a crucial financial planning tool. Why? Because life isn't always predictable. Whether you have student loan debt, a mortgage, or even dependents, life insurance provides a safety net. It ensures your loved ones aren't burdened with financial hardship if something unexpected happens to you.

Think about it: your earning potential is arguably at its highest when you're young. Protecting that potential with life insurance is a smart move. It's not just about death; some policies even offer living benefits, which can be accessed during your lifetime for certain qualifying events. This can provide peace of mind knowing that you have a financial cushion if you encounter unforeseen circumstances.

Term Life vs Permanent Life Insurance Options for Young Adults

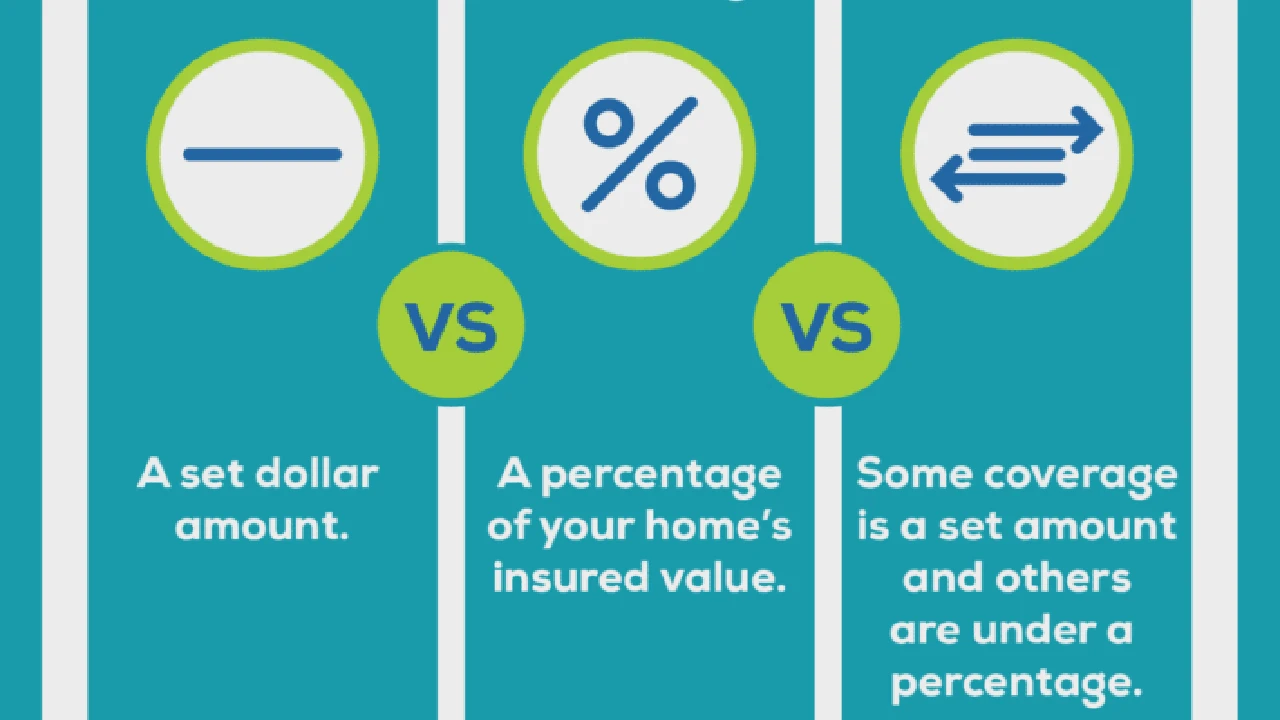

When exploring life insurance, you'll encounter two main types: term life and permanent life. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It's generally more affordable than permanent life insurance, making it an attractive option for young adults on a budget. If you outlive the term, the policy expires, and you'll need to renew or purchase a new policy.

Permanent life insurance, on the other hand, offers lifelong coverage. It also includes a cash value component that grows over time. This cash value can be borrowed against or withdrawn, providing a potential source of funds for future needs. However, permanent life insurance comes with higher premiums compared to term life insurance.

For young adults, term life insurance is often the recommended starting point. It provides sufficient coverage during the years when you're building your career, paying off debts, and potentially starting a family. As your financial situation evolves, you can re-evaluate your needs and consider transitioning to a permanent life insurance policy if desired.

Factors to Consider When Choosing a Life Insurance Company

Selecting the right life insurance company involves careful consideration of several factors. Here are some key aspects to keep in mind:

* **Financial Strength:** Choose a company with a strong financial rating from reputable agencies like A.M. Best, Standard & Poor's, and Moody's. This indicates the company's ability to meet its financial obligations and pay out claims. * **Policy Options:** Look for a company that offers a variety of policy options to meet your specific needs. This includes different term lengths, coverage amounts, and riders (additional benefits) that can be added to your policy. * **Premiums:** Compare premiums from different companies to find a policy that fits your budget. Keep in mind that the lowest premium isn't always the best choice. Consider the company's financial strength and policy features as well. * **Customer Service:** Read reviews and check the company's customer service ratings. A company with excellent customer service will be responsive to your questions and concerns, making the application and claims process smoother. * **Underwriting Process:** Understand the company's underwriting process. Some companies have more lenient underwriting standards than others, which can impact your eligibility and premium rates.Reviewing the Best Life Insurance Companies for Young Adults

Now, let's delve into some of the top life insurance companies that are well-suited for young adults:

1. Bestow Affordable Term Life Insurance for Young Professionals

Bestow stands out for its simplicity and affordability. It offers term life insurance policies with no medical exam required for most applicants. The application process is entirely online, making it quick and convenient for busy young professionals. Coverage amounts range from \$50,000 to \$1.5 million, with term lengths of 10 to 30 years.

**Use Case:** Bestow is ideal for young adults who want a straightforward and affordable term life insurance policy without the hassle of a medical exam. It's a good option for those who are generally healthy and don't have any significant pre-existing conditions.

**Pricing:** Bestow's premiums are competitive, particularly for younger individuals. The exact cost will depend on your age, health, and coverage amount.

2. Haven Life Simplified Term Life Insurance Options

Haven Life, backed by MassMutual, provides a similar online application process to Bestow. It offers term life insurance policies with coverage amounts up to \$3 million. While a medical exam may be required for some applicants, the process is generally streamlined and convenient.

**Use Case:** Haven Life is a solid choice for young adults who prefer a digital application experience and want the backing of a well-established insurance company. It's suitable for those who may need a higher coverage amount than Bestow offers.

**Pricing:** Haven Life's premiums are also competitive, and they offer a range of term lengths to choose from.

3. Ladder Flexible Life Insurance Coverage for Millennials

Ladder offers a unique feature called "laddering," which allows you to decrease your coverage amount over time as your financial needs change. This can help you save money on premiums as you pay off debts and accumulate assets. Ladder also offers term life insurance policies with coverage amounts up to \$3 million.

**Use Case:** Ladder is a great option for young adults who anticipate their life insurance needs decreasing over time. It's particularly well-suited for those who are paying off student loans or mortgages.

**Pricing:** Ladder's premiums are generally competitive, and the laddering feature can help you save money in the long run.

4. Quotacy Compare Life Insurance Quotes from Multiple Providers

Quotacy isn't an insurance company itself, but rather a broker that allows you to compare quotes from multiple life insurance providers. This can save you time and effort in finding the best policy for your needs. Quotacy works with a wide range of reputable insurance companies.

**Use Case:** Quotacy is ideal for young adults who want to compare quotes from multiple companies without having to fill out multiple applications. It's a good option for those who want to explore a wider range of policy options.

**Pricing:** Quotacy doesn't charge any fees for its services. You'll pay the premiums directly to the insurance company you choose.

5. Northwestern Mutual Comprehensive Financial Planning with Life Insurance

Northwestern Mutual is a well-established insurance company that offers a wide range of financial products and services, including life insurance. They provide both term life and permanent life insurance policies, as well as financial planning services.

**Use Case:** Northwestern Mutual is a good option for young adults who want a comprehensive financial plan that includes life insurance. It's suitable for those who prefer a more personalized approach and want to work with a financial advisor.

**Pricing:** Northwestern Mutual's premiums may be higher than some of the online-only providers, but their comprehensive services may justify the cost for some individuals.

6. State Farm Reliable Life Insurance with Local Agent Support

State Farm is another well-known insurance company that offers both term life and permanent life insurance policies. They have a network of local agents who can provide personalized support and guidance.

**Use Case:** State Farm is a good option for young adults who prefer to work with a local agent and want the stability of a large, established insurance company. It's suitable for those who value personalized service and want to build a long-term relationship with their insurance provider.

**Pricing:** State Farm's premiums are generally competitive, and they offer a range of discounts for bundling insurance policies.

7. Transamerica Diverse Life Insurance Products for Different Needs

Transamerica offers a diverse range of life insurance products, including term life, whole life, and universal life insurance. They also offer a variety of riders that can be added to your policy to customize your coverage.

**Use Case:** Transamerica is a good option for young adults who want a wide range of policy options to choose from and the ability to customize their coverage. It's suitable for those who have complex financial needs or want to explore different types of life insurance.

**Pricing:** Transamerica's premiums vary depending on the policy type and coverage amount. It's important to compare quotes from different companies to find the best deal.

Comparing Life Insurance Products Detailed Product Information

To further illustrate the differences between these companies, let's compare some key features:

| Feature | Bestow | Haven Life | Ladder | Quotacy | Northwestern Mutual | State Farm | Transamerica | |-------------------|----------------|-----------------|---------------|---------------|-----------------------|----------------|--------------| | Policy Type | Term | Term | Term | Term/Permanent| Term/Permanent | Term/Permanent | Term/Whole/Universal | | Coverage Amount | \$50k - \$1.5M | Up to \$3M | Up to \$3M | Varies | Varies | Varies | Varies | | Medical Exam | Often Not Req | May Be Required| May Be Required| Varies | Varies | Varies | Varies | | Online Application| Yes | Yes | Yes | Yes | No | No | No | | Laddering Feature| No | No | Yes | No | No | No | No | | Financial Advisor| No | No | No | No | Yes | Yes | Yes |This table provides a quick overview of the key differences between these companies. It's important to do your own research and compare quotes from multiple providers to find the best policy for your individual needs.

Understanding Life Insurance Pricing Factors for Young Adults

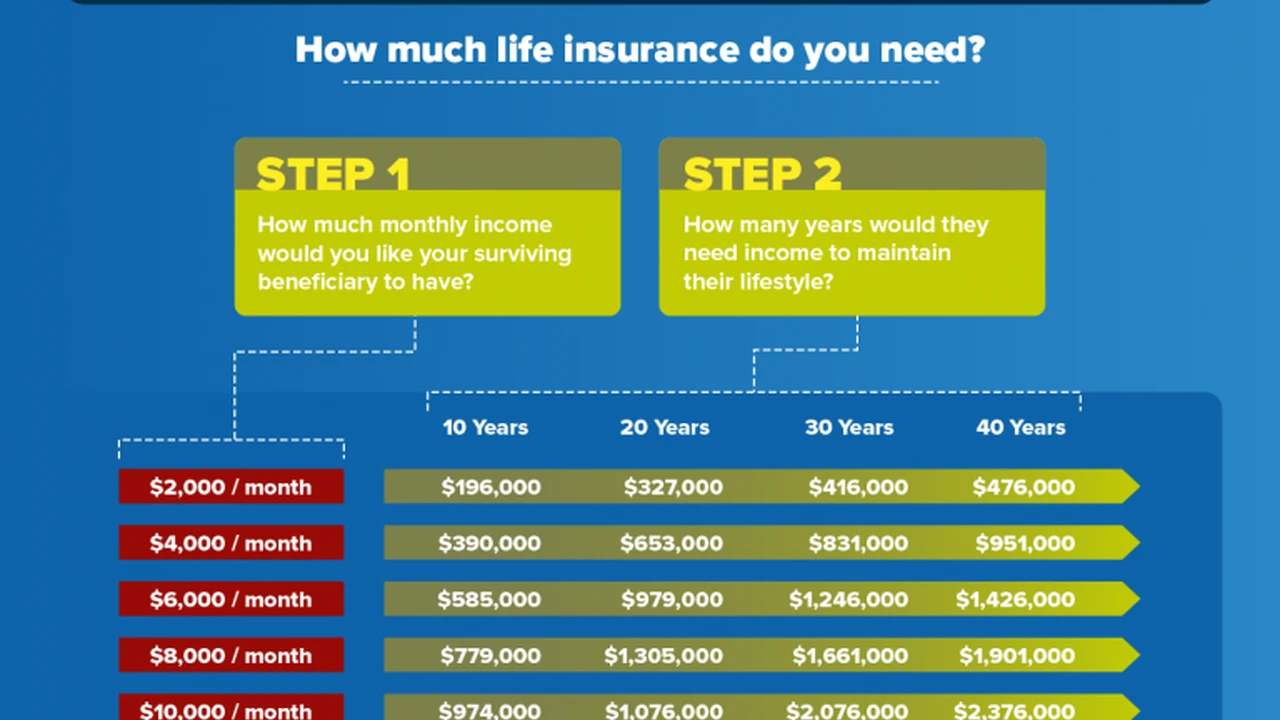

Several factors influence the cost of life insurance for young adults. These include:

* **Age:** Younger individuals generally pay lower premiums than older individuals. * **Health:** Your health is a significant factor in determining your premium rates. Pre-existing conditions can increase your premiums or even make you ineligible for coverage. * **Gender:** Women typically pay lower premiums than men due to their longer life expectancy. * **Lifestyle:** Risky behaviors, such as smoking or participating in extreme sports, can increase your premiums. * **Coverage Amount:** The higher the coverage amount, the higher the premiums. * **Term Length:** Longer term lengths typically result in higher premiums. * **Policy Type:** Permanent life insurance policies generally have higher premiums than term life insurance policies.Navigating the Life Insurance Application Process Smooth Application Steps

The life insurance application process typically involves the following steps:

1. **Get Quotes:** Obtain quotes from multiple insurance companies to compare prices and policy options. 2. **Complete the Application:** Fill out the application form, providing accurate information about your health, lifestyle, and financial situation. 3. **Medical Exam (if required):** Some companies require a medical exam to assess your health. This may involve blood and urine tests, as well as a physical examination. 4. **Underwriting:** The insurance company will review your application and medical exam results to determine your eligibility and premium rate. 5. **Policy Approval:** If your application is approved, you'll receive a policy offer. 6. **Payment and Activation:** Once you pay the first premium, your policy will be activated.Leveraging Life Insurance Riders Enhanced Policy Benefits

Life insurance riders are optional add-ons that can enhance your policy's benefits. Some common riders include:

* **Accelerated Death Benefit Rider:** This rider allows you to access a portion of your death benefit if you're diagnosed with a terminal illness. * **Waiver of Premium Rider:** This rider waives your premium payments if you become disabled and unable to work. * **Accidental Death Benefit Rider:** This rider provides an additional death benefit if you die as a result of an accident. * **Child Rider:** This rider provides coverage for your children. * **Guaranteed Insurability Rider:** This rider allows you to purchase additional coverage in the future without having to undergo another medical exam.Common Life Insurance Mistakes to Avoid for Young Adults

Here are some common mistakes to avoid when purchasing life insurance:

* **Procrastinating:** Don't wait until you're older or have health problems to purchase life insurance. The younger and healthier you are, the lower your premiums will be. * **Underestimating Your Needs:** Accurately assess your financial needs and purchase enough coverage to protect your loved ones. * **Choosing the Wrong Policy Type:** Select a policy type that meets your specific needs and budget. * **Not Comparing Quotes:** Shop around and compare quotes from multiple insurance companies to find the best deal. * **Ignoring Riders:** Consider adding riders to your policy to customize your coverage and enhance its benefits. * **Misrepresenting Information:** Be honest and accurate when completing the application form. Misrepresenting information can lead to your policy being canceled or your claim being denied.Future Proofing Your Finances with Life Insurance Long Term Planning

Life insurance is an essential component of a comprehensive financial plan. It provides a safety net for your loved ones and can help you achieve your long-term financial goals. By carefully considering your needs and selecting the right policy, you can protect your family's financial future and ensure their well-being.

Reviewing Life Insurance Policies Regularly Policy Updates

It's important to review your life insurance policy periodically, especially after major life events such as getting married, having children, or changing jobs. Your needs may change over time, and you may need to adjust your coverage amount or policy type. Reviewing your policy regularly ensures that it continues to meet your needs and provides adequate protection for your loved ones.

Final Thoughts on Securing Your Future with Life Insurance

Investing in life insurance as a young adult is a proactive step towards securing your financial future and protecting your loved ones. By understanding your needs, comparing policy options, and avoiding common mistakes, you can make informed decisions and choose a policy that provides peace of mind and financial security. Don't underestimate the value of life insurance – it's an investment in your family's future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)