7 Best Auto Insurance Companies for New Drivers

Understanding Auto Insurance for New Drivers

So, you're a new driver. Congratulations! Freedom awaits, but so does responsibility. And a big part of that responsibility is auto insurance. It's not exactly the most thrilling topic, but trust me, understanding it is crucial. We're going to break down why auto insurance is so important for new drivers, what factors influence your rates, and how to find the best possible coverage without breaking the bank.

First things first, let's talk about why you absolutely need auto insurance. In most states, it's legally required. Driving without insurance can lead to hefty fines, license suspension, and even jail time. But beyond the legal implications, insurance protects you financially if you're involved in an accident. Imagine causing an accident where someone is injured or their car is totaled. Without insurance, you'd be on the hook for all those medical bills and repair costs. That could be devastating financially.

Now, let's address the elephant in the room: new drivers often face higher insurance rates. Why? Insurance companies are all about assessing risk. And statistically, new drivers are more likely to be involved in accidents. This is due to a lack of experience and potentially riskier driving habits. Think about it – you're still learning the ropes, figuring out how to react to different situations on the road. It's natural to make mistakes. Insurance companies factor this increased risk into your premiums.

Several factors influence your auto insurance rates as a new driver. These include:

- Age: Younger drivers typically pay more.

- Driving Record: A clean driving record is essential. Any tickets or accidents will significantly increase your rates.

- Location: Where you live plays a role. Urban areas with higher traffic density tend to have higher premiums.

- Type of Car: The make and model of your car matters. Sports cars and expensive vehicles are generally more expensive to insure.

- Coverage Levels: The amount of coverage you choose directly impacts your premium. Higher coverage means higher cost.

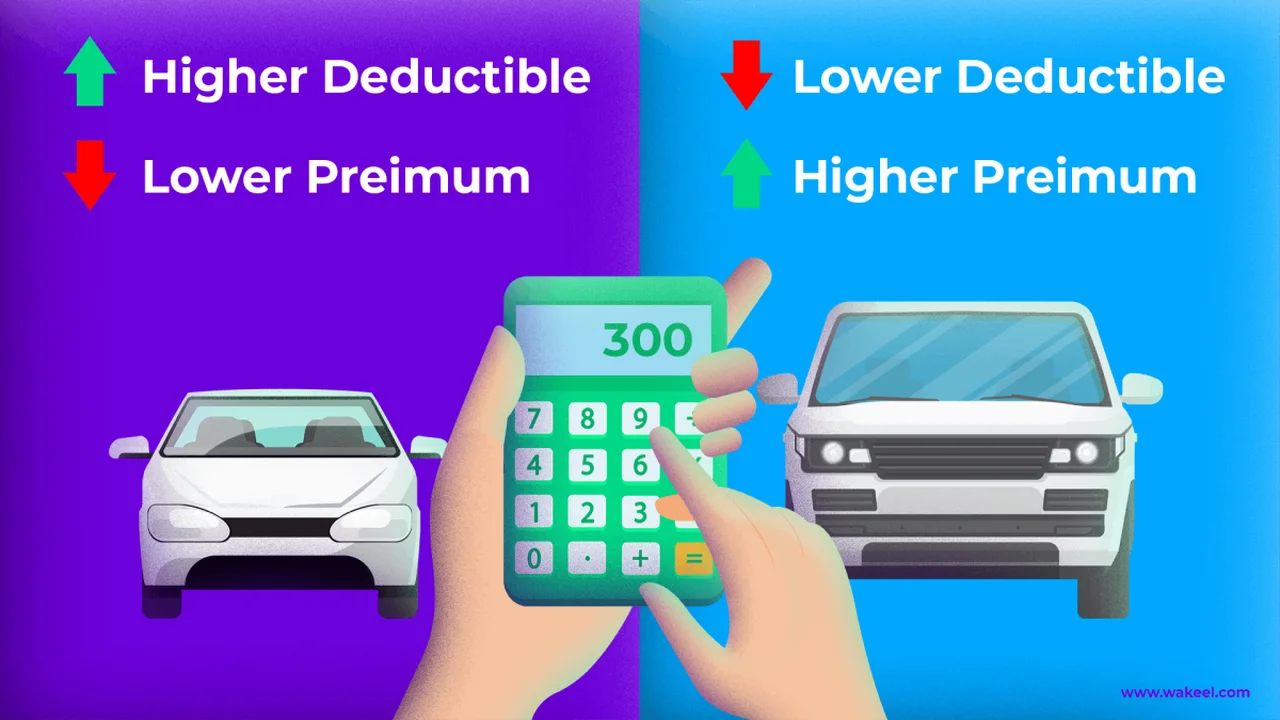

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically results in a lower premium.

So, how can you navigate this complex landscape and find affordable auto insurance as a new driver? That's what we're here to explore. We'll delve into some of the best auto insurance companies for new drivers, highlighting their strengths, coverage options, and potential discounts. We'll also discuss strategies for lowering your premiums and making smart choices about your coverage.

Reviewing the Top Auto Insurance Providers for New Drivers

Okay, let's get down to business. We've researched and analyzed several auto insurance companies to identify those that consistently offer competitive rates and excellent service for new drivers. Keep in mind that the "best" company for you will depend on your individual circumstances and needs. We encourage you to get quotes from multiple providers to compare your options.

1. State Farm Auto Insurance: A Solid Choice for Beginners

State Farm is a household name, and for good reason. They're known for their financial stability, strong customer service, and a wide range of coverage options. They also offer several discounts that can benefit new drivers.

State Farm Auto Insurance: Key Features and Benefits

- Good Student Discount: State Farm offers a significant discount to students who maintain good grades. This is a huge perk for young drivers still in school.

- Drive Safe & Save Program: This program uses telematics to track your driving habits. If you demonstrate safe driving behavior (e.g., avoiding hard braking, speeding, and late-night driving), you can earn a discount on your premium.

- Accident Forgiveness: After a certain period of being accident-free, State Farm may waive the surcharge for your first at-fault accident.

- Wide Range of Coverage Options: State Farm offers all the standard coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional options like rental car reimbursement and roadside assistance.

- Strong Local Agent Network: State Farm has a vast network of local agents who can provide personalized service and guidance. This can be especially helpful for new drivers who are unfamiliar with insurance terminology and coverage options.

State Farm Auto Insurance: Use Cases for New Drivers

Let's look at a couple of scenarios where State Farm could be a good fit for a new driver:

- Scenario 1: A high school student with good grades wants to save money on auto insurance. State Farm's Good Student Discount could significantly reduce their premium.

- Scenario 2: A new driver is concerned about the possibility of causing an accident. State Farm's Accident Forgiveness feature could provide peace of mind.

State Farm Auto Insurance: Potential Drawbacks

While State Farm has many advantages, there are a few potential drawbacks to consider:

- Premiums Can Be Higher Than Some Competitors: While State Farm offers discounts, their base premiums can sometimes be higher than those of some other companies, especially for drivers with less-than-perfect driving records.

- Telematics Program Requires Data Sharing: The Drive Safe & Save program requires you to share your driving data with State Farm. Some drivers may be uncomfortable with this.

State Farm Auto Insurance: Detailed Information and Pricing

Pricing for State Farm auto insurance varies depending on individual factors. It's best to get a personalized quote online or through a local agent. Generally, you can expect to pay around $1,500 - $2,500 per year for full coverage as a new driver, but this can fluctuate significantly.

2. Geico Auto Insurance: Cost-Effective Coverage for Young Drivers

Geico is another well-known insurer, famous for its catchy commercials and competitive rates. They often offer some of the lowest premiums for new drivers, especially those with good driving records.

Geico Auto Insurance: Key Features and Benefits

- Low Premiums: Geico is consistently ranked as one of the most affordable auto insurance companies, making it a great option for budget-conscious new drivers.

- Multiple Discount Opportunities: Geico offers a variety of discounts, including discounts for students, military personnel, and federal employees.

- Mobile App: Geico's mobile app makes it easy to manage your policy, file claims, and access roadside assistance.

- 24/7 Customer Service: Geico provides 24/7 customer service, so you can get help whenever you need it.

- Easy Online Quote Process: Getting a quote from Geico is quick and easy. You can get a quote online in just a few minutes.

Geico Auto Insurance: Use Cases for New Drivers

- Scenario 1: A college student on a tight budget needs affordable auto insurance. Geico's low premiums and student discounts could make it the most attractive option.

- Scenario 2: A new driver wants a hassle-free experience with their insurance company. Geico's mobile app and 24/7 customer service provide convenient access to policy information and support.

Geico Auto Insurance: Potential Drawbacks

- Customer Service Can Be Inconsistent: While Geico offers 24/7 customer service, some customers have reported inconsistent experiences.

- Fewer Local Agents: Geico relies more on online and phone support than on a network of local agents. This may not be ideal for drivers who prefer face-to-face interactions.

Geico Auto Insurance: Detailed Information and Pricing

Geico's pricing is highly competitive. New drivers can often find full coverage policies for around $1,200 - $2,000 per year, depending on their individual circumstances. Their online quote tool is a great way to get a quick estimate.

3. Progressive Auto Insurance: Innovative Options for New Drivers

Progressive is known for its innovative approach to insurance and its focus on providing customized coverage options. Their Snapshot program is particularly appealing to new drivers.

Progressive Auto Insurance: Key Features and Benefits

- Snapshot Program: This program tracks your driving habits and offers a discount based on your performance. Safe drivers can save a significant amount of money.

- Name Your Price Tool: Progressive's Name Your Price tool allows you to set your budget for auto insurance, and they'll show you coverage options that fit your price range.

- Gap Insurance: This coverage helps pay off your car loan if your car is totaled and you owe more than its actual value.

- Rideshare Insurance: If you plan to drive for Uber or Lyft, Progressive offers rideshare insurance to protect you while you're working.

- Online Resources: Progressive provides a wealth of online resources to help you understand auto insurance and make informed decisions.

Progressive Auto Insurance: Use Cases for New Drivers

- Scenario 1: A new driver is a very safe driver and wants to be rewarded for their good habits. Progressive's Snapshot program could help them save money.

- Scenario 2: A new driver is unsure about how much coverage they need and wants to explore different options within their budget. Progressive's Name Your Price tool can help them find the right fit.

Progressive Auto Insurance: Potential Drawbacks

- Snapshot Program Requires Monitoring: The Snapshot program requires you to install a device in your car or use their mobile app to track your driving. Some drivers may find this intrusive.

- Customer Service Ratings Vary: Customer service ratings for Progressive can vary depending on the region.

Progressive Auto Insurance: Detailed Information and Pricing

Progressive's pricing can be competitive, especially if you're a safe driver and participate in the Snapshot program. You can typically find full coverage policies for around $1,300 - $2,200 per year. The Name Your Price tool is a valuable resource for finding coverage that fits your budget.

4. Allstate Auto Insurance: Comprehensive Coverage and Support

Allstate is a well-established insurance company known for its comprehensive coverage options and strong customer support. They offer a variety of discounts and programs that can benefit new drivers.

Allstate Auto Insurance: Key Features and Benefits

- Drivewise Program: Similar to State Farm's Drive Safe & Save and Progressive's Snapshot, Allstate's Drivewise program monitors your driving habits and rewards safe driving with discounts.

- Good Student Discount: Allstate offers a generous discount for students who maintain good grades.

- New Car Discount: If you're driving a new car, you may be eligible for a discount on your Allstate auto insurance policy.

- Safe Driving Bonus: Allstate offers a safe driving bonus to customers who have been accident-free for a certain period of time.

- 24/7 Claim Support: Allstate provides 24/7 claim support, so you can file a claim anytime, day or night.

Allstate Auto Insurance: Use Cases for New Drivers

- Scenario 1: A new driver wants comprehensive coverage and strong customer support. Allstate's reputation for excellent service makes it a good choice.

- Scenario 2: A new driver is committed to safe driving and wants to be rewarded for their good habits. Allstate's Drivewise program can help them save money.

Allstate Auto Insurance: Potential Drawbacks

- Premiums Can Be Higher: Allstate's premiums can sometimes be higher than those of some other companies, especially for drivers with less-than-perfect driving records.

- Drivewise Program Requires Monitoring: The Drivewise program requires you to share your driving data with Allstate. Some drivers may be uncomfortable with this.

Allstate Auto Insurance: Detailed Information and Pricing

Allstate's pricing tends to be in the mid-range. New drivers can expect to pay around $1,600 - $2,600 per year for full coverage. It's recommended to get a personalized quote to see how Allstate's rates compare to those of other companies.

5. USAA Auto Insurance: Exclusive Benefits for Military Families

USAA is a highly respected insurance company that provides exclusive benefits to military members and their families. They consistently rank high in customer satisfaction surveys.

USAA Auto Insurance: Key Features and Benefits

- Low Rates: USAA is known for offering some of the lowest auto insurance rates in the industry, especially for military members and their families.

- Excellent Customer Service: USAA consistently receives high ratings for customer service.

- Military Discounts: USAA offers a variety of discounts specifically for military members and their families.

- Deployment Coverage: USAA provides special coverage options for military members who are deployed overseas.

- Accident Forgiveness: USAA offers accident forgiveness to eligible members.

USAA Auto Insurance: Use Cases for New Drivers

- Scenario 1: A new driver is a military member or a dependent of a military member. USAA's exclusive benefits and low rates make it an excellent choice.

- Scenario 2: A new driver values excellent customer service and wants an insurance company that understands the unique needs of military families.

USAA Auto Insurance: Potential Drawbacks

- Eligibility Requirements: USAA membership is limited to military members and their families.

- Limited Branch Locations: USAA has fewer branch locations than some other insurance companies.

USAA Auto Insurance: Detailed Information and Pricing

USAA's pricing is highly competitive for eligible members. New drivers can often find full coverage policies for around $1,000 - $1,800 per year. If you're eligible for USAA membership, it's definitely worth getting a quote.

6. Nationwide Auto Insurance: On Your Side for New Drivers

Nationwide is another large insurance company that offers a variety of coverage options and discounts. Their SmartRide program is designed to reward safe driving habits.

Nationwide Auto Insurance: Key Features and Benefits

- SmartRide Program: This program monitors your driving habits and offers a discount based on your performance. Safe drivers can save up to 40% on their premiums.

- Vanishing Deductible: With Nationwide's Vanishing Deductible program, your deductible decreases over time as long as you remain accident-free.

- On Your Side Review: Nationwide offers an On Your Side Review, where a local agent will review your coverage needs and help you find the best policy for your situation.

- Multiple Policy Discount: If you bundle your auto insurance with other Nationwide policies, such as homeowners insurance, you can save money.

- 24/7 Claims Reporting: Nationwide provides 24/7 claims reporting, so you can file a claim anytime, day or night.

Nationwide Auto Insurance: Use Cases for New Drivers

- Scenario 1: A new driver is committed to safe driving and wants to be rewarded for their good habits. Nationwide's SmartRide program can help them save money.

- Scenario 2: A new driver wants personalized service and guidance from a local agent. Nationwide's On Your Side Review can help them find the right policy.

Nationwide Auto Insurance: Potential Drawbacks

- SmartRide Program Requires Monitoring: The SmartRide program requires you to track your driving habits. Some drivers may find this intrusive.

- Premiums Can Vary: Nationwide's premiums can vary depending on your location and driving record.

Nationwide Auto Insurance: Detailed Information and Pricing

Nationwide's pricing is generally competitive. New drivers can expect to pay around $1,400 - $2,400 per year for full coverage. The SmartRide program can significantly reduce your premium if you're a safe driver.

7. Travelers Auto Insurance: Reliable Coverage for New Drivers

Travelers is a reputable insurance company with a long history of providing reliable coverage. They offer a variety of discounts and programs that can help new drivers save money.

Travelers Auto Insurance: Key Features and Benefits

- IntelliDrive Program: This program monitors your driving habits and offers a discount based on your performance. Safe drivers can save up to 20% on their premiums.

- Good Student Discount: Travelers offers a discount for students who maintain good grades.

- Safe Driver Discount: Travelers offers a discount for drivers who have been accident-free for a certain period of time.

- Multi-Car Discount: If you insure multiple vehicles with Travelers, you can save money.

- Homeownership Discount: Travelers offers a discount to homeowners.

Travelers Auto Insurance: Use Cases for New Drivers

- Scenario 1: A new driver is a responsible driver and wants to be rewarded for their good habits. Travelers' IntelliDrive program can help them save money.

- Scenario 2: A new driver is a student with good grades and wants to take advantage of available discounts. Travelers' Good Student Discount can help them save money.

Travelers Auto Insurance: Potential Drawbacks

- IntelliDrive Program Requires Monitoring: The IntelliDrive program requires you to share your driving data with Travelers. Some drivers may be uncomfortable with this.

- Customer Service Ratings Can Vary: Customer service ratings for Travelers can vary depending on the region.

Travelers Auto Insurance: Detailed Information and Pricing

Travelers' pricing is generally competitive. New drivers can expect to pay around $1,500 - $2,500 per year for full coverage. The IntelliDrive program can help you save money if you're a safe driver.

Tips for Lowering Your Auto Insurance Premiums as a New Driver

Finding affordable auto insurance as a new driver can be challenging, but it's not impossible. Here are some proven strategies for lowering your premiums:

Complete a Driver's Education Course

Many insurance companies offer discounts to drivers who have completed a driver's education course. This course helps you learn the rules of the road and develop safe driving habits. It demonstrates to insurance companies that you're taking responsibility for your safety and the safety of others.

Maintain Good Grades

As mentioned earlier, most insurance companies offer a good student discount. Maintaining a B average or higher can significantly reduce your premiums. This shows insurers you are responsible and disciplined, traits often associated with safer driving.

Choose a Safe Car

The type of car you drive can have a big impact on your insurance rates. Avoid sports cars and expensive vehicles, as they tend to be more expensive to insure. Opt for a safe and reliable car with good safety ratings. Consider vehicles with features like anti-lock brakes, airbags, and electronic stability control, as these can also qualify you for discounts.

Increase Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically results in a lower premium. However, make sure you can afford to pay the deductible if you need to file a claim.

Shop Around and Compare Quotes

Don't settle for the first quote you receive. Shop around and compare quotes from multiple insurance companies. Use online quote tools and contact local agents to get the best possible rates. Remember that prices can vary significantly between insurers, so it's worth the effort to compare your options.

Drive Safely and Avoid Accidents

The best way to lower your auto insurance premiums is to drive safely and avoid accidents. A clean driving record is essential for getting the lowest rates. Avoid speeding, reckless driving, and driving under the influence. The longer you maintain a clean record, the more likely you are to qualify for discounts and lower premiums.

Consider Usage-Based Insurance

Usage-based insurance programs, like State Farm's Drive Safe & Save, Geico's DriveEasy, Progressive's Snapshot and Allstate's Drivewise, track your driving habits and reward safe driving with discounts. If you're a safe driver, this can be a great way to save money on your auto insurance.

Bundle Your Insurance Policies

Many insurance companies offer discounts if you bundle your auto insurance with other policies, such as homeowners insurance or renters insurance. This can be a significant source of savings.

Pay Your Premiums on Time

Paying your premiums on time demonstrates financial responsibility and can help you maintain good standing with your insurance company. Some insurers may even offer discounts for automatic payments or paying your premiums in full upfront.

Understanding Different Types of Auto Insurance Coverage

Navigating the world of auto insurance can be confusing, especially for new drivers. It's important to understand the different types of coverage available so you can make informed decisions about your policy.

Liability Coverage

Liability coverage is the most basic type of auto insurance and is required in most states. It protects you financially if you're at fault in an accident and cause injury or property damage to someone else. Liability coverage typically has two components: bodily injury liability and property damage liability.

- Bodily Injury Liability: This covers the medical expenses, lost wages, and other damages incurred by someone who is injured in an accident you caused.

- Property Damage Liability: This covers the cost of repairing or replacing someone else's property (e.g., their car) that is damaged in an accident you caused.

Collision Coverage

Collision coverage pays for damage to your car if you're involved in an accident, regardless of who is at fault. This coverage is optional, but it's often recommended, especially if you have a newer car or if you can't afford to pay for repairs out-of-pocket.

Comprehensive Coverage

Comprehensive coverage pays for damage to your car that is not caused by a collision. This includes damage from events such as theft, vandalism, fire, hail, and natural disasters. Comprehensive coverage is also optional, but it can provide valuable protection against unforeseen events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you're involved in an accident with a driver who doesn't have insurance or who doesn't have enough insurance to cover your damages. This coverage is particularly important because it ensures that you're protected even if the other driver is at fault.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage pays for your medical expenses and lost wages if you're injured in an accident, regardless of who is at fault. PIP coverage is required in some states.

Medical Payments Coverage

Medical payments coverage pays for your medical expenses if you're injured in an accident, regardless of who is at fault. This coverage is similar to PIP coverage, but it typically has lower limits.

Gap Insurance

Gap insurance covers the "gap" between what you owe on your car loan and what your car is actually worth if it's totaled. This coverage is particularly important if you have a new car or if you made a small down payment.

Rental Car Reimbursement

Rental car reimbursement coverage pays for the cost of renting a car while your car is being repaired after an accident. This coverage can be helpful if you rely on your car for transportation.

Roadside Assistance

Roadside assistance coverage provides assistance if you experience a breakdown or other problem while driving. This coverage typically includes services such as towing, jump starts, tire changes, and fuel delivery.

Making the Right Choice for Your Auto Insurance Needs

Choosing the right auto insurance company and coverage options is a personal decision that depends on your individual circumstances and needs. Consider your budget, driving record, and the type of car you drive when making your decision. Don't be afraid to ask questions and seek advice from insurance professionals. By doing your research and making informed choices, you can find affordable auto insurance that provides the protection you need.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)