7 Best Homeowners Insurance Companies for First-Time Buyers

Understanding Homeowners Insurance A Comprehensive Guide for New Buyers

Buying your first home is a monumental achievement. It's a symbol of stability, a place to build memories, and a significant financial investment. Protecting that investment with homeowners insurance is crucial. But navigating the world of homeowners insurance can feel overwhelming, especially for first-time buyers. This guide will demystify the process, helping you understand what homeowners insurance covers, how much coverage you need, and how to choose the best company for your specific needs.

Homeowners insurance isn't just a nice-to-have; it's often a requirement from your mortgage lender. It protects you financially from unexpected events that could damage or destroy your home and belongings. These events, known as perils, can include fire, windstorms, hail, theft, vandalism, and certain types of water damage. Without homeowners insurance, you'd be responsible for covering these costs out of pocket, which could be financially devastating.

Before we dive into the best homeowners insurance companies, let's explore the core components of a standard policy:

- Dwelling Coverage: This covers the cost to repair or rebuild your home if it's damaged by a covered peril. It's essential to have enough dwelling coverage to cover the full replacement cost of your home.

- Personal Property Coverage: This covers the cost to replace your personal belongings, such as furniture, clothing, electronics, and appliances, if they're damaged or stolen. Most policies cover your personal property on an "actual cash value" (ACV) basis, which means you'll receive the depreciated value of the item. You can also opt for "replacement cost" coverage, which pays for the cost to replace the item with a new one.

- Liability Coverage: This protects you financially if someone is injured on your property and you're found liable. It covers medical expenses, legal fees, and settlements.

- Additional Living Expenses (ALE): Also known as loss of use coverage, this covers the cost of temporary housing and living expenses if your home is uninhabitable due to a covered peril.

- Other Structures Coverage: This covers structures on your property that are not attached to your home, such as a detached garage, shed, or fence.

Factors to Consider When Choosing Homeowners Insurance for the First Time

Choosing the right homeowners insurance policy involves careful consideration of several factors. Here's a breakdown of the key elements to keep in mind:

- Coverage Needs: Determine the amount of coverage you need based on the replacement cost of your home and the value of your personal belongings. Consider any specific risks in your area, such as flooding or earthquakes, and whether you need additional coverage for these perils.

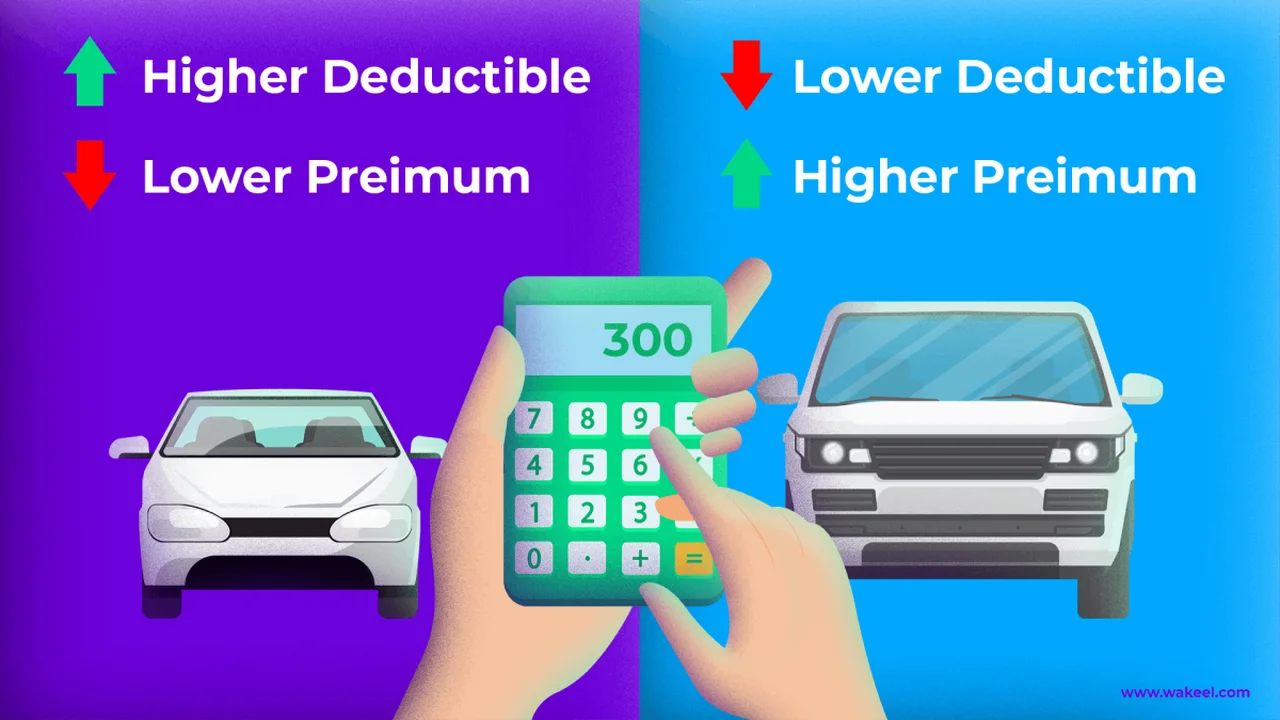

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but you'll need to be prepared to pay more if you file a claim.

- Policy Limits: Policy limits are the maximum amount your insurance company will pay for a covered loss. Make sure your policy limits are adequate to cover potential damages.

- Exclusions: Be aware of any exclusions in your policy, which are events or perils that are not covered. Common exclusions include damage from floods, earthquakes, and wear and tear.

- Discounts: Many insurance companies offer discounts for things like having a security system, being a non-smoker, or bundling your homeowners insurance with your auto insurance.

- Customer Service: Choose an insurance company with a reputation for excellent customer service. You want to be able to easily contact your insurer and get prompt assistance if you need to file a claim.

- Financial Stability: Select an insurance company with strong financial ratings. This ensures that the company will be able to pay out claims if you need them.

Top Homeowners Insurance Companies for First-Time Home Buyers Reviewed

Now, let's take a look at some of the best homeowners insurance companies for first-time buyers. These companies were selected based on their coverage options, pricing, customer service, and financial strength.

State Farm Homeowners Insurance A Solid Choice for New Homeowners

State Farm is one of the largest and most well-known insurance companies in the United States. They offer a wide range of coverage options and are known for their excellent customer service. State Farm is a solid choice for first-time buyers who want a reliable and reputable insurer.

Key Features:

- Comprehensive coverage options

- Excellent customer service

- Strong financial ratings

- Available in all 50 states

Use Cases:

- First-time homebuyers looking for a reliable and reputable insurer

- Homeowners who want comprehensive coverage options

- Individuals who value excellent customer service

Pricing: State Farm's premiums are generally competitive with other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: State Farm offers a variety of discounts, including discounts for having a security system, being a non-smoker, and bundling your homeowners insurance with your auto insurance. They also offer a free online tool to help you estimate your coverage needs.

Allstate Homeowners Insurance Customizable Options and Strong Digital Presence

Allstate is another major insurance company that offers a wide range of coverage options and a strong digital presence. They are known for their customizable policies and their convenient online tools.

Key Features:

- Customizable policies

- Strong digital presence

- Wide range of coverage options

- Available in all 50 states

Use Cases:

- First-time homebuyers who want a customizable policy

- Homeowners who prefer to manage their insurance online

- Individuals who want a wide range of coverage options

Pricing: Allstate's premiums are generally competitive with other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: Allstate offers a variety of discounts, including discounts for having a smart home device, being a senior citizen, and bundling your homeowners insurance with your auto insurance. They also offer a mobile app that allows you to manage your policy, file claims, and get assistance.

Liberty Mutual Homeowners Insurance A Variety of Discounts for First Time Buyers

Liberty Mutual is a large insurance company that offers a variety of discounts and coverage options. They are known for their competitive pricing and their commitment to customer service.

Key Features:

- Competitive pricing

- Variety of discounts

- Commitment to customer service

- Available in all 50 states

Use Cases:

- First-time homebuyers looking for competitive pricing

- Homeowners who want a variety of discounts

- Individuals who value customer service

Pricing: Liberty Mutual's premiums are generally lower than those of other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: Liberty Mutual offers a variety of discounts, including discounts for being a new homeowner, having a safe home, and bundling your homeowners insurance with your auto insurance. They also offer a 24/7 claims service.

USAA Homeowners Insurance Exclusive Benefits for Military Families

USAA is a financial services company that provides insurance and other financial products to members of the military and their families. They are known for their excellent customer service and their competitive pricing.

Key Features:

- Excellent customer service

- Competitive pricing

- Exclusive benefits for military families

- Available to military members and their families

Use Cases:

- Military members and their families

- Homeowners who value excellent customer service

- Individuals looking for competitive pricing

Pricing: USAA's premiums are generally lower than those of other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: USAA offers a variety of discounts, including discounts for being a military member, having a safe home, and bundling your homeowners insurance with your auto insurance. They also offer a mobile app that allows you to manage your policy, file claims, and get assistance.

Travelers Homeowners Insurance Experience and Financial Strength

Travelers is a well-established insurance company with a long history of providing homeowners insurance. They are known for their financial strength and their commitment to customer service.

Key Features:

- Financial strength

- Commitment to customer service

- Wide range of coverage options

- Available in most states

Use Cases:

- First-time homebuyers who want a financially stable insurer

- Homeowners who value customer service

- Individuals who want a wide range of coverage options

Pricing: Travelers' premiums are generally competitive with other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: Travelers offers a variety of discounts, including discounts for having a new home, being a responsible homeowner, and bundling your homeowners insurance with your auto insurance. They also offer a 24/7 claims service.

Amica Mutual Homeowners Insurance High Customer Satisfaction Ratings

Amica Mutual is known for its high customer satisfaction ratings and its commitment to providing excellent customer service. They are a mutual company, which means they are owned by their policyholders.

Key Features:

- High customer satisfaction ratings

- Commitment to customer service

- Mutual company owned by policyholders

- Available in most states

Use Cases:

- First-time homebuyers who value customer service

- Homeowners who want to be insured by a mutual company

- Individuals who want a company with high customer satisfaction ratings

Pricing: Amica Mutual's premiums are generally competitive with other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: Amica Mutual offers a variety of discounts, including discounts for having a safe home, being a loyal customer, and bundling your homeowners insurance with your auto insurance. They also offer a dividend program for policyholders.

Nationwide Homeowners Insurance On Your Side Customer Service

Nationwide is a large insurance company that offers a wide range of coverage options and a commitment to customer service. They are known for their "On Your Side" customer service philosophy.

Key Features:

- Wide range of coverage options

- Commitment to customer service ("On Your Side")

- Strong financial ratings

- Available in most states

Use Cases:

- First-time homebuyers who want a company with a strong customer service focus

- Homeowners who want a wide range of coverage options

- Individuals who value financial stability

Pricing: Nationwide's premiums are generally competitive with other major insurers. However, rates can vary depending on your location, coverage needs, and deductible.

Detailed Information: Nationwide offers a variety of discounts, including discounts for having a smart home, being a new homeowner, and bundling your homeowners insurance with your auto insurance. They also offer a 24/7 claims service and a mobile app that allows you to manage your policy.

Homeowners Insurance Policy Comparison Choosing the Right Fit

Comparing different homeowners insurance policies is essential to find the right fit for your needs and budget. Here's a table comparing the key features of the companies discussed above:

| Company | Coverage Options | Customer Service | Pricing | Discounts | Financial Strength |

|---|---|---|---|---|---|

| State Farm | Comprehensive | Excellent | Competitive | Security system, Non-smoker, Bundling | Strong |

| Allstate | Customizable | Good | Competitive | Smart home, Senior citizen, Bundling | Strong |

| Liberty Mutual | Wide Range | Good | Competitive | New homeowner, Safe home, Bundling | Good |

| USAA | Comprehensive | Excellent | Competitive | Military member, Safe home, Bundling | Excellent |

| Travelers | Wide Range | Good | Competitive | New home, Responsible homeowner, Bundling | Excellent |

| Amica Mutual | Comprehensive | Excellent | Competitive | Safe home, Loyal customer, Bundling | Strong |

| Nationwide | Wide Range | Good | Competitive | Smart home, New homeowner, Bundling | Strong |

Homeowners Insurance Coverage Options What Do You Really Need

Beyond the standard coverage components, several optional endorsements can enhance your homeowners insurance policy. Understanding these options allows you to tailor your coverage to your specific needs and protect against unique risks.

- Flood Insurance: Standard homeowners insurance policies typically do not cover flood damage. If you live in a flood-prone area, you'll need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer.

- Earthquake Insurance: Similar to flood insurance, earthquake insurance is not typically covered by standard homeowners insurance policies. If you live in an area prone to earthquakes, you'll need to purchase a separate earthquake insurance policy.

- Sewer Backup Coverage: This coverage protects you financially if your sewer line backs up and causes damage to your home.

- Personal Umbrella Policy: This provides additional liability coverage beyond the limits of your homeowners insurance policy. It can protect you from lawsuits and other financial liabilities.

- Scheduled Personal Property Coverage: This provides additional coverage for valuable items, such as jewelry, artwork, and collectibles.

- Identity Theft Protection: This coverage helps you recover from identity theft, including expenses related to credit monitoring, legal fees, and lost wages.

Saving Money on Homeowners Insurance Tips and Tricks

While homeowners insurance is a necessary expense, there are several ways to save money on your premiums. Here are some tips and tricks to help you lower your costs:

- Shop Around: Get quotes from multiple insurance companies to compare prices and coverage options.

- Increase Your Deductible: A higher deductible typically results in a lower premium.

- Bundle Your Insurance: Many insurance companies offer discounts for bundling your homeowners insurance with your auto insurance.

- Improve Your Home's Security: Install a security system, smoke detectors, and other safety devices to reduce your risk of loss and qualify for discounts.

- Maintain Your Home: Regularly maintain your home to prevent damage from occurring.

- Review Your Coverage Annually: Review your coverage annually to make sure it still meets your needs and that you're not paying for coverage you don't need.

- Pay Your Premium Annually: Some insurers offer a discount for paying your premium annually instead of monthly.

- Ask About Discounts: Don't be afraid to ask your insurance company about available discounts.

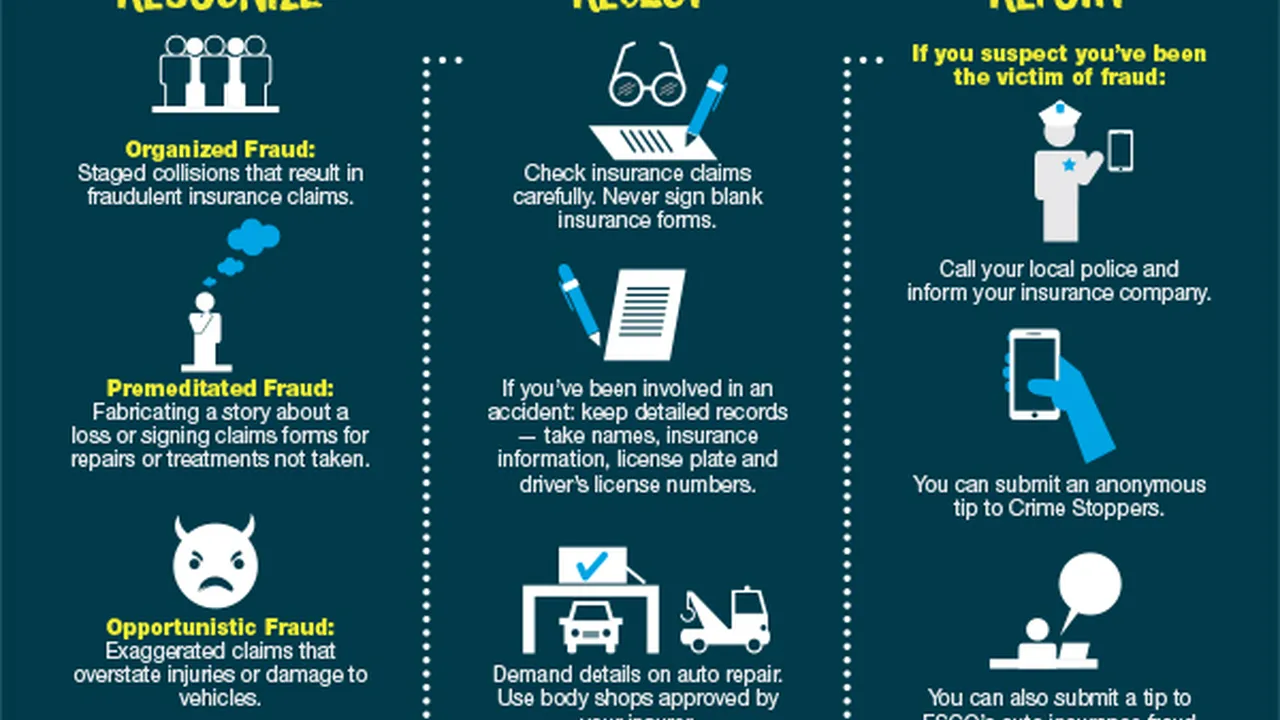

Homeowners Insurance Claims Process What to Do After a Loss

Filing a homeowners insurance claim can be a stressful experience, but understanding the process can help you navigate it more smoothly. Here's a step-by-step guide to filing a claim:

- Report the Loss: Contact your insurance company as soon as possible to report the loss.

- Document the Damage: Take photos and videos of the damage to your home and belongings.

- Protect Your Property: Take steps to prevent further damage to your property, such as covering damaged areas with tarps.

- Create an Inventory: Create a list of all damaged or stolen items, including their value.

- File a Police Report: If the loss involves theft or vandalism, file a police report.

- Meet with the Adjuster: Your insurance company will send an adjuster to inspect the damage and assess your claim.

- Review the Settlement Offer: Review the settlement offer from your insurance company carefully.

- Negotiate if Necessary: If you're not satisfied with the settlement offer, negotiate with your insurance company.

- Repair or Replace Damaged Property: Once your claim is approved, you can begin repairing or replacing your damaged property.

Navigating Homeowners Insurance as a First Time Buyer Additional Considerations

As a first-time home buyer, there are a few additional considerations to keep in mind when purchasing homeowners insurance.

- Mortgage Requirements: Your mortgage lender will likely require you to have homeowners insurance. They may also have specific coverage requirements.

- Closing Costs: Homeowners insurance is typically included in your closing costs. Be prepared to pay for your first year's premium upfront.

- Escrow Account: Your lender may require you to set up an escrow account to pay for your homeowners insurance and property taxes.

- Understand Your Policy: Take the time to read and understand your homeowners insurance policy. Ask your insurer any questions you have about your coverage.

The Future of Homeowners Insurance Trends to Watch

The homeowners insurance industry is constantly evolving. Here are some trends to watch in the future:

- Smart Home Technology: Smart home devices, such as water leak detectors and security systems, are becoming increasingly popular. These devices can help prevent losses and qualify homeowners for discounts.

- Climate Change: Climate change is increasing the frequency and severity of natural disasters, such as hurricanes, wildfires, and floods. This is leading to higher insurance premiums and more stringent coverage requirements.

- Data Analytics: Insurance companies are using data analytics to better assess risk and personalize coverage options.

- Digitalization: The insurance industry is becoming increasingly digital, with more and more consumers managing their policies online.

Making an Informed Decision About Homeowners Insurance

Choosing the right homeowners insurance policy is a crucial step in protecting your new home. By understanding the different coverage options, comparing policies, and considering your specific needs, you can make an informed decision and ensure that you have the financial protection you need. Take your time, do your research, and don't hesitate to ask questions. Your peace of mind is worth it.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)