Health Insurance Open Enrollment_ What You Need to Know

Navigating the Complex World of Health Insurance A Beginner's Guide

Choosing the right health insurance can feel like navigating a labyrinth. With so many options and jargon, it's easy to feel overwhelmed. This guide aims to demystify the process, providing you with the knowledge and tools to make informed decisions about your health coverage.

Let's start with the basics. Health insurance is essentially a contract between you and an insurance company. You pay a premium, and in exchange, the insurance company agrees to pay for a portion of your medical expenses. The specifics of what's covered, how much you pay, and the rules you need to follow can vary significantly depending on the plan you choose.

Understanding the key terms is crucial. Here are a few you'll encounter frequently:

- Premium: The monthly payment you make to maintain your health insurance coverage.

- Deductible: The amount you pay out-of-pocket for covered healthcare services before your insurance company starts paying.

- Copay: A fixed amount you pay for a specific healthcare service, like a doctor's visit or prescription.

- Coinsurance: The percentage of the cost of a covered healthcare service that you pay after you've met your deductible.

- Out-of-pocket maximum: The maximum amount you'll pay for covered healthcare services in a plan year. Once you reach this amount, your insurance company pays 100% of covered expenses.

- Network: The group of doctors, hospitals, and other healthcare providers that your insurance company has contracted with to provide services at a discounted rate.

Now, let's explore the different types of health insurance plans available.

Exploring Different Types of Health Insurance Plans

The health insurance landscape is diverse, offering various plan types to cater to different needs and budgets. Here's an overview of some of the most common types:

Health Maintenance Organizations HMOs

HMOs are known for their lower premiums and focus on coordinated care. You typically need to choose a primary care physician (PCP) within the HMO's network who will manage your care and refer you to specialists if needed. Staying within the network is crucial, as out-of-network care is generally not covered, except in emergencies.

Key Features of HMOs:

- Lower premiums compared to other plan types.

- Requires a primary care physician (PCP).

- Referrals needed to see specialists.

- Limited coverage for out-of-network care.

- Focus on preventative care.

Preferred Provider Organizations PPOs

PPOs offer more flexibility than HMOs, allowing you to see any doctor or specialist without a referral. However, you'll typically pay less if you stay within the PPO's network. Out-of-network care is usually covered, but at a higher cost.

Key Features of PPOs:

- Greater flexibility in choosing doctors and specialists.

- No referrals needed.

- Coverage for out-of-network care (at a higher cost).

- Higher premiums compared to HMOs.

Exclusive Provider Organizations EPOs

EPOs are similar to HMOs in that you typically need to stay within the network to receive coverage. However, unlike HMOs, you usually don't need a referral to see a specialist. Out-of-network care is generally not covered, except in emergencies.

Key Features of EPOs:

- No referrals needed to see specialists.

- Limited coverage for out-of-network care.

- Premiums typically lower than PPOs but higher than HMOs.

Point of Service POS Plans

POS plans offer a blend of HMO and PPO features. You typically need to choose a PCP who will manage your care and refer you to specialists. However, you can also see out-of-network providers, but you'll pay more.

Key Features of POS Plans:

- Requires a primary care physician (PCP).

- Referrals needed to see specialists (generally).

- Coverage for out-of-network care (at a higher cost).

- Premiums typically fall between HMOs and PPOs.

High-Deductible Health Plans HDHPs with Health Savings Accounts HSAs

HDHPs have higher deductibles than traditional health plans, but they also offer the opportunity to save money in a Health Savings Account (HSA). An HSA is a tax-advantaged savings account that you can use to pay for qualified medical expenses. These plans are often attractive to individuals who are generally healthy and don't anticipate needing a lot of medical care.

Key Features of HDHPs with HSAs:

- Higher deductibles.

- Opportunity to contribute to a Health Savings Account (HSA).

- HSA contributions are tax-deductible.

- HSA funds can be used for qualified medical expenses.

- HSA funds can grow tax-free.

Understanding Health Insurance Marketplace Plans and Subsidies

The Affordable Care Act (ACA) created health insurance marketplaces where individuals and families can purchase health insurance plans. These marketplaces offer a variety of plans from different insurance companies, and you may be eligible for subsidies to help lower your monthly premiums or out-of-pocket costs.

Key Features of Marketplace Plans:

- A variety of plans available from different insurance companies.

- Eligibility for subsidies based on income.

- Guaranteed issue, meaning you can't be denied coverage due to pre-existing conditions.

- Essential health benefits, including coverage for doctor's visits, hospital stays, prescription drugs, and preventative care.

Subsidies Available Through the Marketplace:

- Premium Tax Credits: These credits lower your monthly premium payments.

- Cost-Sharing Reductions: These reductions lower your out-of-pocket costs, such as deductibles, copays, and coinsurance.

To determine if you're eligible for subsidies, you'll need to provide information about your income and household size when you apply for coverage through the marketplace.

Evaluating Health Insurance Needs and Making Informed Decisions

Choosing the right health insurance plan is a personal decision that depends on your individual needs, circumstances, and budget. Here are some factors to consider when evaluating your options:

- Your Health Status: If you have chronic health conditions or anticipate needing frequent medical care, you may want to choose a plan with lower out-of-pocket costs, even if it means paying a higher premium.

- Your Budget: Consider your monthly premium, deductible, copays, and coinsurance when evaluating the overall cost of a plan.

- Your Preferred Doctors and Hospitals: Check to see if your preferred doctors and hospitals are in the plan's network.

- Your Prescription Drug Needs: Make sure the plan covers your prescription drugs and understand the cost-sharing arrangements.

- Your Tolerance for Risk: If you're comfortable with a higher deductible and the potential for higher out-of-pocket costs, you may want to consider a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA).

Don't be afraid to ask questions and compare different plans before making a decision. You can contact insurance companies directly, work with a licensed insurance agent, or utilize online resources to gather information and compare your options.

Specific Product Recommendations and Use Cases

While recommending specific health insurance plans requires understanding individual circumstances and is best done through a licensed professional, we can explore hypothetical scenarios and suggest plan types that might be suitable.

Scenario 1: Young, Healthy Individual with a Limited Budget

For a young, healthy individual with a limited budget, a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA) might be a good option. The lower premiums can make coverage more affordable, and the HSA allows them to save money for future medical expenses. This individual might not need frequent medical care, so the higher deductible is less of a concern. They could also consider a Bronze plan in the marketplace, which typically has the lowest premiums but the highest out-of-pocket costs.

Potential Plan Type: HDHP with HSA or Bronze Marketplace Plan

Scenario 2: Family with Young Children

A family with young children might prefer a plan with lower out-of-pocket costs, such as a Gold or Platinum plan in the marketplace. While the premiums will be higher, these plans typically have lower deductibles, copays, and coinsurance, which can be beneficial if the children need frequent doctor's visits or require specialized care. A PPO plan might also be a good choice, as it offers more flexibility in choosing doctors and specialists without requiring referrals.

Potential Plan Type: Gold or Platinum Marketplace Plan, PPO Plan

Scenario 3: Individual with a Chronic Health Condition

An individual with a chronic health condition will likely benefit from a plan that provides comprehensive coverage and predictable out-of-pocket costs. A Gold or Platinum plan in the marketplace might be a good option, as these plans typically have lower deductibles, copays, and coinsurance. It's also important to choose a plan that includes the individual's preferred doctors and covers their prescription drugs. A plan with a low out-of-pocket maximum is also crucial to protect against catastrophic medical expenses.

Potential Plan Type: Gold or Platinum Marketplace Plan, HMO or PPO depending on provider preference

Product Comparisons Health Insurance Options Analyzed

Let's compare different plan types based on key factors:

Premium:

- HDHP with HSA: Generally Lowest

- HMO: Low

- EPO: Moderate

- POS: Moderate

- PPO: High

- Platinum Marketplace Plan: Highest

Deductible:

- HDHP with HSA: Highest

- HMO: Low to Moderate

- EPO: Moderate

- POS: Moderate

- PPO: Moderate to High

- Platinum Marketplace Plan: Lowest

Flexibility in Choosing Doctors:

- HDHP with HSA: Varies depending on the underlying network.

- HMO: Least Flexible (requires PCP and referrals).

- EPO: Moderate (no referrals, but limited network).

- POS: Moderate (requires PCP and referrals for in-network care).

- PPO: Most Flexible (no referrals and out-of-network coverage).

- Platinum Marketplace Plan: Varies depending on the specific plan.

Out-of-Pocket Costs (excluding premium):

- HDHP with HSA: Potentially Highest (until deductible is met).

- HMO: Low to Moderate.

- EPO: Moderate.

- POS: Moderate.

- PPO: Moderate to High.

- Platinum Marketplace Plan: Lowest.

This comparison provides a general overview. The specific costs and benefits of each plan will vary depending on the insurance company and the plan details.

Detailed Information on Health Insurance Pricing Factors Influencing Premiums

Health insurance premiums are determined by a variety of factors. Understanding these factors can help you better understand your premium costs and potentially find ways to lower them.

Key Factors Influencing Health Insurance Premiums:

- Age: Older individuals typically pay higher premiums than younger individuals, as they are generally more likely to need medical care.

- Location: Premiums can vary significantly depending on where you live. Areas with higher healthcare costs tend to have higher premiums.

- Tobacco Use: Tobacco users typically pay higher premiums than non-tobacco users, as they are at a higher risk for certain health conditions.

- Plan Category: As mentioned earlier, Platinum plans typically have the highest premiums, while Bronze plans have the lowest.

- Individual vs. Family Coverage: Family coverage is more expensive than individual coverage, as it covers more people.

- Deductible: Plans with lower deductibles typically have higher premiums, while plans with higher deductibles have lower premiums.

Strategies for Potentially Lowering Your Health Insurance Premiums:

- Increase Your Deductible: Choosing a plan with a higher deductible can lower your monthly premium. However, be sure you can afford to pay the deductible if you need medical care.

- Shop Around: Compare plans from different insurance companies to find the best rates.

- Maintain a Healthy Lifestyle: Some insurance companies offer discounts to individuals who maintain a healthy lifestyle, such as exercising regularly and not smoking.

- Take Advantage of Preventive Care: Preventive care services are typically covered at no cost to you, and they can help you stay healthy and avoid more costly medical treatments down the road.

- Explore Subsidies: If you're eligible for subsidies through the health insurance marketplace, be sure to apply to lower your monthly premiums or out-of-pocket costs.

Understanding Cost Sharing and Out-of-Pocket Expenses

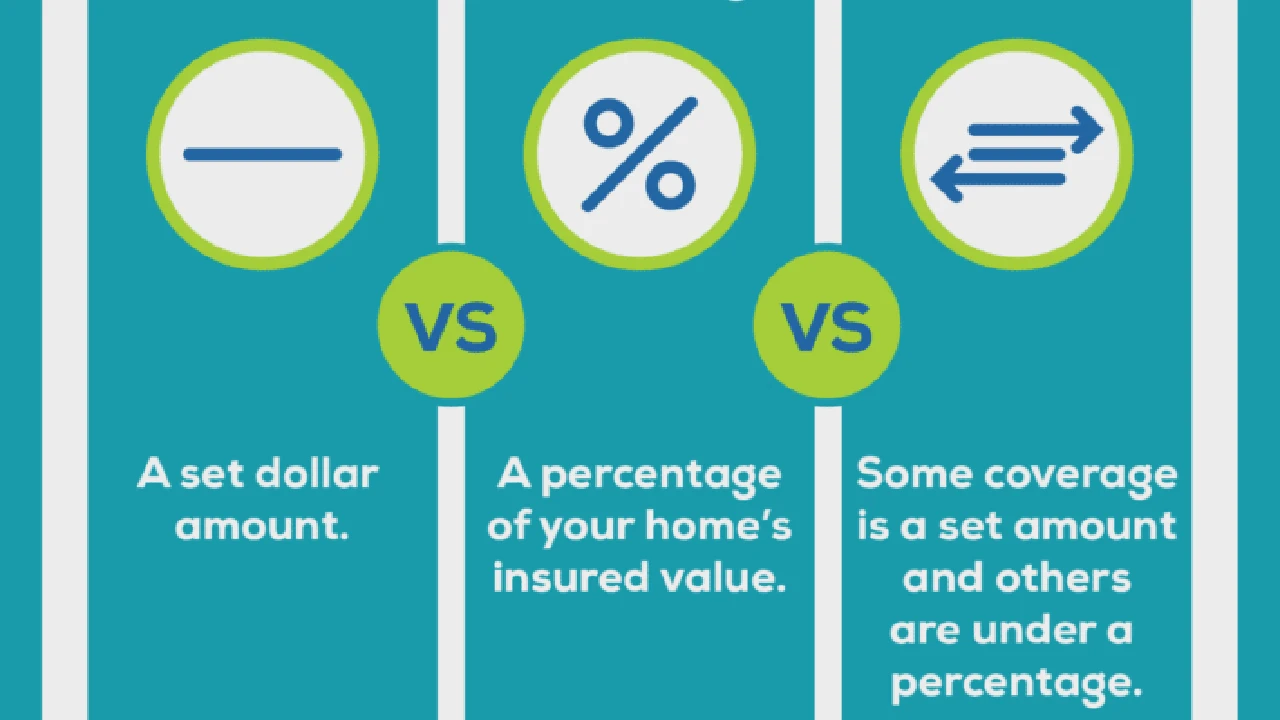

Beyond the premium, it's crucial to understand how cost-sharing works in your health insurance plan. Cost-sharing refers to the expenses you pay out-of-pocket for healthcare services, such as deductibles, copays, and coinsurance.

Deductible: As mentioned earlier, the deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance company starts paying. Once you've met your deductible, you'll typically only pay copays or coinsurance for covered services.

Copay: A copay is a fixed amount you pay for a specific healthcare service, such as a doctor's visit or prescription. Copays are typically lower than the full cost of the service.

Coinsurance: Coinsurance is the percentage of the cost of a covered healthcare service that you pay after you've met your deductible. For example, if your coinsurance is 20%, you'll pay 20% of the cost of the service, and your insurance company will pay the remaining 80%.

Out-of-Pocket Maximum: The out-of-pocket maximum is the maximum amount you'll pay for covered healthcare services in a plan year. Once you reach this amount, your insurance company pays 100% of covered expenses.

Understanding your cost-sharing responsibilities is essential for budgeting for healthcare expenses and making informed decisions about your medical care.

The Importance of Preventative Care and Wellness Programs

Preventive care is a cornerstone of good health and can help you stay healthy and avoid more costly medical treatments down the road. Most health insurance plans cover a range of preventive care services at no cost to you, including:

- Annual checkups: These checkups allow your doctor to assess your overall health and screen for potential health problems.

- Vaccinations: Vaccinations can protect you from a variety of infectious diseases.

- Screenings: Screenings can detect certain health conditions early, when they are easier to treat. Examples include mammograms for breast cancer, colonoscopies for colon cancer, and Pap tests for cervical cancer.

- Wellness Programs: Many insurance companies offer wellness programs that provide resources and support to help you maintain a healthy lifestyle. These programs may include smoking cessation programs, weight management programs, and stress management programs.

Taking advantage of preventive care services and wellness programs can help you stay healthy, lower your healthcare costs, and improve your overall quality of life.

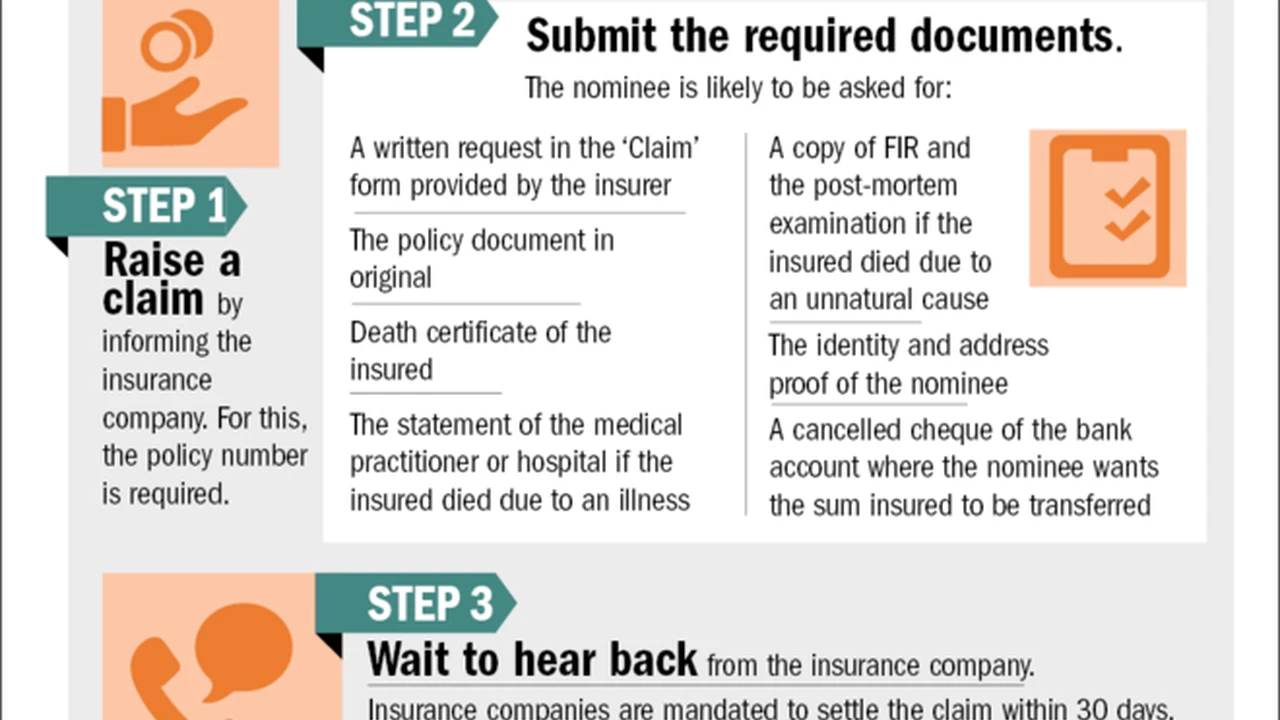

Navigating the Health Insurance Claim Process

Understanding the health insurance claim process can help you avoid surprises and ensure that your claims are processed correctly.

The Typical Claim Process:

- You Receive Medical Care: You receive medical care from a doctor, hospital, or other healthcare provider.

- The Provider Submits a Claim: The healthcare provider submits a claim to your insurance company.

- The Insurance Company Processes the Claim: The insurance company reviews the claim to determine if it is covered under your plan.

- You Receive an Explanation of Benefits (EOB): The insurance company sends you an Explanation of Benefits (EOB), which is a statement that explains how the claim was processed, how much the provider charged, how much your insurance company paid, and how much you owe.

- You Pay Your Share of the Costs: You pay your share of the costs, such as copays, coinsurance, or amounts that are not covered by your insurance plan.

Tips for Navigating the Claim Process:

- Keep Accurate Records: Keep copies of all your medical bills and EOBs.

- Review Your EOBs Carefully: Make sure the information on your EOB is accurate.

- Contact Your Insurance Company with Questions: If you have questions about your claim or your EOB, contact your insurance company for clarification.

- Appeal Denied Claims: If your claim is denied, you have the right to appeal the decision.

Understanding Health Insurance Appeals and Grievances

If your health insurance claim is denied or you disagree with a decision made by your insurance company, you have the right to appeal the decision. The appeals process typically involves submitting a written request to your insurance company outlining the reasons why you disagree with the decision. Your insurance company will then review your request and make a final decision. If you're still not satisfied with the outcome of the internal appeal, you may have the right to an external review by an independent third party.

Grievances are formal complaints you can file with your insurance company if you have a problem with your coverage or the service you receive. Common grievances include issues with access to care, delays in treatment, and dissatisfaction with the quality of care.

The Future of Health Insurance Trends and Innovations

The health insurance landscape is constantly evolving, with new trends and innovations emerging all the time. Some of the key trends shaping the future of health insurance include:

- Telemedicine: Telemedicine is the use of technology to provide healthcare services remotely. Telemedicine is becoming increasingly popular, as it offers convenient and affordable access to care.

- Wearable Technology: Wearable technology, such as fitness trackers and smartwatches, can track your health data and provide insights into your health and wellness. Some insurance companies are offering incentives to individuals who use wearable technology to track their health data.

- Personalized Medicine: Personalized medicine is the tailoring of medical treatment to the individual characteristics of each patient. Personalized medicine is becoming increasingly common, as it offers the potential to improve treatment outcomes and reduce side effects.

- Artificial Intelligence AI: AI is being used in a variety of ways in the health insurance industry, including to automate claims processing, detect fraud, and personalize healthcare recommendations.

These trends and innovations are transforming the way healthcare is delivered and financed, and they have the potential to improve the health and well-being of individuals and communities.

Resources for Finding Affordable Health Insurance Coverage

Finding affordable health insurance coverage can be challenging, but there are a variety of resources available to help you navigate the process.

Key Resources:

- Health Insurance Marketplace: The health insurance marketplace is a government-run website where individuals and families can purchase health insurance plans. You may be eligible for subsidies to help lower your monthly premiums or out-of-pocket costs.

- Medicaid: Medicaid is a government-funded healthcare program that provides coverage to low-income individuals and families.

- Medicare: Medicare is a government-funded healthcare program that provides coverage to individuals age 65 and older, as well as to certain younger individuals with disabilities.

- State Health Insurance Assistance Programs SHIPs: SHIPs are state-run programs that provide free counseling and assistance to individuals with Medicare.

- Licensed Insurance Agents: Licensed insurance agents can help you compare plans from different insurance companies and find the best coverage for your needs and budget.

Final Thoughts On Choosing The Right Health Insurance Plan For You

Choosing the right health insurance plan requires careful consideration of your individual needs, circumstances, and budget. By understanding the different types of plans available, evaluating your healthcare needs, and taking advantage of available resources, you can make informed decisions about your health coverage and protect your financial well-being.

Remember to prioritize preventive care, understand your cost-sharing responsibilities, and don't hesitate to ask questions and seek help when needed. A well-chosen health insurance plan can provide peace of mind and access to the healthcare you need to stay healthy and thrive.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)