Travel Insurance and Adventure Activities_ Coverage for Extreme Sports

Travel Insurance The Basics Explained

Let's start with the fundamentals What is travel insurance anyway Think of it as a safety net for your trips It protects you against unforeseen events that can disrupt your travel plans and potentially cost you a lot of money

These events can range from minor inconveniences like lost luggage to serious emergencies like medical expenses or trip cancellations Travel insurance provides financial compensation and assistance to help you navigate these situations smoothly

Why Do You Need Travel Insurance

Now you might be thinking "Do I really need travel insurance" The answer is almost always yes Consider this You're thousands of miles away from home in a foreign country and you suddenly fall ill Without travel insurance you're responsible for all medical costs which can be astronomical

Or imagine your flight gets canceled due to bad weather You're stranded at the airport with no place to stay Travel insurance can cover your accommodation and meal expenses until you can catch the next flight

Travel insurance offers peace of mind knowing that you're protected against unexpected events It allows you to relax and enjoy your trip without constantly worrying about what might go wrong

What Does Travel Insurance Cover

Travel insurance policies typically cover a wide range of events including

- Trip Cancellation and Interruption Reimbursement for non-refundable travel expenses if you have to cancel or cut short your trip due to covered reasons like illness injury or family emergency

- Medical Expenses Coverage for medical treatment hospitalization and emergency medical evacuation if you get sick or injured while traveling

- Lost or Stolen Luggage Reimbursement for the value of your belongings if your luggage is lost stolen or damaged

- Travel Delays Coverage for expenses incurred due to flight delays or cancellations such as accommodation meals and transportation

- Personal Liability Protection against financial losses if you're held liable for causing injury or damage to someone else's property

It's important to read the policy carefully to understand the specific coverage limits exclusions and conditions

Different Types of Travel Insurance Policies Choosing the Right Fit

Not all travel insurance policies are created equal There are different types of policies designed to meet specific needs and travel styles

Single Trip vs Annual Travel Insurance

Single Trip Insurance This type of policy covers a single trip You specify the dates of your departure and return and the policy provides coverage for that specific period Single trip insurance is ideal for travelers who only take one or two trips per year

Annual Travel Insurance Also known as multi-trip insurance this type of policy covers multiple trips within a year There's usually a limit on the duration of each trip typically 30 60 or 90 days Annual travel insurance is a cost-effective option for frequent travelers

Comprehensive vs Basic Travel Insurance

Comprehensive Travel Insurance This type of policy offers the most extensive coverage It typically includes trip cancellation interruption medical expenses lost luggage travel delays and personal liability Comprehensive policies are suitable for travelers who want the highest level of protection

Basic Travel Insurance This type of policy provides more limited coverage It usually covers only essential events like medical expenses and lost luggage Basic policies are a more affordable option for travelers on a budget

Specialized Travel Insurance

In addition to the standard types of travel insurance there are also specialized policies designed for specific situations

- Adventure Travel Insurance Covers activities like hiking rock climbing scuba diving and other adventure sports

- Cruise Travel Insurance Provides coverage for cruise-related events like missed ports medical emergencies and cabin confinement

- Business Travel Insurance Offers coverage for business travelers including lost or delayed baggage meeting cancellations and emergency business assistance

Travel Insurance Product Recommendations Our Top Picks

Choosing the right travel insurance policy can be overwhelming With so many options available it's important to do your research and compare different policies Here are some of our top picks based on coverage price and customer reviews

World Nomads Explorer Plan For the Adventurous Traveler

Product Overview World Nomads is a popular travel insurance provider known for its comprehensive coverage and focus on adventure travelers The Explorer Plan is their top-tier policy offering extensive coverage for a wide range of activities and destinations

Key Features

- Trip cancellation and interruption coverage

- Medical expenses coverage up to $100000

- Lost or stolen luggage coverage

- Coverage for adventure activities like hiking rock climbing and scuba diving

- 24/7 emergency assistance

Use Cases The World Nomads Explorer Plan is ideal for travelers who are planning adventurous trips involving activities like hiking trekking skiing or scuba diving It's also a good option for travelers who want comprehensive coverage and peace of mind

Pricing The price of the World Nomads Explorer Plan varies depending on the duration of your trip your age your destination and the level of coverage you choose A 10-day trip to Europe for a 30-year-old could cost around $100-$150

Detailed Information World Nomads offers a user-friendly website and mobile app where you can easily purchase and manage your policy They also have a helpful customer support team that can answer your questions and assist you with claims

Allianz Global Assistance AllTrips Premier Plan Comprehensive Coverage for All Travelers

Product Overview Allianz Global Assistance is a well-established travel insurance provider offering a wide range of policies to suit different needs The AllTrips Premier Plan is their most comprehensive policy providing extensive coverage for trip cancellation interruption medical expenses and other travel-related events

Key Features

- Trip cancellation and interruption coverage up to 100% of trip cost

- Medical expenses coverage up to $50000

- Lost or stolen luggage coverage

- Travel delay coverage

- 24/7 emergency assistance

Use Cases The Allianz Global Assistance AllTrips Premier Plan is suitable for travelers who want comprehensive coverage and peace of mind It's a good option for families couples and individuals who are planning expensive trips or who have concerns about potential travel disruptions

Pricing The price of the Allianz Global Assistance AllTrips Premier Plan depends on the duration of your trip your age your destination and the level of coverage you choose A 10-day trip to Europe for a 30-year-old could cost around $80-$120

Detailed Information Allianz Global Assistance offers a user-friendly website and mobile app where you can easily purchase and manage your policy They also have a helpful customer support team that can answer your questions and assist you with claims

Travel Guard Essential Plan Affordable Protection for Budget Travelers

Product Overview Travel Guard is a reputable travel insurance provider offering a range of policies to suit different budgets and needs The Essential Plan is their most affordable policy providing basic coverage for essential travel-related events

Key Features

- Trip cancellation and interruption coverage

- Medical expenses coverage

- Lost or stolen luggage coverage

- 24/7 emergency assistance

Use Cases The Travel Guard Essential Plan is a good option for budget travelers who want basic protection against unexpected events It's suitable for short trips domestic travel or travelers who are less concerned about comprehensive coverage

Pricing The price of the Travel Guard Essential Plan is typically lower than more comprehensive policies A 10-day trip to Europe for a 30-year-old could cost around $50-$80

Detailed Information Travel Guard offers a user-friendly website and mobile app where you can easily purchase and manage your policy They also have a helpful customer support team that can answer your questions and assist you with claims

Travel Insurance Use Cases Real World Examples

To better understand how travel insurance works let's look at some real-world examples

Case Study 1 Trip Cancellation Due to Illness

Sarah was planning a dream vacation to Italy She had booked flights hotels and tours months in advance However a week before her trip she fell ill and her doctor advised her not to travel

Fortunately Sarah had purchased travel insurance with trip cancellation coverage She filed a claim and was reimbursed for her non-refundable travel expenses including her flights hotels and tours

Case Study 2 Medical Emergency in a Foreign Country

John was hiking in the Himalayas when he suffered a serious injury He needed to be evacuated to a hospital for treatment

John's travel insurance policy covered his medical expenses including the cost of the emergency evacuation The insurance company also arranged for his repatriation back to his home country

Case Study 3 Lost Luggage on a Business Trip

Maria was traveling to a conference for work Her luggage was lost during the flight

Maria's travel insurance policy covered the cost of her lost luggage She was able to purchase new clothes and toiletries so she could attend the conference without any disruption

Travel Insurance Product Comparisons Deciding Which Policy is Best

When choosing a travel insurance policy it's important to compare different policies and consider your specific needs and circumstances Here's a comparison of the three policies we discussed earlier

| Feature | World Nomads Explorer Plan | Allianz Global Assistance AllTrips Premier Plan | Travel Guard Essential Plan |

|---|---|---|---|

| Trip Cancellation and Interruption Coverage | Yes | Yes | Yes |

| Medical Expenses Coverage | Up to $100000 | Up to $50000 | Yes |

| Lost or Stolen Luggage Coverage | Yes | Yes | Yes |

| Travel Delay Coverage | Yes | Yes | No |

| Adventure Activities Coverage | Yes | No | No |

| Price | Higher | Medium | Lower |

Key Considerations

- Coverage Needs Consider the types of events you want to be covered for If you're planning adventurous activities you'll need a policy that covers those activities

- Budget Travel insurance policies vary in price Choose a policy that fits your budget without sacrificing essential coverage

- Destination Some policies offer better coverage in certain destinations If you're traveling to a remote or high-risk area you may need a more comprehensive policy

- Age and Health Older travelers and those with pre-existing medical conditions may need to pay higher premiums or purchase specialized policies

Travel Insurance Detailed Information Unveiling the Fine Print

Before purchasing a travel insurance policy it's important to read the fine print and understand the terms and conditions Here are some key areas to pay attention to

Policy Exclusions What's Not Covered

Travel insurance policies typically have exclusions which are events or situations that are not covered Common exclusions include

- Pre-existing Medical Conditions Some policies may not cover medical expenses related to pre-existing medical conditions unless you purchase a specific rider

- Acts of Terrorism Some policies may exclude coverage for events related to terrorism

- Participation in Illegal Activities Policies typically exclude coverage for injuries or losses sustained while participating in illegal activities

- Traveling Against Medical Advice If you travel against your doctor's advice your policy may not cover medical expenses

- Alcohol or Drug Abuse Policies may exclude coverage for injuries or losses sustained while under the influence of alcohol or drugs

Coverage Limits How Much Will the Policy Pay

Travel insurance policies have coverage limits which are the maximum amounts the policy will pay for different types of claims It's important to understand these limits and choose a policy that provides adequate coverage for your needs

For example a policy may have a medical expenses coverage limit of $50000 which means the insurance company will only pay up to $50000 for medical treatment You'll be responsible for any expenses exceeding that limit

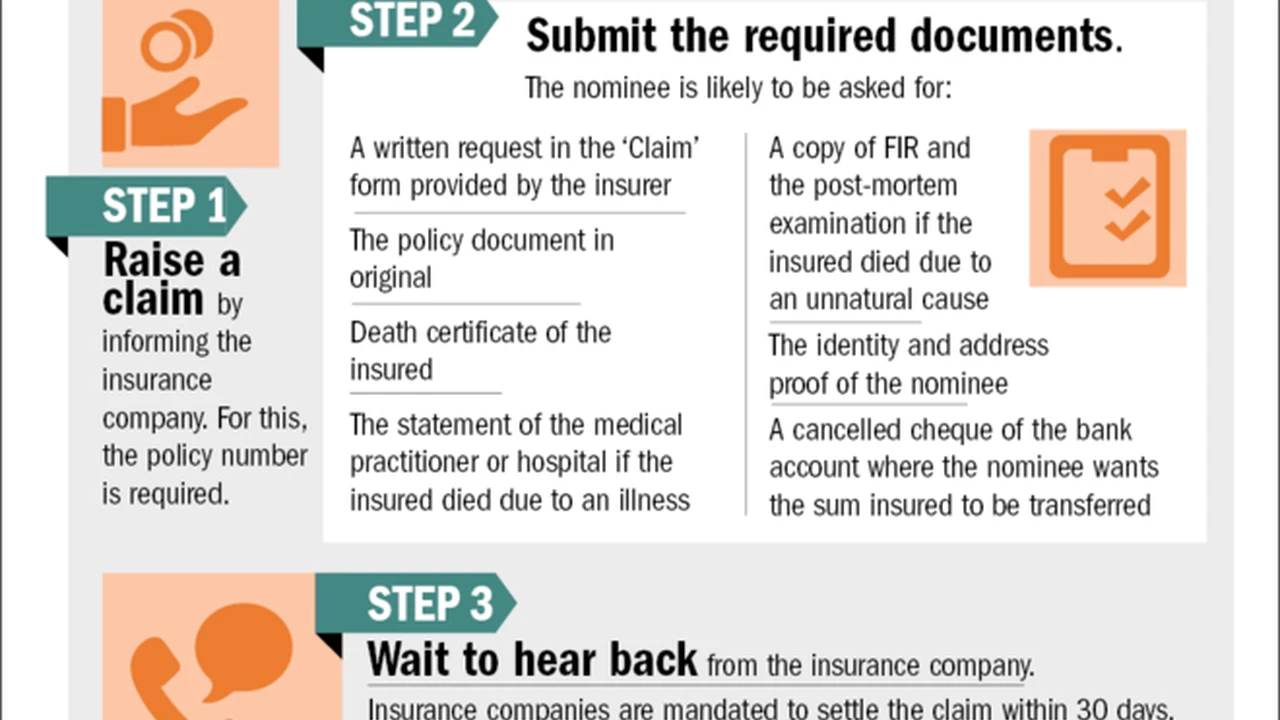

Claim Process How to File a Claim

If you need to file a claim it's important to follow the insurance company's claim process carefully This typically involves

- Notifying the Insurance Company Contact the insurance company as soon as possible after the event occurs

- Gathering Documentation Collect all relevant documentation such as medical records police reports and receipts

- Submitting the Claim Form Complete the claim form accurately and submit it along with the required documentation

- Cooperating with the Insurance Company Respond to any requests for additional information or documentation from the insurance company

The insurance company will review your claim and determine whether it's covered under the policy If your claim is approved you'll receive reimbursement for your covered expenses

Travel Insurance Pricing Factors Influencing the Cost

The price of travel insurance can vary depending on several factors These include

Trip Duration Length of Your Trip

The longer your trip the more expensive your travel insurance will be This is because the longer you're away from home the higher the risk of something going wrong

Destination Where You're Traveling

Some destinations are considered higher risk than others For example countries with unstable political situations or high crime rates may result in higher premiums

Age Your Age Impacts the Premium

Older travelers typically pay higher premiums than younger travelers This is because older travelers are more likely to have pre-existing medical conditions and are at a higher risk of needing medical treatment

Coverage Level How Much Coverage You Need

Comprehensive policies with higher coverage limits will cost more than basic policies with lower limits

Pre-existing Medical Conditions Your Health History Matters

If you have pre-existing medical conditions you may need to pay a higher premium or purchase a specialized policy to ensure that your medical expenses are covered

Travel Insurance Tips Tricks and Best Practices

Here are some tips tricks and best practices to help you get the most out of your travel insurance

Read the Policy Carefully Understand Your Coverage

The most important tip is to read the policy carefully before you purchase it Make sure you understand what's covered what's not covered and what the coverage limits are

Compare Quotes Shop Around For the Best Deal

Don't just buy the first policy you find Compare quotes from different insurance providers to find the best deal

Purchase Early Don't Wait Until the Last Minute

Purchase your travel insurance as soon as you book your trip This way you'll be covered for trip cancellation if something unexpected happens before you leave

Keep Your Policy Information Handy Access Your Policy Easily

Keep a copy of your policy information with you while you're traveling so you can easily access it if you need to file a claim

Contact the Insurance Company If You Need Help

If you have any questions or need assistance contact the insurance company's customer support team They can help you understand your policy file a claim or get emergency assistance

Choosing the right travel insurance policy is an important part of planning any trip By understanding the different types of policies comparing quotes and reading the fine print you can find a policy that provides the coverage you need at a price you can afford Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)